In the previous post I wrote about how you can get started with starting up your crypto trading bot on Pionex. One of the biggest issues that you will find when starting out your Pionex bot is that it can be quite expensive. For example, if you want to start a bot using the prescribed settings for the VET/ETH pair is 3 ETH. This price varies everyday, but le's say you have less funds or if you want to spread your funds around a bit, you can do this by tweaking your bot.

How To Tweak Your Bot?

So everything I will say after this is speculation and if you have a different opinion, I would like to hear from you, so here goes. When you preset a particular range for a bot, it seems that the amount of cryptocurrency required to run the bot is dependant on the number of grids that the bot has to run.

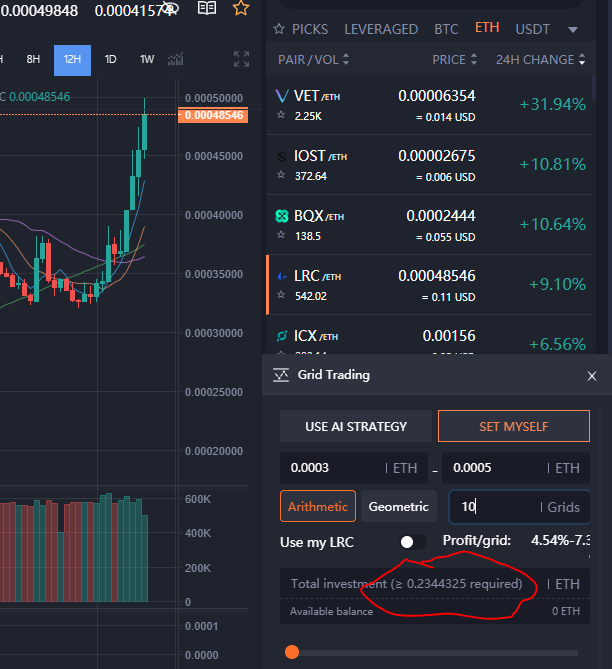

For example, if you were to check out the LRC/ETH pair, it takes 2.9 Eth to run it. The amount is based on the price action from the last seven days.

So, if you have less than 2.9 Eth to invest, you can set it yourself instead of using the AI strategy prescribed. To set up the bot, I would zoom out and set the range based on the support of the daily and a little bit over the resistance on the daily chart.

So, if you have less than 2.9 Eth to invest, you can set it yourself instead of using the AI strategy prescribed. To set up the bot, I would zoom out and set the range based on the support of the daily and a little bit over the resistance on the daily chart.

Now here comes the tweaking bit. You can start by putting in ten grids to see how much it will cost you. You can add on from there to see the amount that suits your budget. Here's an example:

Notice that you require far less to run your bot here. But of course, there is a caveat to this. If you compare both images above, you will notice that the first image shows 99 grids as compared to 10 grids. This means that your bot will trade far less often. That is not exactly a bad thing since you are charged according to the trades you make, not a monthly fee like Cryptohopper.

How Has That Worked Out?

I tried this strategy with the KNC/ ETH pair. If you were to check this pair over the last few days and weeks, it has been on a parabolic upswing. When I first got on it, it cost me 1 ETH. Due to the parabolic nature of the pair, my bot quickly hit the top range that the bot was programmed to trade in.

(Now would you look at KNC go...)

Because of that, my bot stopped trading, waiting for the price to drop before entering another trade. Of course, impatient ol' me decided to shut the bot down. When I restarted the bot, it required me to deposit 2 ETH. As such, I tweaked the settings and paid only 0.7 ETH for the bot. I did this another time after the bot hit its cap again. Both times, I closed my bot in a small profit.

This can be applied to any of the pairs that you think is going to go parabolic. For example, the KNC/ETH pair went parabolic due to the impending release of Katalyst. In true "buy the rumor" fashion, KNC has continued pumping.

Conclusion

Of course, this does not always work out for all pairs but the point here is not to pick the ones that will go parabolic, but to invest in the pairs that are volatile. This is because the more volatile a pair is, the more trades the bot will do and the more profits you will gain.

I hope you have found this useful, if you have not signed up and want to, I would appreciate that you would sign up using my referral link. If you have any thoughts, do buzz me in the comments below.

That is too expensive to use the full feature of Pionex. Any exchange that is new should be less expensive so that more people are attracted to it.

Agreed, but my best performing ones are also my cheapest. Like the dgb and nexo eth pairs. You can go through them and pick the ones that aren't that expensive