Antoni Trenchev is the co-founder of the company Nexo, which serves the clients offering them products that you can know from both the banking sector and decentralized finances. All in one place, the Nexo platform. All that with outstanding interest rates within the crypto space.

Antoni, in one of the latest interviews, you mentioned that Nexo is supposed to be something of a middle ground between DeFi and CeFi. Can you develop this idea further and explain it to readers? Where is the position of Nexo in the space?

Nexo is a melting pot of services: some are as old as time – savings accounts, some are concepts that are ”so 2018” – crypto-collateralized credit lines and others are the finance of tomorrow – a full-fledged crypto bank in your phone. The way we see the future of crypto-driven fintech, will feature two equally transparent, private, and secure parts – CeFi and DeFi.

To answer your question directly – we are an enabler of the many use cases of DeFi projects yet in a CeFi environment – we support DeFi tokens as collateral for our credit lines and we pay savings interest on them. Take DAI, for instance, the decentralized stablecoin running on Ethereum. We give you up to 12% savings yields on your DAI. At the same time, you take advantage of the $375M in insurance provided by our partners on all custodial assets – something very few companies in the space can brag about.

The fact that we are a centralized platform tackles a pretty big institutional issue, stemming from the inherent anonymity of DeFi – institutional investors cannot enter into contractual obligations with an anonymous counterparty. With Nexo, however, we provide exposure to DeFi with an additional level of security thanks to our partners in custody.

Nexo platform

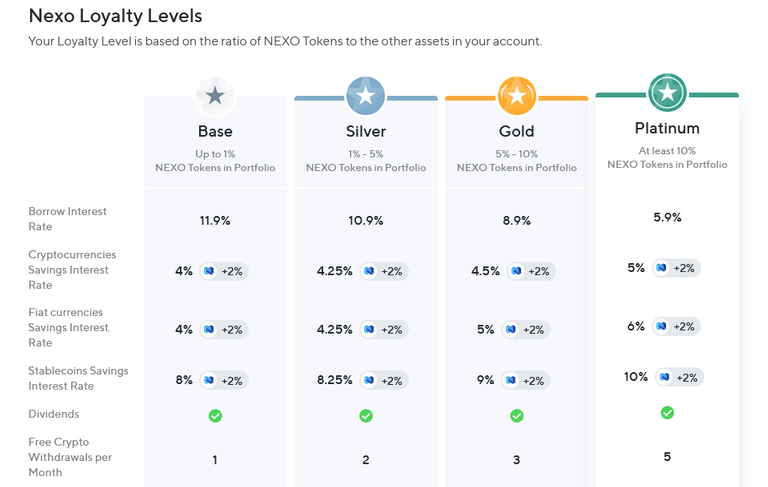

I often hear questions, how it is possible to achieve such attractive interest rates for loans and at the same time for deposits? For Platinum membership, the interest on loans is 5.9% and on deposits up to 12% (when paid in NEXO), those are really outperforming the current competitors. Are such attractive interest rates sustainable in the long run?

Absolutely. The rates you described are our absolute best rates and apply only when you meet the Platinum tier of our Loyalty program. Have in mind that our average customer pays double-digit interest on their credit line and doesn’t take advantage of the superior savings yields, which require a certain percentage of NEXO Tokens in one’s portfolio balance.

Our business model is simple, yet robust. I can’t overstate the importance of our lending model – we never lend on an under-or un-collateralized basis, unlike our competitors, which gives us the sustainability advantage and means that our client's assets are backed by this over-collateralized portfolio.

A recent addition to our product lineup, the Nexo Exchange is another enabler of our fully sustainable ecosystem because our users no longer need to leave the Nexo platform to buy, sell, or exchange NEXO Tokens and swap between all the cryptocurrencies we support.

Many people praise Nexo’s feature-rich platform and smooth user experience but crave more connection with the Nexo team itself. What’s your position on this and how are you prioritizing connection to your community and fanbase audiences?

We recently launched nexo.io/community – a dedicated community page where our clients can share their Nexo success stories and suggestions, watch our AMAs, take part in competitions and community events, and many more to come. While still in its infancy, we hope to make this portal a place for hard questions, honest conversations, and fruitful discussions.

Nexo’s bleeding edge innovation positioned you as clear front runners in the crypto lending space, but since launch, many competitors have arrived and some are now outperforming Nexo (certainly in terms of token price/market cap value) – what are three standout differences that separate NEXO from the rest and how is Nexo defending its position as the industry’s number one?

Nexo’s offering is instant: the in-house exchange lets you buy crypto, immediately start earning interest on it, and you don’t have to pay any transfer fees because your assets land in your wallet instantly. Then you have the credit line – you transfer assets and you can withdraw a loan against them instantly.

Just as our products are focused on the “now”, our efforts are focused on the long-term. We are extremely proud to be the only ones this close to acquiring banking licenses – one in the U. S. and one in Europe, we are planning to increase our custodial insurance to $1B by the end-2021, and we are working with multiple Big Four firms and smaller auditing companies to provide those coveted audited financial statements. If that’s not front-running, I don’t know what is.

Dividends are often heralded as Nexo’s flagship product differentiator; however, they receive radio silence for 11 months of the year? How do you view the market's perception of Nexo’s dividends? What plans does Nexo have to manage community expectations towards its biggest USP?

The thing with our dividends is: they may happen once a year but NEXO Token holders discuss them throughout the year. Indeed, they hold a special place I cannot disclose anything yet but expect big news on that front very soon.

You have been very vocal on where you see Bitcoin price heading and are often publicly forecasting future BTC price predictions on Bloomberg – where do you see NEXO’s marketcap over the next 12, 24, and 36 months?

All I’m going to say is that thanks to our macrotokenomic overhaul Nexonomics and making the acquisition of NEXO Tokens much more accessible, we’re slowly but surely moving into the top 50 cryptocurrencies by market cap.

Vocal CEOs that embrace communication have led more than 80% of global companies with the fastest growth over the last 5 years. Nexo community is really proud of your frequent appearances at conferences, on talk shows, and in the media but would cherish a more direct connection with us, your own community advocates. Are there any plans to provide a consistent CEO communications platform to NEXOnians? Do you share the view that ‘stakeholder capitalism’ would bond your audiences and help catalyze Nexo’s goals?

In February, we kicked off the highly anticipated monthly AMAs. These sessions are equally exciting for me as they are for our community because the questions are so different from the mundane, operational ones as well as from the market- and industry-related ones I get during interviews. The AMAs – the next one is slated for March 26 – are the first step in ensuring better direct communication with our clients and even more transparency. We are also planning to disclose more information on how we structure our products.

The whole team is ecstatic about something big which we teased the community about recently – the first Nexo governance vote. Speaking of stakeholder capitalism, we believe such votes to be a great and perfectly legitimate way to take community suggestions into consideration. Stay tuned!

Nexo clearly has a lot of strengths and holds well-earnt market-leading positions in many aspects of its business practice – what do you see as key areas of focus for Nexo to improve upon over the year ahead?

Tokenomics, bank license acquisitions, our expanding institutional offering, and our plans of becoming a publicly-listed company.

You have scheduled much attractive news – a credit card program, an internal exchange, Nexo entering the stock exchange, or acquisition of a bank. Can you give the readers some positive news that way?

We’ve made tremendous progress with the bank we are looking at in Europe, so you can expect news as early as this year.

We are at the very end of the interview. I have the last thing on my mind: can you describe Nexo in five words?

Taking over the world compliantly.

Thank you so much for your time, it was a pleasure to get some news about Nexo.

This article will be also published in the English column of blockchainfo, where you can find several different interviews with people from the crypto sphere such as Andreas M. Antonopoulos, The Crypto Lark, and many more.

Interesting interview, thanks! :)

@tipu curate + nomination to my latest upvote giveaway ;)

Upvoted 👌 (Mana: 39/78) Liquid rewards.

Thanx a lot :)