I have read many comments and complaints about Ethereum gas fees being too high. Some even think that this is very bearish for ETH price. I beg to differ and here is why.

Rising Ethereum Gas Fees?

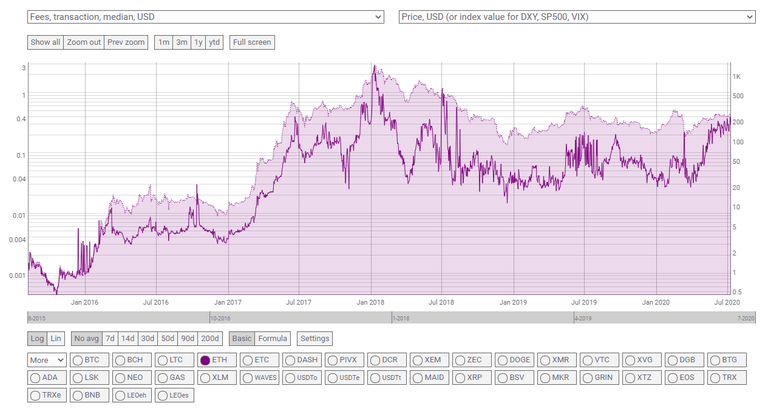

Ethereum gas fees are ticking up over the years in USD terms, as shown in the chart below, and some people are frustrated about it. But why are gas fees rising?

Source

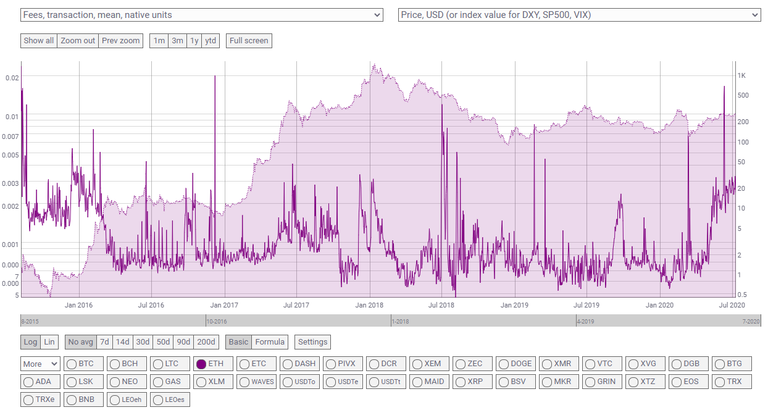

As you can see from the chart below, fees in native unit is relatively stable since 2016. Therefore, the rising gas fees in USD terms is just because they are tracking ETH price. As ETH price increases, fees in fiat terms also increases and vice versa.

Source

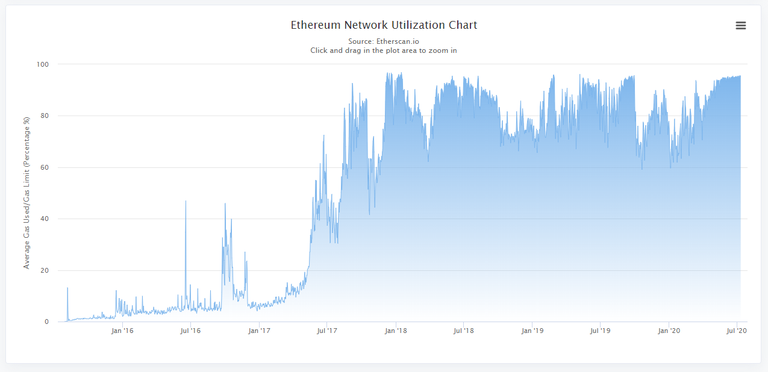

Has the Ethereum network gotten more congested over the years? Not really, Ethereum has been congested since 2017 😅 as shown in the chart below.

My point here is that nothing much has changed in terms of the network activity on Ethereum. Fees are stable in native units and in USD terms. In fact, it is actually cheaper as compared to the period of ICO fever.

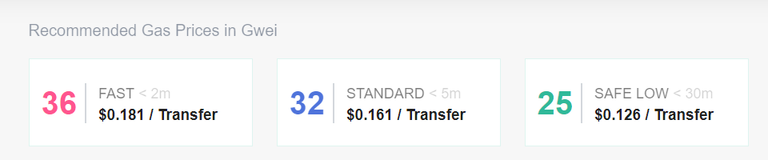

A normal transfer of Ether costs less than $0.20 which is very cheap when comparing with a international wire transfer/remittance.

Source

Recently, I did a international transfer on TransferWise and it cost me S$20 for a S$2000 transfer. This is already considered cheaper than if I were to transfer via a bank. So, if anyone can move millions of dollars worth of Ether with a $0.20 fee, is it really expensive?

Impression of High Gas Fees

I attribute the impression of high Ethereum gas fees to the recent rise of DeFi. As you probably know, the amount of fees you pay is proportionate to the complexity of the transaction you are making. Smart contracts in DeFi projects are typically more complex than a normal transfer. Hence, you will be paying more when you make DeFi transactions.

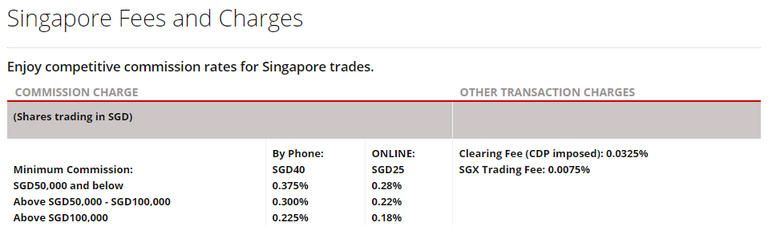

However, if you compare it with fees on traditional financial platforms, is it expensive? Let's have a look at the fees to trade equities on a popular brokerage in Singapore.

Source

The so-called "competitive commission rates" are a total rip-off if you compared it to the gas fees I am paying for DeFi transactions. As you can see, the minimum commission is S$25 with additional taxes and fees to be added on. If I want to minimize my fees in percentage terms, I have to make a trade of over S$100,000. Even if I want to hit the percentage fees at 0.28%, I will need to trade about S$9,000 of equities to make it worth.

Compare this to swapping a token on Uniswap or 1inch, which one is more expensive?

Bullish

If so many people are complaining about the high gas fees, why are people still using it? I think the reason is rather simple. Most participants are willing to pay this fees because it is worth it. If you are a whale farming 10s or 100s of $COMP each day, that few dollars of gas fees are negligible considering the amount of yield being harvested.

DeFi provides an alternative to traditional financial platforms. As more services come online, more capital will be drawn in. As more capital is drawn in, more services are developed and improved. This creates a upward spiral which reinforces itself and continues to gain traction. At the heart of this, Ether is needed to pay for the fees.

The fact that Ethereum network is still so heavily utilized despite the impression of a high gas fees proves that the fees are not considered high to these participants. The silent majority are still happy users of Ethereum while most of the complaints are from the minority.

From another perspective, why do people still pay for iPhones despite them being so expensive? It is because iPhones have other features/values that allow them to command a premium. Likewise for Ethereum, it is clear that users are willing to pay a premium to use Ethereum because it is worth it. In a way, the market knows best.

Conclusion

I think transfer fees are still relatively low on Ethereum network. We have an impression that DeFi transactions are expensive but it is really cheap as compared to traditional financial platforms. When determining whether something is expensive or cheap, we have to make the right comparison. I understand that most people are comparing with the so-called Ethereum killers. The problem is, not many DeFi services are on those platforms and there is a lack of liquidity as well.

What I do agree is that Ethereum DeFi, at this stage, is still a whale's/dolphin's game. It is not suitable for smaller players who just want to invest a small amount of money. For these investors, the better options might be CeFi platforms like BlockFi, Celsius or Nexo. These platforms allow you to earn interests on your crypto hodlings but you just have to trust them as a custodian.

I think layer 2 solutions will be adopted really soon to help make Ethereum DeFi more inclusive for smaller players. In addition Ethereum 2.0 is also on-track, though it will still take a year or 2 to materialize.

Note that this is not a financial advice. Please do your own research and due diligence when you invest your money.

25% of post rewards goes to @ph-fund, 5% goes to @leo.voter and 5% goes to @peakd to support these amazing projects.

When compare the fee of $20 for international transfer on TransferWise and $0.20 fee to transfer eth. It is like 100% cheaper. With more corporation and people adopting cryptocurrency as digital currency, I think most of us would skip the bank and use cryptocurrency instead.

!tip 0.2

Thanks for the tip! Yea, I think it is important to make the right comparison

I still remember when the bitcoins reached 15 thousand dollars and the network fees in localbitcoins and the other payment gateways rose to 10 dollars in short if you want to change 20 dollars at that time 10 dollars stayed in network fees.

It all depends on the user

Yes, most of the time it is a fixed fee for all kind of transactions. Hence, it is more worthwhile to transact large amount. However, this is also the case for many of our current financial services. There is often a fixed admin fee and a percentage slap on top of the base fee when dealing with large transactions.

What you say about gas fee is interesting and surely all the de-fi activity could have a role to play there.

This makes me think when Ethereum moves from POW to POS the energy consumption should go down drastically and perhaps the gas fee would go down or at in fiat terms.

What are your thoughts about this @culgin

I think moving from PoW to PoS will certainly lower the gas fees on Ethereum. But it is still quite a long way to go. Of course I do believe that Ethereum will get there eventually. However, I think it is unlikely we will see that in this cycle.

One of the factors contributing to the ethereum's value is the fact that you pay a fee for almost everything you do on the ethereum blockchain. So this is a fact.

Yea, there is a very clear utility for holding ether. So the more the Ethereum network is utilized the stronger the potential for ETH to appreciate.

🎁 Hi @culgin! You have received 0.2 HIVE tip from @dolphin-assemble!

Sending tips with @tipU - how to guide.

Congratulations @culgin! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: