Several days back, I made this post on why I believe there will be a sustained period of high inflation when the economy starts to recover from COVID-19. Today, I am going to share how I intend to navigate this period of high inflation. As always, this is my personal thought process and should not be taken as investment/financial advice. Due diligence and research are still required when you invest your own money.

Hard Assets

As the economy recovers, I plan to turn my attention to hard assets. Traditionally, these includes real estates, commodities and energy. A major misconception which many holds is that hard assets are hedge for a stock market crash. This, in my opinion, is wrong. Hard assets can fall in price during a stock market crash as well. It really depends on what triggered the crash and the underlying problems.

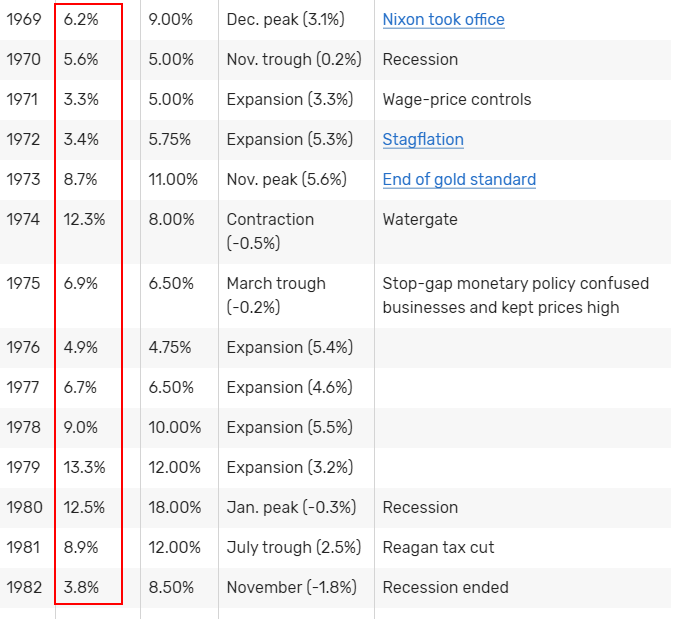

What hard assets can and should do is to hedge against high inflation. Especially an extended period of high inflation. The 1970s was a period of high inflation in the US. If you look at the table below, inflation went as high as 13.3% in 1979. During this period, the average inflation was a staggering 7.5% per year.

Source

Gold

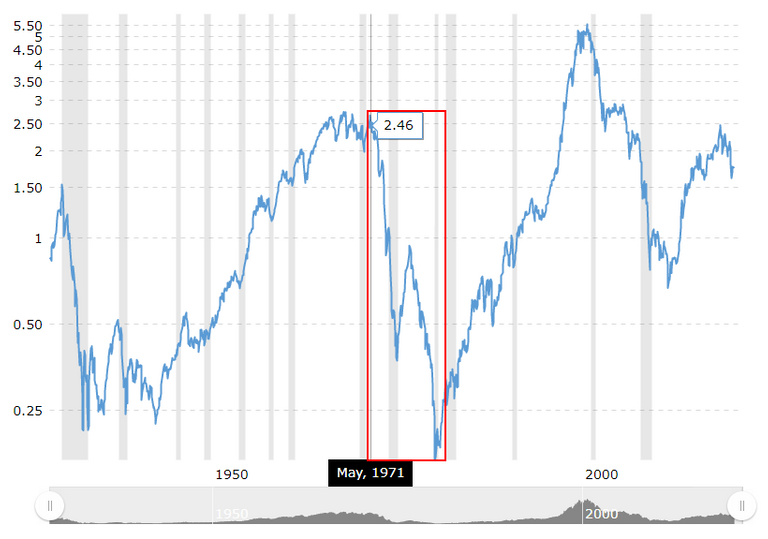

The chart below is the S&P 500 to gold ratio chart. The number tells you how many ounces of gold it would take to buy the S&P 500 on any given month. Hence, a rising trend means stocks are outperforming gold. And a downward trend means gold is outperforming stocks.

Source

As you can see, gold hugely outperformed stocks in the 1970s. While that is largely because Nixon put an end to the gold standard in 1971, I think a good part of it is also because gold is a hard asset.

Hence, gold will certainly be in my portfolio when the economy starts to recover. In fact, I am already invested in gold.

Real Estates

By definition, real estates are also hard assets. However, I think the pandemic may have a long-term impact on real estate prices. Especially in the commercial space, I foresee more companies opting for long-term remote working arrangements and may reduce their office spaces as a result.

Therefore, if I were to invest in real estates, I will prefer basic residential properties rather than commercial properties. Essentially, not all real estates will outperform a diversified portfolio of stocks during the initial phase of recovery.

One interesting play of real estates is to make use of the current low interest rate environment to secure fixed and low interest mortgage loans. Then hold it for capital gain or rent it out for an income. Of course that is provided that you have the excess cash to pay the initial down-payment and be confident that you can meet the monthly loan repayment obligations.

Other Commodities

I am personally rather bullish of copper or other basic raw materials. I think copper will be an interesting play among the other commodities because post-pandemic, there will likely be more allocation of capital to beef up IT and telecommunications infrastructures. With copper being an essential raw material for these industries, I think demand will be stable if not higher.

In addition, the push for electric vehicles also increases the demand for copper. Hence, it will certainly be something which I will add to my portfolio very soon.

Diversified Portfolio of Stocks

Do not get me wrong. I am certainly not staying away from stocks. In fact that will be rather silly. Stocks is likely to do well in a period of high inflation as long as interest rates remain low.

However, in the scenario where inflation goes out of hand, there is a chance for Fed to raise interest rates to curb inflation. Especially if the period of inflation turns out to be stagflation (inflation + low or negative growth). This happened before in the early 1980s, when Paul Volcker, then chair of Federal Reserve, raised interest rate stop inflation.

That is why during such period of great uncertainty, I will make sure that I have a diversified stocks portfolio.

Bitcoin as an Asymmetric Investment

The potential rewards for investing in Bitcoin is huge though it might go to zero. In other words, it is an asymmetric investment. Among the other cryptocurrencies, Bitcoin's narrative is still such that it is hard money and a store of value. Hence, given a period of high inflation, I think everyone should own a little bit of Bitcoin.

Assuming I have a $100k portfolio, I think it is rather safe to just put $5k into Bitcoin and see what it does over the next 5-10 years. Even if it goes to zero, I am still good since it is just 5% of my portfolio. However, if Bitcoin do a 10x over 5 years, I will benefit substantially.

Having Sufficient Liquidity

Liquidity is important. You do not want to have all your portfolio in real estates or something which takes time to sell. I am someone who likes to keep about 10% of my assets liquid. In the past, I will recommend keeping them as bonds or savings. However, in a low interest and potentially high inflation environment, I will strongly advise against that.

Bonds are basically a claim for future dollar. If inflation weakens the purchasing power of dollars, effectively you are getting less in the future. Furthermore, given the low interest rates, the bond yields are likely to be low and more likely than not, they are unable to offset inflation.

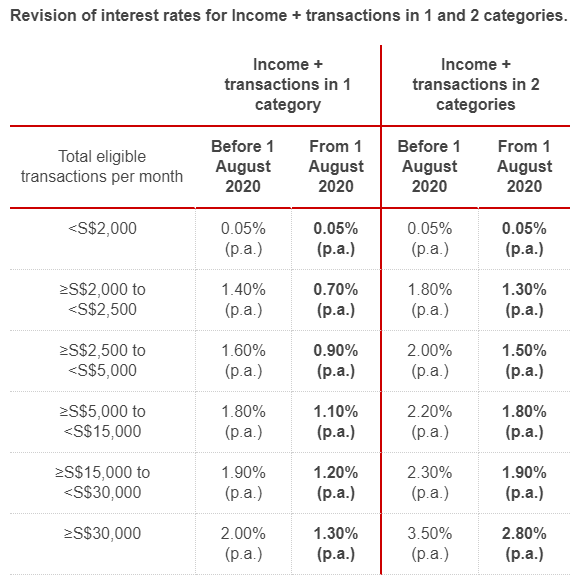

Recently, I received this email from a local bank, telling me that the savings interest rate is going to be cut.

As you can see, there is a 0.7% cut across the board. Even before the cut, the interest can barely beat inflation. In the past, there were no better option but now we have DeFi.

As I mentioned before, DeFi is an alternative for us to earn more interests on our money. As long as you understand the risks, using DeFi as a form of savings account will be an interesting play. Therefore, for my liquid assets, I will stay away from conventional bonds and put more into DeFi.

Conclusion - Stay Invested

There is a reason for Ray Dalio to say "cash is thrash" and that is largely because he is also anticipating a period of high inflation. The key to ensure your wealth is not eroded by inflation is to stay invested. Holding too much cash or bonds is not going to be a good strategy in such period of high inflation.

That is also why I think the benchmark 60-40 investment portfolio (60% stocks and 40% bonds) will likely change in the near future. It will no longer be a good benchmark. I personally think, a 40-30-20-10 portfolio may be a better benchmark. 40% in stocks, 30% in gold, 20% in cryptocurrencies and 10% in cash and equivalents.

25% of post rewards goes to @ph-fund and 5% goes to @peakd to support these amazing projects.

the problem is even hard investments like properties got big loss in this panademic i am not talking about homes but about stores and restaurants .

Yea, as I said, not all real estates will do well. Commercial properties will likely underperform. That is why I am recommending basic residential. Even luxury residential will probably not do well.

Also, I am talking about when the economy starts to recover. We are still in the midst of the crisis now.

Diversifying our portfolio is an idea that my son had told me before. Not putting our eggs into the same basket.

!tip

Thanks for your tip again!

Your son sounds like a good financial advisor. Haha.. May I know what is his profession?

He is in NS now but he is investing in stocks recently using his NS pay.

I see. Always good to start investing early 🙂

Diversification is certainly a strategy.

I see a lot of logic in this approach.

Gold, investing in this asset has always been quite profitable. Bitcoin, no doubt you have to have, those of us on this platform find it much easier to understand this blockchain thing.

Yup you are right. Thanks of your comment!

🎁 Hi @culgin! You have received 0.1 HIVE tip from @fun2learn!

Sending tips with @tipU - how to guide.