What if the guy used the 3 ETH as collateral to borrow 170 DAI and bought 1 more ETH? How much would it be worth now?

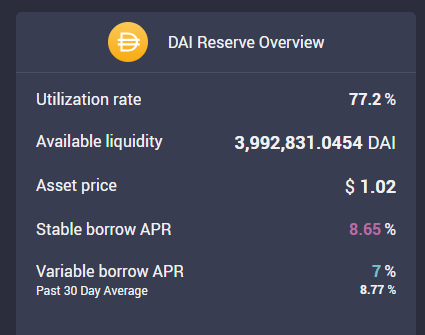

($395 * 4) - ($170 * 1.5) = $1325 [assuming an unrealistic perpetual interest rate of 50%. Actual interest rate should be well below 10%]

Of course, I am not encouraging people to do this. I am trying to illustrate that is just a tool and it depends on how the user uses it.

Do you think that would work?! We should find out🤤 can I borrow some ETH from you 😆

I mean people are actually doing these things and making bunch of money so I’m sure it works sometimes.

How is your experience like?!

What do you mean whether it will work? Do you mean whether this strategy will work? Or do you mean if using ETH collaterals to borrow DAI will work?

I am personally slightly leverage by using some of my coins as collateral to borrow USDC. The USDC can be put into some other projects to earn extra yield or to buy more cryptos.

I mean are you making good profit for doing this?! I think my issue is my seed money is too small so I need save some ETH first and I will try something different.

Oh I see. I am making decent profits by buying the tokens of DeFi projects. Not really by participating in DeFi. At this stage, DeFi yields are still more for whales. You can only see decent returns if you have substantial amount of seed money.

Nice! I’m just a small fish so I will take a break from defi 😂