Inflation is a stealthy thief. It takes away your purchasing power without you even noticing. In Singapore, using food as an example, a plate of chicken rice used to cost me $2.50 during my college days. Fast forward 12 years, a plate of chicken rice is now about $3.50 on average. That is a 40% increase over 12 years translating to a simple inflation of 3.33% annually.

With the US and other countries pumping in trillions of dollars into the world, we can expect a period of high inflation. You might ask why is the effect not seen yet. The answer lies in the "Quantity Theory of Money". The basis of the theory is a simple formula,

MV=PQ

Where,

M = money supply in the economy,

V = velocity of circulation,

P = price level in the economy

Q = output produced by the economy

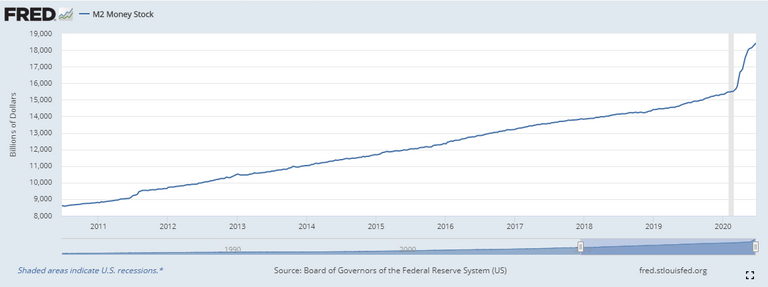

With trillions of dollars printed out from thin air, the money supply in the economy had naturally increased. According to the chart below, we can clearly see a spike in money supply since 2020.

Source

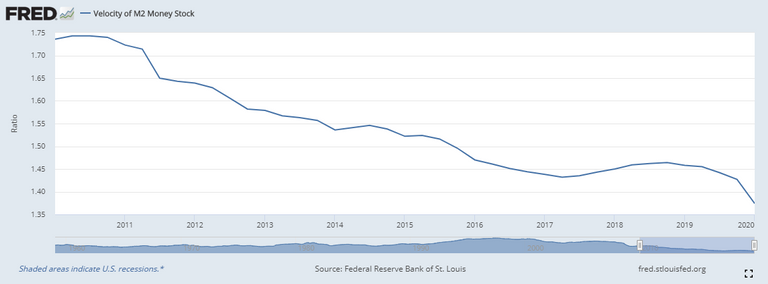

But why have we not see any inflation or at least we do not really feel it yet? The answer is simple, that is because the velocity of circulation has also been declining during the same period of time.

Source

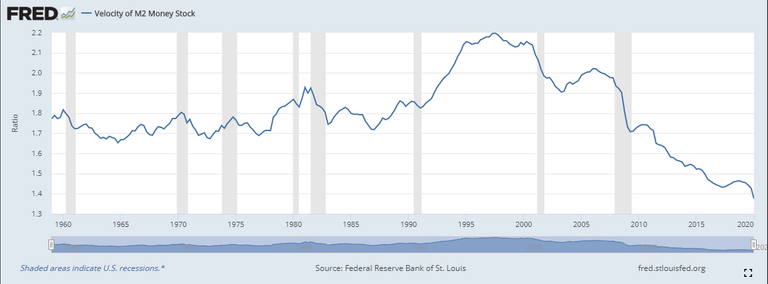

Velocity of money is simply the rate at which money changes hand. When I buy something from you and hand over my money to you for the goods, the money changes hand. Naturally, this means more business activities will lead to higher velocity of money supply. As you can see from the chart above, velocity of money has been declining for a while now. In fact it is at its historic low if we zoom out the timeframe.

Source

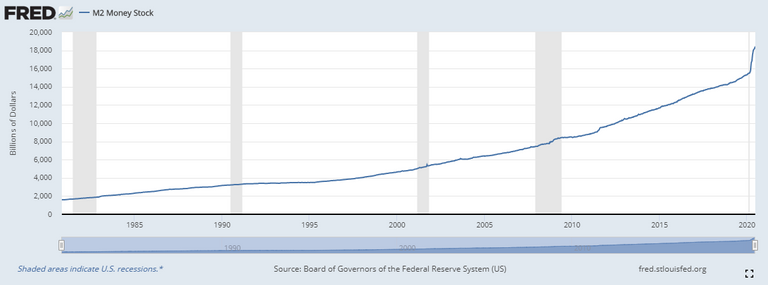

While money supply is at its historic high,

Source

Let's now look at the other side of the equation. "Q" is the output of the economy. Essentially, this is the overall productivity of the economy, how much goods and services were produced in a period of time. Productivity does not improve or increase overnight and it requires years to grow. So we can expect "Q" to be relatively stable in a short period of 5 years.

Hence, the effect of inflation has not been really seen because we have historic low velocity of money and productivity being hit as a result of the pandemic. For now, things balanced out without changing "P", the price of goods and services in the economy. However, what will happen when we emerge out of the pandemic and business activities start to pick up? Here is when I think a period of high inflation is going to start.

During this period, velocity of money starts to pick up due to increase in business transactions. However, productivity is not picking up as quickly. With the money supply at a historic high, the increase in business activities will cause sharp increases in prices as well.

This can also be explained from a demand/supply point of view. Due to the pandemic, travel and consumption are reduced and overall demand for goods are reduced as well. Post crisis, demand for goods is expected to increase but because many businesses had permanently shutdown, we have lesser supply of goods. Hence, with more demand but a temporary shortage of goods, price naturally increases.

Interesting dynamics of upcoming inflation

In this period of inflation, I believe there are certain types of goods that will see higher inflation than others. Those industries that productivity aren't much affected by the pandemic will see lower inflation (e.g. internet businesses like Netflix), while businesses like food/beverages and general retail are likely to see higher inflation.

Some might wonder why there is a disconnect between the economy and the stock market. While the economy seems to be suffering, the stock markets are seeing a potential V-shape recovery. I personally attribute this to inflation. To many people, the concept of inflation is only on consumer goods. However, the impact of inflation can be seen in all markets. Equities, properties, bonds and etc.

Conclusion

I expect a period of high inflation as a result of high money supply and a potential sharp increase in velocity of money circulation post crisis. Once the money is in the system, it is tough to get it out. In the US, the Fed had tried to do so in 2018 but failed terribly and ended up having to inject more. In the Europe, they have not even tried since the 2008 crisis.

If my analysis is sound, high inflation is likely coming and ironically, it will come when the economy starts to recover from the pandemic. While I point out the potential problem in this post, I have not talked about the solution. I will leave it to the next post to discuss how I am positioning my portfolio for this period of high inflation. 😎

25% of post rewards goes to @ph-fund and 5% goes to @peakd to support these amazing projects.

Dear @culgin

I just bumped accidentally at your publication. Solid read. Topics related to technology and economy are my favourite ones.

Inflation is indeed a quiet thief:) Like an assasin. You don't see it coming and then ... slash and your throat / wallet is bleeding like nuts ...

My strong believe is, that in upcoming months (and perhaps even year or two) we will witness general deflation in prices. Especially since current crisis seem to be just unfolding and demand for products won't be there. People are stocking up on savings. So many businesses will be often forced to sell their products with huge discounts - just to bring enough revenue to survive.

However, once real economy and financial markets will start to recover - then indeed I would expect inflation to catch up. It's also like self-fullfiling prophecy. Right now business owners are holding to their FIAT and savings, trying to prepare themselfs for difficult times.

The moment when worst will be over - all those people and "smart money" will be running away from FIAT into any sort of assets. Causing domino-efect. Just like self-fullfiling prophecy.

Hope I'm making sense .... your explanation is surely more professional.

Upvoted already. Cheers :)

Yours, Piotr

I think the coming months there will be more businesses becoming insolvent or bankrupt. They might try to clear their stock and sell cheap but only if their goods are non-perishables or has a long expiry date. Not all businesses belong to this category.

Maybe it because it relates about the consumers. Yes, it became higher but the demands are lower.

Yup, demand is lower for now hence it cancel out the lowered supply.

Inflation is inevitable...you can't print money out of nothing and use it to buy various goods that have scarcity. We are selling out future generations wealth, to help keep things going now. Inflation is a stealth tax, and very insidious. The effects could be much worse in the future, than the problems that they are trying to help solve today

Dear @pbgreenpoint

I've seen some of your content and I would like to share small recommendation with you.

Consider joining our project.hope community. Some of your content would fit perfectly. We like to share publications related to technology, blockchain, AI and economy, marketing etc.

Our community on STEEM: https://hive.blog/trending/hive-175254 Our discord server: https://discord.gg/uWMJTaW

Hope to see you :)

Cheers,Piotr

@project.hope founder

Fully agreed. We are just stealing money from our future generations and kicking the can down the road. The future generations will likely see us as a very selfish generation.

@culgin inflation is like a worm. It slow slow get all our savings and we never know about it. Yes we can see the effect of inflation after this covid-19 situation every world is facing economy meltdow now and we need to prepare for some crazy ride.

Indeed. Thanks for the comment

I guess that is why people are turning to cryptocurrency when they see each country currencies are at risk. After this Covid-19, it is more like world inflation with many losing their jobs. Hopefully everything turns around when a possible cure that is not expensive for common people.

!tip

The number of crypto users are increasing, it is still very low considering the world's population. Most people are probably still not aware of the potential problem yet. Thanks for the tip!

The foresight of the book Jeckyl Island describes this effect & how to remedy it.

I received a copy from HighImpactVlogs and can dump a copy on PH Discord later.

Those at the top get maximum value from this system & see no point in helping out the lower levels.

= Those in power don't deserve it.

Yes, and that is why the wealth gap is increasing. If this continues, it will eventually reach a tipping point leading to social unrest and even war.

A very good read with graph-based contributions, which give validity to what you say.

I will wait for the next publication, to see what you propose, in what way you are preparing for this that could be coming.

It will surely serve many of us.

Thank you.Hla @culgin, I must say that I am very grateful to you for bringing this publication.

Thank you!

🎁 Hi @culgin! You have received 0.1 HIVE tip from @dolphin-assemble!

Sending tips with @tipU - how to guide.