With the outbreak of the DeFi bull market in 2020, hundreds of projects have flooded the market this year. Driven by interests, more and more users have begun to become DEX audiences, and a spontaneous learning movement has begun. Everyone wants to get tickets to this feast of financial equality in the blockchain field.

At the same time as the explosion of various DeFi tokens, DEX, a once niche category, has recently become a popular Red Sea track for blockchain.

When one after another "xxSwap" was born, the DEX track continued to usher in new challengers, trying to solve the current DEX dilemma. Is it possible for DEX to overturn CEX and become the king of the next era? Who can solve the pain points of DEX in one fell swoop?

DEX still has a long way to go

In the past month, DEX trading volume can be said to be a helicopter jump. The first stop for new projects to be listed is no longer CEX, and DEX has become a new vane.

According to data released by Dune Analytics, as of September 17, the DEX transaction volume in September has exceeded the total DEX transaction volume in August. The current transaction volume in September is as high as US$14.9 billion, an increase of nearly 30% from the US$11.6 billion in August. In August, the DEX transaction volume exceeded 11 billion U.S. dollars, nearly three times higher than the 4.4 billion U.S. dollars in July.

The gratifying results of DEX are inseparable from the money-making effect brought by the DeFi bull market. When the boom of liquid mining and liquidity pools began to sweep the currency circle, DEX became a rich train, carrying a steady stream of users to the new "big casino".

The head effect of DEX is obvious, but the pattern of DEX is not static.

Messari's latest data shows that Uniswap exchange accounts for 62% of the DEX market share. But even with such a strong head effect, the DEX market continues to have breakers born. Sushiswap eroded 70% of Uniswap's liquidity in less than five days.

However, the direct copy of the UniSwap contract and the front-end Sushiswap did not have much innovation, and did not pay attention to polishing its own products, which indirectly caused Sushi to fall from the altar and be abandoned by the fast iterative DeFi era. Since September, the price of Sushi has continued to fall, with the highest drop of nearly 93%.

This means that the market needs to update the gameplay to bring new excitement.

The competition of the DEX circuit officially started. When more and more DEX obtain financing, each project needs to think deeply about how to build its own moat, seize more market share, and obtain more new traffic. Although DeFi has become a new heat wave in the currency circle, a large part of investors have not yet participated in it. This is because, for most people, the threshold for using DEX is too high.

Compared with the order book model, DEX is a comprehensive innovation that retains the decentralized characteristics of the blockchain in an anti-censorship, decentralized, unauthorized, and non-custodial manner. However, the lack of K-line, the inability to place orders for price limit trading, and higher slippage make DEX not in line with the usual habits of currency users in centralized exchanges.

In addition, some people in the industry believe that liquidity is the lifeblood of exchanges. Liquidity mining with DEX features solves liquidity problems, but it also comes with risks. When encountering extreme market declines, DEX liquidity mining is more prone to a run on the market, and its trading depth on which survival depends will become extremely uncertain.

OKEX CEO Jay also agrees that the liquidity pool and AMM model are a stopgap measure for DEX's poor performance (to) support long tail tokens.

DEX that is simply swap no longer meets the needs of users. The new moat should be for a better user experience. The order book model + AMM model will be a popular form of next-generation DEX products.

New players are entering the arena one after another, and TitanSwap is one of the players stepping on this trend.

TitanSwap is more like an enhanced version of multi-chain Uniswap. TitanSwap proposes DEX optimization solutions from the aspects of trading and liquidity mining.

In terms of transactions, TitanSwap hopes to provide users with lower slippage, faster transaction speed, more comprehensive transaction data, richer order types, and cross-chain asset swaps without losing the characteristics of DEX.

In terms of liquidity, TitanSwap is committed to minimizing the risk of impermanent losses, and on the basis of greatly reducing the technical threshold of market makers, improving risk resistance and improving market efficiency.

Richer trading options

TitanSwap abandons the shortcomings of AMM-only Swap can not be specified price transaction. The simultaneous realization of limit orders in the AMM model is the biggest feature of TitanSwap that distinguishes it from other DEXs on the market.

This is because the trading habit of most investors in the market is to directly set the prices of buy and sell orders, and wait for the market to automatically take orders after placing orders.

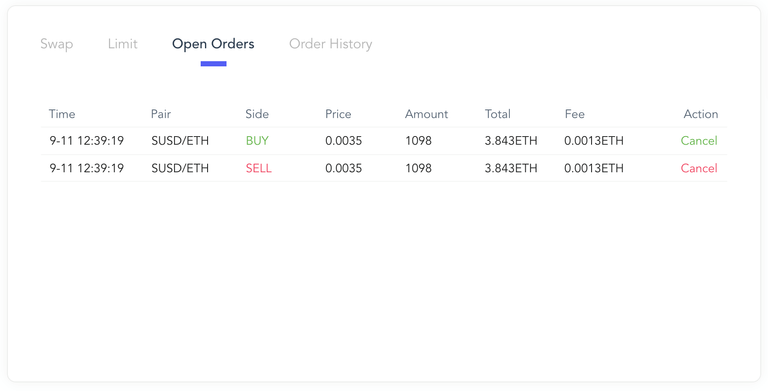

(TitanSwap price limit trading interface)

(TitanSwap trading interface)

At present, when using TitanSwap limit order transaction, TitanSwap will charge the user a certain fee as the cost of executing the order when the price reaches the preset value. When the user cancels the order, this part of the fee is refunded in full.

It is understood that in the TitanSwap limit order "current order" order list, the order status is divided into Monitor (monitoring the user specified price) and Executing (executing the user limit order). When the status is Executing, the user cannot cancel the order.

(TitanSwap transaction record interface)

It is not a simple matter for DEX based on the AMM model to realize the transaction of the order book model at the same time.

TitanSwap has realized the automatic order DEX under the automatic market maker (AMM) mechanism, which realizes the automatic execution of user limit orders through the non-custodial method of smart contracts.

In simple terms, the price on AMM is automatically monitored for users through smart contracts. When the price reaches some conditions set by the user, operations such as limit orders and tracking orders are completed.

The limit order is just the beginning of TitanSwap. Through a similar mechanism, users can entrust smart contracts to implement more abundant order types, and even realize automatic arbitrage among the same type of liquidity pools and cross-type liquidity pools.

However, TitanSwap developer Ghughur admitted that it is relatively simple to write the logic of the limit order into the smart contract. In the future, if you want to implement more logic, such as tracking commissions, automated arbitrage, etc., if these logics are put into smart contracts, the smart contracts will be too large, and the handling fees required for execution will become higher, even for a single transaction. It may exceed the limit of the entire block.

Therefore, TitanSwap is seeking a balance. At present, it is considering centralized processing of price discovery, specific order execution logic, etc., and placing orders related to fund security in smart contracts for execution.

Of course, there are also other contestants who have seen the pain points of Uniswap which can only be traded at current prices and instant transactions, UniTrade is one of them.

UniTrade also wants to optimize the user experience in trading, and focuses on the mechanism of limit orders and automatic order execution. However, UniTrade has not disclosed the official version so far, and it is still at the stage of paper talk. It has not been tested by the market, and there may be more variables in the future. In contrast, TitanSwap, which has been launched first, has the first mover advantage.

However, the limit order is only one of the needs of users when using DEX, and does not represent all the demands of users when they pursue better use of DEX.

In order to provide users with more friendly transaction services, the dimension of evaluation is not only the type of transaction.

Provide users with smaller transaction slippage and mine better transaction prices

For users, richer transaction types are the icing on the cake, but if they focus more on transactions, users are more willing to pay attention to whether the exchange is providing them with better transaction prices and smaller transaction slippage.

When looking for better trading prices, TitanSwap is sometimes more like an aggregation exchange.

In terms of specific operations, TitanSwap will now discover the liquidity pool that can realize the trading pair according to the user's trading pair, and simultaneously compare the prices and slippages of different liquidity pools, and then select the best trading pool to complete the transaction.

This function is completed by TITAN Smart Route proposed by TitanSwap. The features of this solution are: support for more transaction pairs, smaller slippage and support for cross-chain.

Since the main digital assets are currently carried on Ethereum, TitanSwap will first realize the automatic routing of different liquidity pools on Ethereum.

TitanSwap first establishes the liquidity pool TITAN Pool on the Ethereum network, but TITAN Pool is not the only choice for TitanSwap. TitanSwap will determine the best liquidity pool finally used based on the transaction pairs traded by traders and the size of their orders.

TITAN's selection criteria are mainly to realize the exchange of more tokens for users under intelligent routing calculations. The selected path includes TITAN Pool, Uniswap Pool, Balancer Pool, Curve Pool and other liquid pools.

Of course, 1inch is a more efficient routing platform that is widely adopted today. Cross-DEX transactions can already be realized through 1inch. By integrating services with various DEX service providers, users can also get more affordable transaction prices.

In the short term, TITAN Smart Route's first phase goal is not superior to 1inch, but after the cross-chain function is realized, TITAN Smart Route will lead by 1inch in the range of options.

Cross-chain is one of the rigid needs of users in transactions.

For example, if there is no TITAN Smart Route cross-chain intelligent routing scheme, users want to trade different assets on the two public chains of Ethereum and TRON, they need to convert ERC20 assets to ETH through Uniswap, and then go to another Converted to TRX, and finally converted to TRC20 tokens in JustSwap. The chain in this operation process is too long and too cumbersome.

After realizing the automatic routing of different liquidity pools on Ethereum, the next step of TITAN Smart Route is to realize cross-chain intelligent routing, that is, to automatically select multiple liquidity pools on multiple main chains.

In the next phase, TITAN Smart Route will anchor other basic assets of the main chain on Ethereum, and realize cross-chain asset exchange in this way. For example, the exchange of TRC-20 to ERC20 can complete the real non-custodial cross-main chain asset exchange through multiple main chains, multiple liquidity pools, and multiple exchange steps, thereby supporting more trading pairs and completing one-stop cross-chain Asset swap.

In this way, the method provided by TitanSwap not only greatly reduces the user's operating costs, but also reduces the intermediate transaction costs.

However, not all contestants can quickly realize cross-chain requirements like TitanSwap. This is because the development of cross-chain functions partly relies on the improvement of infrastructure, and some DEX choose to develop cross-chain basic protocols by themselves, which involves a larger amount of engineering and delays the delivery cycle of this function.

Currently, TitanSwap is using the renBTC protocol to implement cross-chain operations. Compared with the currently more common custodial cross-chain solutions wBTC and tBTC, the renBTC smart contract is a non-custodial access mechanism. Its core is the RenVM virtual machine, a decentralized network mainly composed of thousands of "dark nodes" Run on. Therefore, TITAN's solution is more decentralized and practical.

In addition, under the AMM model, price discovery and the risk of liquidity providers largely depend on the Bonding Curve.

TitanSwap proposes the TITAN Adaptive Bonding Curve, which automatically adapts to different bond curves for different asset types, which will bring greater liquidity and a perfect combination of better price discovery mechanisms to ensure that users can obtain Smaller slippage, lower cost, and more systematically provide greater liquidity.

TITAN believes that the main reason for impermanent losses is price fluctuations, especially violent fluctuations.

TitanSwap's solution is to dynamically adjust the curvature of the Bonding Curve to make the curve steeper when the price fluctuates sharply, thereby reducing the profitability of arbitrageurs and making the price return to normal prices more quickly and at a lower cost.

TitanSwap will decide whether it needs to dynamically adjust the curvature based on Realized Variant and the way of VPIN. This scheme is similar to the implementation mechanism of Bancor V2, but Bancor V2 requires price oracle recognition, and there may be cases where the oracle fails.

A previous report by Huobi Research Institute showed that regardless of the sharp rise or fall in the price of digital assets, VPIN's forecasts will often increase significantly. It has a certain predictive effect and can be regarded as a leading indicator of volatility. Options trading, market makers' provision of liquidity, and exchange risk management are of guiding significance.

When discussing how to deal with extreme challenges such as network congestion, the Layer 2 support solution proposed by TitanSwap is also very interesting.

When considering the use of Layer 2 technology, TITAN hopes to achieve exponential improvements, and TITAN considers using state channels or unmanaged side chains. TITAN believes that its Layer 2 support solution is more suitable for using Optimistic Rollup. TITAN will gradually realize the support of this solution on the Ethereum official network in the process of cooperation with Optimistic Rollup.

From the perspective of transaction fees and transaction delays, Layer's solution exploration will greatly enhance the user experience. Odaily Planet Daily believes that the sooner the players land on the application, they will be the first to obtain considerable first-mover bonuses in the DEX market.

TITAN wants to provide participants with new opportunities for liquidity mining

In addition to the trading function, another major aspect of the current DEX is liquidity mining.

Whether it is CEX or DEX, any exchange relies on market makers to provide liquidity and depth to the platform. However, the market makers of traditional centralized exchanges need to play a professional role, and it is not possible for all ordinary users to participate in the work of market makers.

The reason why the AMM-based DEX can emerge is also because it removes the professional threshold requirements for market makers, and anyone can inject liquidity into the pool and obtain benefits.

"The liquidity mining model brings many benefits. On the one hand, it is not only the matching of dex, but also the one-to-one demand for borrowing. The threshold is relatively high, but the liquidity pool model can solve the problem to a large extent. And the threshold and cost of dex.” TitanSwap developer Ghughur interpreted the benefits of liquid mining.

TITAN hopes to provide liquidity providers with a feast of income. The current income composition of liquidity providers on TITAN includes AMM fee income, liquidity distribution under the corresponding weights of different trading pools TITAN, stable currency Compound Pool lending rates, and stable currency Y Pool loan interest rate, Synthetix Pool reward, Ren Pool reward, etc.

However, more often the hidden rule of liquid mining is that only big players can become the final winners, and small companies are almost unprofitable.

How to balance the relationship between large liquidity providers and ordinary liquidity providers so that ordinary participants can participate fairly without becoming escorts, which is a big problem.

Under the AMM mechanism, liquidity depends on the amount of funds. If the purpose of DEX is to provide users with better depth, it must not exclude the larger liquidity providers. The larger the funds enter the flow pool, the better user trading experience can be achieved.

TitanSwap hopes to provide users with better depth and can only achieve a balance between liquidity providers of different sizes.

TitanSwap revealed that TITAN will hold some special events in the future that emphasize more balanced income and profitable small casual users. In the short term, it will encourage more people to participate in DEX, hoping that more people can experience liquid mining The operation process.

DEX is not just a tool train to different casinos, DEX itself also has a strong wealth effect.

On September 17, Uniswap announced the launch of the governance token UNI, and then airdropped 150 million UNI to nearly 50,000 addresses that had invoked Uniswap V1 or V2 contracts. The currency circle joked that "a iPhone 12 was manually allocated."

In the long run, the wealth effect of choosing a DEX is no less than choosing an early Binance, OK and Huobi.

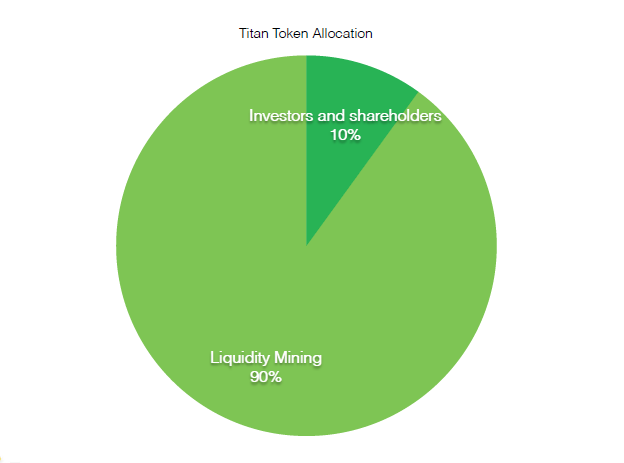

TitanSwap also designed the governance token TITAN, with a total of 10 billion TITAN issued. At present, the main way for users to obtain TITAN is trading and liquidity mining. Holders have the right to propose and vote, and can jointly decide part of TITAN's future governance rights.

In terms of distribution, TITAN promised to release 90% of TITAN tokens through liquid mining. The team has no pre-mining and no reservations. 10% of the tokens are sold to investors as start-up capital, after which the TITAN project becomes a true decentralized community project. This ratio is already much higher than most DEX projects.

However, it is worth reflecting on that hot spots in the currency circle always come and go quickly. DeFi and liquid mining waves have indeed pushed DEX into the mainstream window ahead of time. When DeFi hot spots are exhausted, how much DEX will remain Market space?

How to make a product with a longer life cycle is the common proposition of all players on the current DEX circuit.

TitanSwap also has its own considerations for this.

The official TitanSwap team stated that the distribution volume of TITAN will be consistent with the growth process of the entire network. As the network transaction volume increases, the liquidity of TITAN token distribution will increase, so that when TITAN is used more, there will be more More users will hold TITAN tokens.

This design is actually to keep the tokens from being concentrated in the hands of early large liquidity providers as much as possible.

"In this way, the annualized rate of return may be relatively low, but TITAN pays more attention to the long-term than short-term incentives. We don't want to leave only a mess after a wave of heat passes." Ghughur said.

The latest news shows that at 8 pm on September 24, Huobi launched TITAN and launched a "new coin mining" activity for TITAN. This event will provide 4 million TITAN tokens as rewards for participating in the new coin mining activity For the lock-up users, the total lock-up limit is 8 million HT.

The birth of TitanSwap brought a more interesting arbitrage tool to this game.

Odaily Planet Daily believes that DEX and CEX should coexist for a long time in the future, but the future DEX will definitely move towards integrating more CEX functions. TITAN is likely to use its first-mover advantage to become a breaker in the future DEX ecosystem. Whether it is breaking through the current Uniswap dominance or bringing new wealth to the market, TITAN's move is worth looking forward to.

Source

Direct translation without giving credit to the original author is Plagiarism.

Repeated plagiarism is considered fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.

Please note that direct translations including attribution or source with no original content are considered spam.

This post has been rewarded with an upvote from city trail as part of Neoxian City Curation program

. We are glad to see you using #neoxian tag in your posts. If you still not in our discord, you can join our Discord Server for more goodies and giveaways.

. We are glad to see you using #neoxian tag in your posts. If you still not in our discord, you can join our Discord Server for more goodies and giveaways.

Do you know that you can earn NEOXAG tokens as passive income by delegating to @neoxiancityvb. Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP. Read more about the bot in this post. Note: The liquid neoxag reward of this comment will be burned and stake will be used for curation.

Congratulations @foxcrypto! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

!hw ban

Mass plagiarism fraud.

Banned @foxcrypto.