The crypto space is arguably the vastest digital space, both in technology and asset market. Apart from technology and finance, sentiments also set in as a couple of project exhibits certain ethics which is welcomed by a number of people. People who gets caught in this love spell develops an unconditional love for the project in question and stick to them as a result.

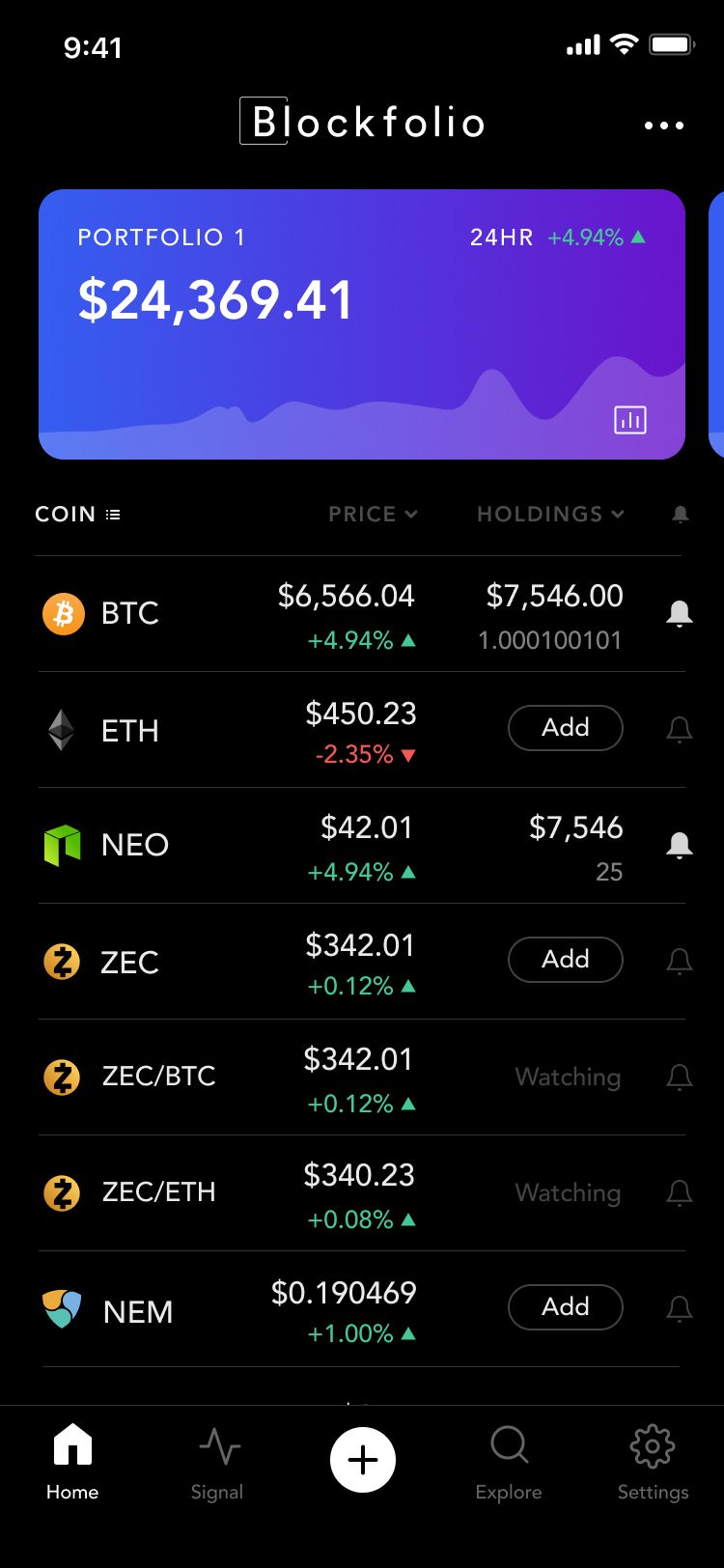

What is your cryptocurrency portfolio looking like? Oh wait; let me guess…two times actually. Majority of investors will fall amongst the first category, a tangible more will see themselves in the second category. Of course, every trader falls amongst the first category...most, to be on a more correct side.

Love happens many times, naturally. Whatever makes you like a cryptocurrency project can happen all over again, as many times as possible and in different ways. You’d end up investing in a couple of projects. This is you I guess – THE DIVERSIFIER!

Majority of cryptocurrency investors prefer to split the funds across a couple of crypto assets. Personally, this is me too. For several reasons, a diversified portfolio is a common practice in the cryptocurrency space. Why pick one when you can actually get as many as possible? Well, this comes with its own demerits; and merits too.

Cryptocurrency is a very risky investment, thanks to its well pronounced volatility. Values of crypto assets fluctuate over time, towards different directions. While this fluctuation is general across crypto assets; the direction of this fluctuation may differ across these assets; most times. A bad day for one project could be a good day for the other. A ‘safety-minded’ investor would spread his capital across a couple of projects and minimize his losses in situations like this. Gains made by one project might be enough to offset the losses incurred by the other project having a bad day. Things stays ‘even’, for now at least.

A number of reasons would make an investor diversify. A gamer and a believer in Artificial intelligence will probably put his money on two projects related to this, maybe some Verasity and SingularityNet tokens respectively. If you believe in crypto as a portable payment medium, you’d probably add some Pascal coin and nano to your portfolio. This may go on until as long as your cravings and sentiments last.

Apart from personal interest and minimizing risks, certain ethics held up by a project is enough to attract an investor’s attention to the extent of investing in them. Projects with a certain level of decentralization and encouragement for community involvement tend to attract a good number of investors. On the contrast; centralized projects are also attractive to some. Whatever serves your taste the most. Investors love to put their money where their mouth is. But this could happen more than once and diversification may come in as a result.

If the last two reasons explain your diversification, then price movements hardly become your focus. However, diversifying to ‘minimize risk’ works most of the times…but certainly not every time. When losses are minimized, profits are also minimized as a result, pick your poison! I guess you already did as a diversifier.

Alright, let me guess again. You are holding just one cryptocurrency asset. Choosing to stay with just one investment amidst tons of enticing project is a very unique decision, I’m certainly not in this category! Maximalism is a popular culture in early bitcoin investors who believe in an extreme superiority if the alpha blockchain and disagrees on the importance of any related project. I recently ran into a community of bitcoin maximalist and if you wonder what their perspective could be, take a look at this, lol.

The choice to stick to one project in contrast to diversification is similar to the proverbial ‘putting all eggs in one basket’. Could be a move to maximize profits, even though this could get very risky; on the brighter side, a massive success by the project you are solely invested in could blow your portfolio up with gains. The risks are high, but what on earth is not risky? There’s hardly a satisfactory answer to that rhetoric.

Apart from the decision to take the risky side and maximize profits, a very strong believe in a project's use-case, ethics and overall structure breeds maximalist views. Bitcoin and ripple probably hold the highest number of maximalists, but many other ‘good’ projects have investors who are ready to stick with only them and till the end. Tough decision I must say. Imagine how it feels to see such project record a 20% value loss in 24hrs. Cryptocurrency HODLers are arguably the most emotionally humans (lol), but this could burn hands in certain cases.

What’s your portfolio game? Invested in ten projects or invested in one project only? Each with a different feeling and reason for adoption. Share your view, which one are you and why? All eyes on the comment section!

Diversification is certainly healthy but unfortunately it is subject to one standard so far, the price of bitcoin. If you seek to protect yourself from the changes and diversify to save yourself from them, unfortunately you are falling into a vicious circle since most cryptocurrencies and perhaps all of them depend on the price of bitcoin, so it is the same to have only bitcoin as many currencies that depend on it. Personally for economic reasons I don't have bitcoin but I do have other currencies.

Greetings dear friend, I can include myself among the investors who have a diversified portfolio, there are always good projects that can ensure future profits and stability at present, diversification undoubtedly allows you to have a balance in the investment portfolio.

See you later, have a great weekend.

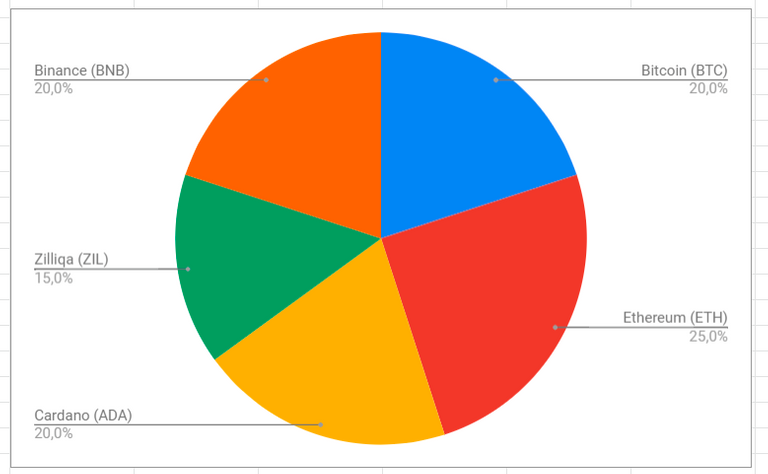

Just checked my proportions:

Am I diversifier? Or still maximalist?

Posted Using LeoFinance Beta

I know that normally it is better to divide it into a few instruments. However, when I start to work, it makes me very uncomfortable to see a few different cryptos and see fractions. For this, even if it is involuntary, I am always dragged to make transactions with a single instrument and without fractions 😀

I am the similar investor that you mentioned here in the post where I want to keep My Portfolio diversified with various crypto coins. keeping all the money in the common coin is highly risky and I do not see any reason to do this because the best way is to put money on various coins because if couple of them does not perform then also remaining will be able to cover the losses.

In today's era technology is playing one of the biggest role in our life and also simplifying many things for us. We use some part of technology starting from the day in the morning until we sleep so I'm right to say that we are dependent on it through various ways including the area you mentioned in the post. this is fantastic post and thanks to you for sharing

Excellent post friend, I must say that it is difficult to take a position, a while ago I put all the eggs in one basket, now I diversify, I feel that it works for me.

I am not one to put all my eggs in one basket, the crypto space isn't a stable place because it's so volatile and one should expect anything. Nice piece