Author: @madridbg, through Power Point 2010, using public domain images.

Greetings dear members of this prestigious platform, continuing with the series of publications associated with bitcoin as the currency of the future, in this installment we will address the demands that occur through this and how they affect the price of the crypto-asset.

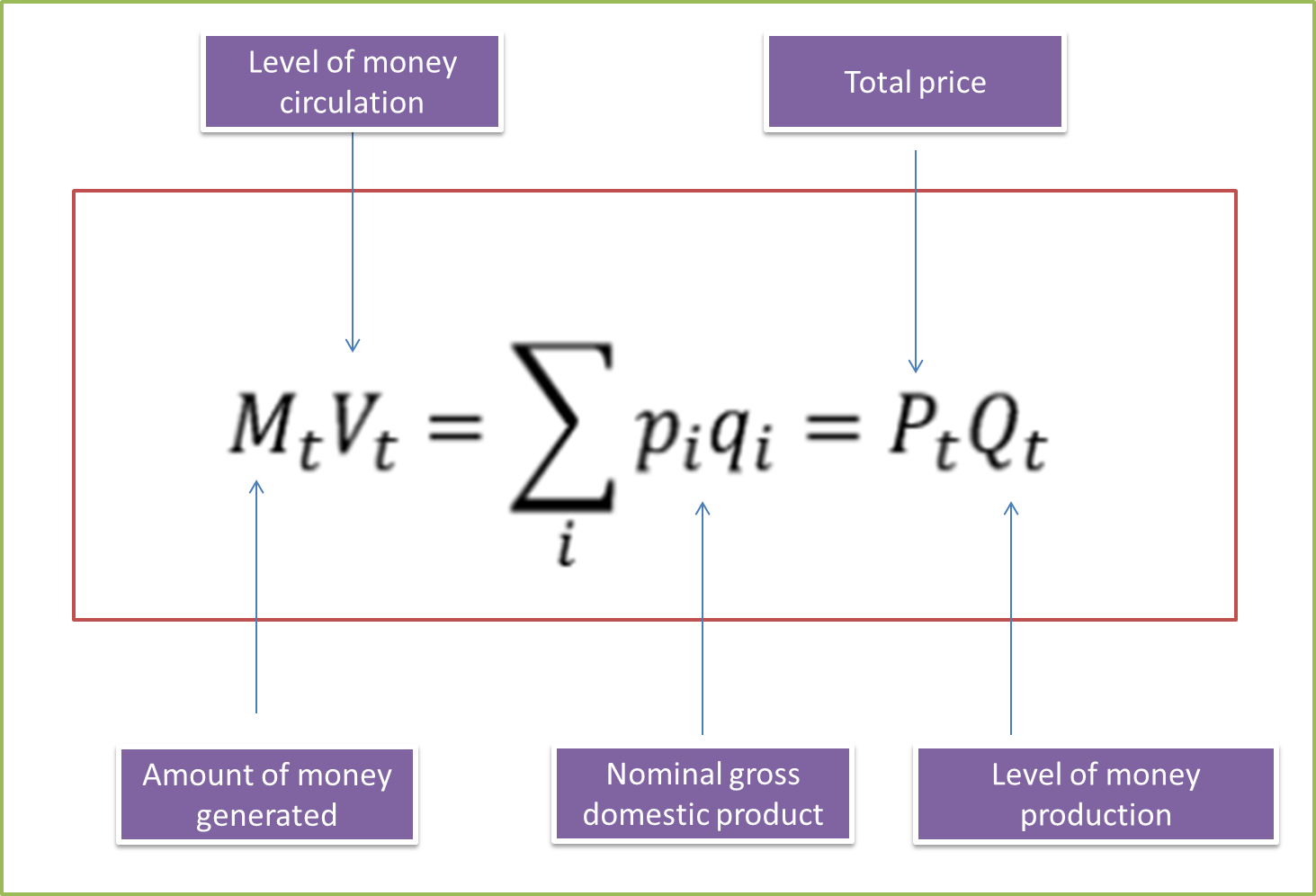

In this sense, it is important to remember that the economy in general moves through the equation proposed by Fischer in mid-1911, which is an algebraic formulation that describes the relationship between the supply and demand of money in a given period of time. [1]

Fig. 2. Fischer's equation of supply and demand for an asset. Author: McLeay and Ryland, (2015). Adapted by @madridbg, through Power Point 2010.

If we analyze the above equation, we realize that the demand for money is influenced by the nominal GDP and it depends on fixed rates in terms of the level of circulation of money and the level of production of the same, if the above are kept fixed, the only way for a variation in the total price to occur is a function of the amount of money that is generated.

In the case of BTC, the amount of money generated is exogenous, so the fluctuation in the price will depend on the other variables of the equation, hence we can establish that bitcoin prices are immune to money supply shocks, so changes in the demand for BTC either by saving or by transaction will have one-to-one effects on the prices of the crypto-asset.

When we go deeper into the demand for BTC, we must apply the portfolio theory, which is based on having a diversified stop of crypto-assets and visualizing them as a whole that makes up its monetary capital, as long as the risks and income potentialities of the currency are evaluated individually. Consequently, BTC prices are influenced by the difficult production of the same and by the safeguard that investors have in their investment portfolios.

This safeguard, appreciation or accumulation are responsible for the historical levels that have marked the price of bitcoin in these times, which depends to a certain extent on the projections and future expectations about the currency. Such a phenomenon has originated an overwhelming level of speculation that economists call "the creation of a bubble."

Fig. 3. Chart on the generation of an economic bubble. Author: McLeay and Ryland, (2015). Adapted by @madridbg), through Power Point 2010.

In my opinion the rise that bitcoin has generated is associated with the phase of greed and self-deception and it is likely that we are on the verge of a trend change in this currency. I therefore invite you to leave your perspective in the comments section below.

BIBLIOGRAPHY CONSULTED

[1] Michael McLeay, Amar Radia y Ryland Thomas. (2015). Money in the modern economy: an introduction. Journal of Institutional Economics, vol. 17. Number 33. Article: Online Access

OF INTEREST

•

Grateful with the community @project.hope and with all the management team of the same one that they motivate us to continue working in a mutual and balanced growth.

Ambition and greed create and drive these trends along with large movements of money from companies that are highly influential.

It has been witnessed for a long time that when these situations occur, they significantly affect the market, causing a group of people to bend towards a trend either to buy or to sell.

The most classic example we have with the Doge coin and the words that were said on Twitter that made the purchase skyrocket in millions.

Greetings @reinaldoverdu certainly a great contribution that you make us, the volatility of the crypto markets is a function of many variables that we can call in terms of time, volume, supply and demand of the product, which is why it becomes so difficult to predict the movements of a particular currency.

#posh twitter

@tipu curate 3

Upvoted 👌 (Mana: 39/78) Liquid rewards.