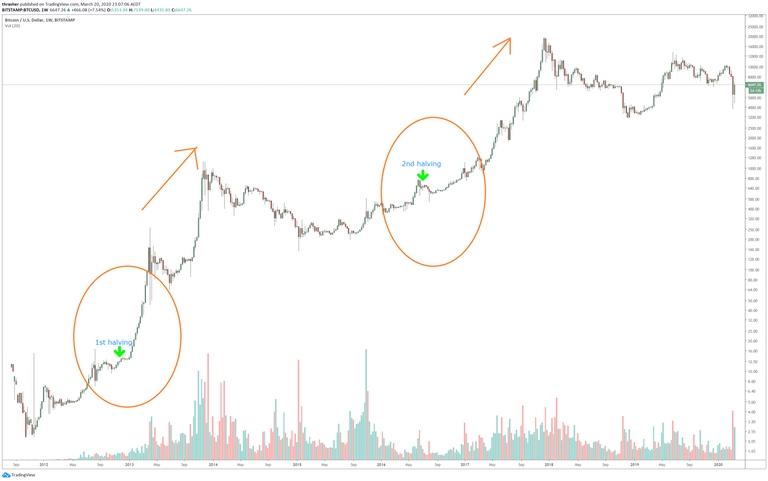

Bitcoin crashed during market carnage of March, 2020 and fell below 5000$. Price recovered after that steadily. Global equities performed really poor in Q1. Actually Bitcoin outperformed Dow & S&P500 in the first quarter of 2020. Now the Bitcoin’s halving is only 3 days away and the miner reward will be reduced from 12.5 BTC to 6.25 BTC. Bitcoin halving happened a few times earlier. The first halving took place on 29th November, 2012 at block height 210,000. The second halving took place on 10th July, 2016 at block height 420,000. Each halving ensured a bull run almost. This time also we can see that demand is increasing. Bitcoin price is hovering in the range of 9600 -10000$ and it can break past 13000$.

BTC/USD Price movement in last 2 months from Coingecko

Will we see a bullish explosion? Price is a function of various sentiments. It is obviously difficult to predict price in this volatile market. But Bitcoin has really established its ‘store of value’ since its launch. A store of value is anything that retains purchasing power for the future. Money has a store of value because we can purchase goods or services with money. Store of value is a key function of money. Previously people used to use gold, silver and other precious metals as currencies because of their ability to store value. Yes, those were easy to transport and could be formed into different denominations. USA was on a gold standard till 1971 and dollars were redeemable for a specific weight of gold. President Richard Nixon ended dollar-gold convertibility. USA is using fiat currency since 1971. Fiat is declared as a legal tender by government but its value is not attached to gold or any other commodity. There lies the extreme risk. Fiat currency’s store of value is attacked when hyperinflation occurs. Also, the money supply is determined by the government. Government can print any amount of money and the money supply has no ceiling basically. USA recently defended Federal Reserve’s decision to print 6 Trillion dollar as Donald Trump said, “It’s our money; we are the ones, it’s our currency.” Quite fine! Government has the authority to print money. Infinite money supply will lead to infinite inflation. So, how does the money store its value? This is the reason people tend to focus on other stores of value like gold, silver and real estate. Traditionally these have been able to store the value far better than fiat currency.

“If you put the federal government in charge of the Sahara Desert, in five years there’d be a shortage of sand.” – Milton Friedman

Government won’t explain their money printing rationale. 6 Trillion dollar stimulus of USA government can buy 70% of entire world’s gold supply at spot price. 6 Trillion is also double of India’s present GDP (2.94 trillion dollar). We don’t know where we are headed, but we’re on the way to a disaster. This disaster is government-sponsored.

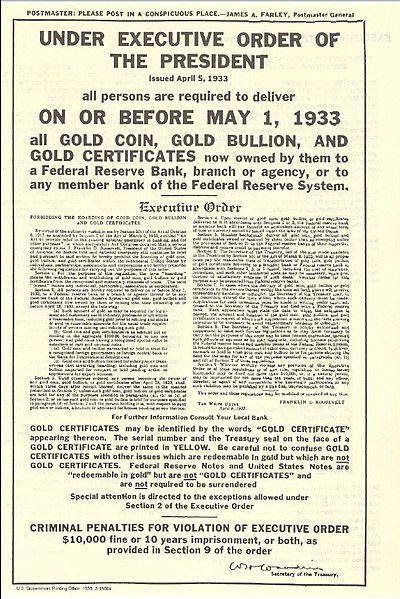

Image Source – US government EO 6102 in 1933 which forced all Americans to deposit gold

Gold has got the cult asset status because it arrests control of the issuance out of the hands of imperfect controlling authority. The supply of gold has been limited and it gives enough reason to use it to curb the inflation. Yes, it stores value quite well. But alas! Gold standard is nowhere used. UK replaced gold standard in 1931 and the USA followed them in 1933. "We have gold because we cannot trust governments," President Herbert Hoover famously said in 1933. Then it was history. All Americans were forced to convert their gold to the US dollar. USA abandoned remaining currency dependability on gold in 1973. Everywhere gold standard has been replaced by fiat money. Fiat money is basically a government order. The government orders it to be accepted as a means of payment.

Image Source – Historical BTC/USD price jump post halving

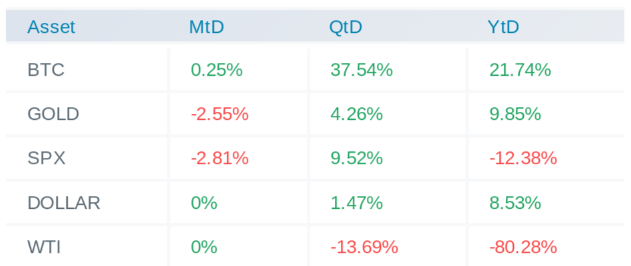

Bitcoin was designed to be a deflationary currency. The issuance rate of Bitcoin decreases with time and it makes it scarcer. The demand for Bitcoin comes from the demand of gold standard. Bitcoin’s inflation will drop to 1.8% after halving and such low inflation will make it a more attractive asset. If we look at all macro assets, worst performing has been WTI crude with YTD almost 80% negative return and BTC has outperformed all including gold and silver with 20%+ YTD return.

Image Source – Macro assets return this year

Gresham’s law states "bad money drives out good." It is based on the idea that people want to get rid of the money which gets undervalued quickly and hoards the money which increases its value over time. Mr Gresham lived from 1519 to 1579, and he was the founder of the Royal Exchange of the City of London. During that time, Henry VIII changed the composition of English shilling. A substantial portion of the silver was replaced with base metals. People quickly became aware of the matter and they began to separate the English shilling coins as per their production dates. People started to hoard the coins, which had more silver as if those were melted down, produced more value than their face value. That’s how people choose an asset to hoard. Only the bad money remains in circulation. Bitcoin’s store of value has increased unexpectedly. People have started to hoard Bitcoin. Mr Grisham’s law is still very relevant. Governments all over the world fought earlier and will continue to fight Grisham’s law. How is it done? They put a prohibition on removing coins from circulation or they confiscate private properties like gold. We should remember that Franklin Roosevelt forced Americans to sell gold at $20.67 in 1933 and after collecting the gold, he adjusted the price to its real price of $35 per Troy ounce. You get it right - that is 69.33% profit. People have been crazy to hoard precious metals since ages but Bitcoin is a very new asset class. The way it is storing value is quite significant. Storing of value clearly indicates that people are hoarding. The modern gold standard is born as Bitcoin and it has surpassed gold in the value pyramid. Time to buy the next generation asset?

Note: All the images (if not cited) are created by the author using free vectors

Awesome articles, a great summary of many things I know already, but great to see other liked minded people.

I mainly follow Mike Maloney and Jeff Berwick on gold and cryptos + some videos here and there about Monero, an interesting space to look at.

I already purchased some crypto expecting it will rise while stille keep some liquidity and plan so sell a bunch when it will raiss over the 12K mark and then purchase again if a dip occors around the 10K mark in the futur, while keep some obviously in case. I have other cryptos in small quantity and some Monero also, but BTC seems to be the king for store of value so far.

What do you plan on doing ?

Thanks for your appreciation. I hold good % of my portfolio in BTC and ETH. I keep on trading alts mainly in BTC pair. I avoid fiat market or stablecoin market as I find more SOV in BTC than fiat. Price fluctuation of alts in BTC market is the best trading opportunity to increase BTC count. Acc to me, ETH is extremely undervalued and it'll come back in form with launch of ETH 2.0.

Ok thanks for sharing your insights.

Do you have a good video or article on why's ETH in undervalued ?

Will check for BTC and ALTs trading opportunities in the Alts I consider interesting.

No...I am planning to write some :) One will come by 1-2 days

Here's a community where you could cross post you publication :

https://peakd.com/@hodlcommunity/celebrating-the-1st-week-and-milestones-of-the-hodl-community

Another great article 😇

Many thanks

Always 😇

Nice and informative

many thanks

Posted Using LeoFinance

It is weird when you think about it that people used to pay in gold or other metals 😄

Yes but that was the norm once upon a time everywhere :)

welcome to our community please join our discord channel as well and enjoy our services ;)

https://discord.gg/bAcUWPb

Good article. It is an interesting year. For sure!