Hello! Hive reachout community! What a wonderful opportunity for me to share my thoughts on this week's prompt. Thanks to the management of hive reachout community for the continuous weekly prompts, these are very engaging and educative topics.

I stumbled on this week's prompt and I thought to myself hmmm..what a way to start the year with such an interesting topic as this.

The concept of finance is very crucial to every individual because it's almost as if all our live's struggles, waking up early in the morning and sleeping late at night is all centered around gaining some level of financial freedom. Our parents or guardians enrolled us into school early and also mentored us to study professions which they perceived to have more financial potential.

Have you ever wondered why our parents always insist we study certain professions? It is because these are professions in which they believed we are most likely to succeed. But what then happens after we must have finished school and graduated, we get the job and we are happy, the pay is good yet it looks as if the more we get the money the more our needs and expenses. We see it happen to some of our parents and people we know, who we used to think were very rich before but after retirement we begin to wonder , but I thought this person was rich".

Some of them struggled their way into getting high paying jobs and after several years of commitment, active and dedicated service to their job, they now retire and all of a sudden they go back to default setting! They become broke again.

What is really happening? What don't we know? Why is Mr A succeeding financially and I'm struggling?. He's successful I'm also successful, he is a graduate with a skill that makes him money I'm also a graduate with a skill that makes me money too. But why does it look like I'm always the one struggling financially and not him?.

Please walk with me as I attempt to answer some of these questions I believe most of us must have pondered upon at some point in our lives. I will be discussing some strategies that l believe will ensure financial stability.

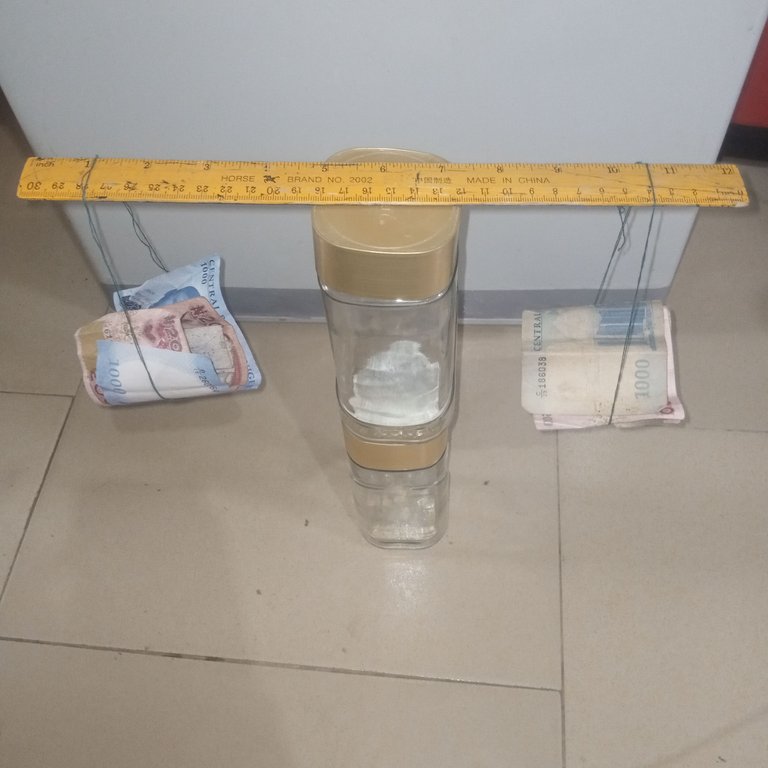

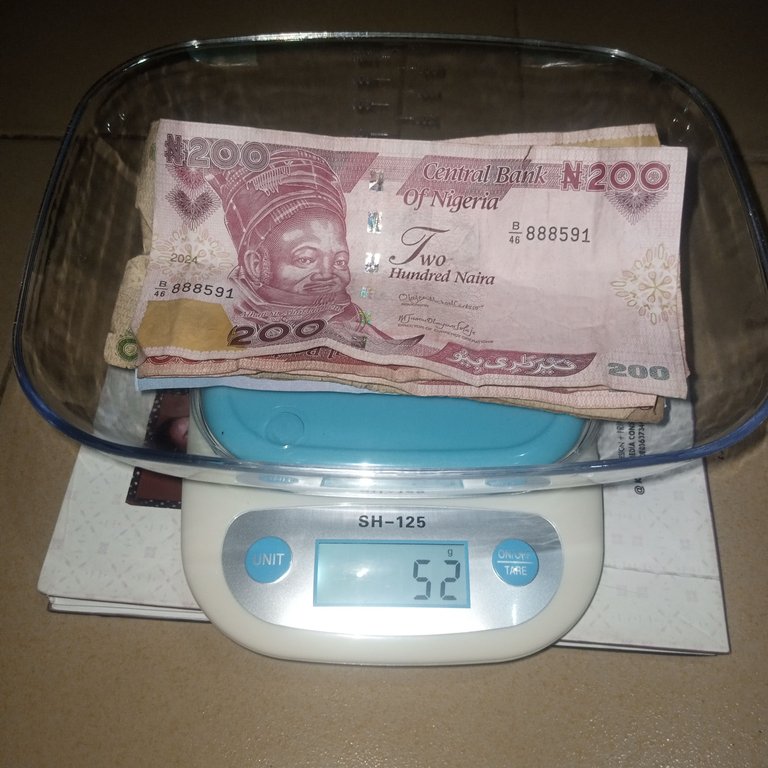

Firstly, savings! This cannot be overemphasized. Saving is very important if we want a stable financial life. Life is full of uncertainties so we save for the unknown. I understand we have needs and needs have utmost priorities above others hence, we must learn to prioritize our necessary needs per time.

After we must have carefully identified our needs and wants, we use this knowledge and draft out a savings plan that best fits these needs. This is not done recklessly without a careful thought so that we don't later run back to our savings account in no time and take out everything in it.

Secondly, ensuring a continuous flow of income through passive income generation. What do l mean by that? Well this is income generated without necessarily involving any daily physical activity by the individual such as royalties. Book authors and music artist make money off of books and songs they had released years ago respectively through book sales and downloads.

I have learnt over the years in my little experience as a fashion designer that it is risky to depend solely on sewing projects from individual clients. Infact while in the university, I noticed the most time I make money is when school is still in session and even while at home the most money I make is only during weddings and festive seasons. After this seasons are over I go back to being broke again. My getting money was solely dependent on clients giving me work which was very frustrating.

Since the beginning of the year I have been thinking of how to generate passive income for myself. I have resolved to launch a clothing line where I sell ready to wear outfits to other boutiques and supermarkets. This will ensure steady flow of income whether I'm actively working or not.

Thirdly, investment. Savings and passive income generation is not enough strategy to employ if we want to be financially stable. We engage in good investment that will yield good returns. Infact investment is much more potent than savings when talking about financial stability, but that doesn't make saving less important.

Learn to take calculated risks, study and understand the terms and conditions, conduct risk assessments before you involve yourself in any investment.

Lastly, we must understand that financial stability is not all about making more money but also finding ways to spend less. That is to say making more money and spending less money. Take for example we eat everyday, food items such as tomatoes, pepper and vegetables e.t.c can be planted around the house, so instead of having to buy food items everyday, we already have them in our backyard.

In conclusion, we need to understand that for us to have a stable financial life, we must satisfy these three conditions:

- Learn to make money

- Learn to save money

3 Learn to replenish (make money circle back to you). In order words investment.

Number 3 is very crucial if we don't want our wells to run dry.

All pictures are mine

You highlighted very practical strategies. It's one thing to make money, and it's another thing to be able to handle it prudently. Achieving financial stability requires discipline and commitment.

Yes, that's very correct. Maintaining and multiplying money requires thorough discipline and commitment.

You've indeed highlighted nice and credible strategies to achieve financial stability in one's life.

I like how you ended wonderfully with those three points.

Your pictures are nice and creative.

Thank you for the kind words. It is left for us to put these strategies to use and watch how stable we become financially.

I love your concepts for the images @leone001

You've digested the topic into little fragments for better understanding. It's not just about having the money or looking for more money, how one is able to manage the little he or she has brings about financial stability.

Thank you for sharing this with us

Thank you so much sir @ovey10.

Yeah that's true, how we manage our finances is very crucial.

Congratulations @leone001! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 900 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThank you @hivebuzz . I'm glad that I'm making progress. I will keep doing my best to meet up my target

Welldone work sir, indeed you have say it all.

Thank you @roseayuba. Well I guess we just have to act on it then.