According to my mentor, reading brings you closer to personalities you wouldn't have ever met in your lifetime, takes you to places you wouldn't have ever visited, and exposes you to ideas and perspectives of a wide coverage!

Growing up, I never liked reading books, all thanks to my literature teacher in college. Being a science student coupled with my experience with my then-literature teacher Mrs. Adewale, made me detest books. However, a lot has changed in the past years as I have discovered that there is a part of me that hungers for knowledge, not just in my field but in all aspects of life.

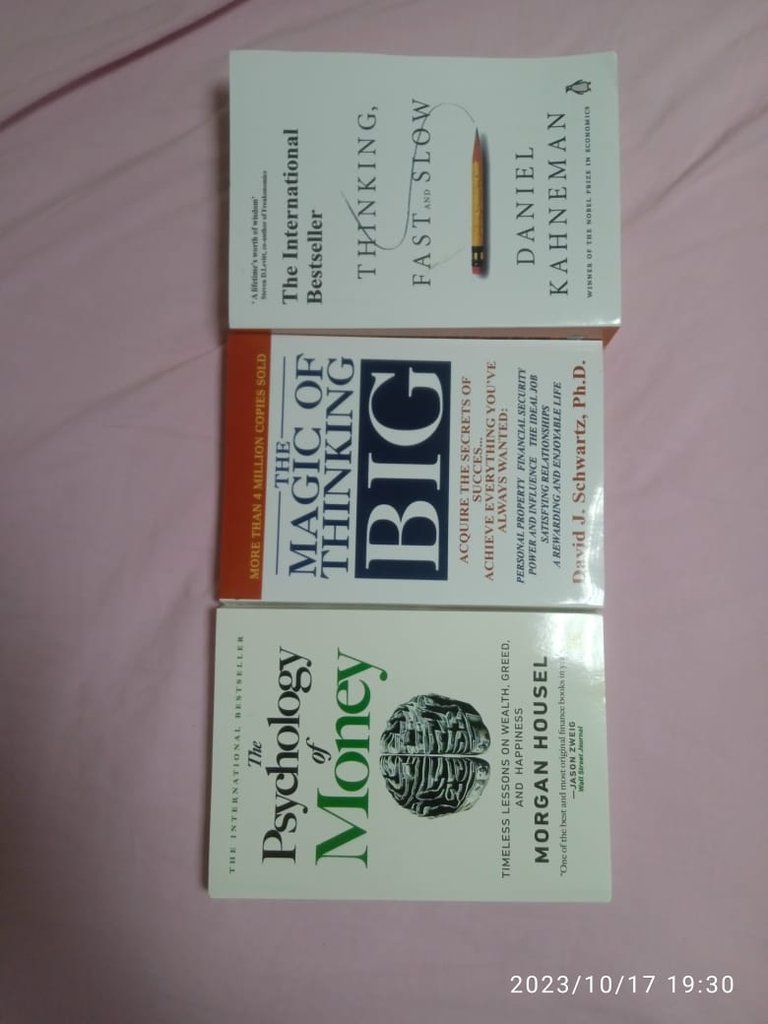

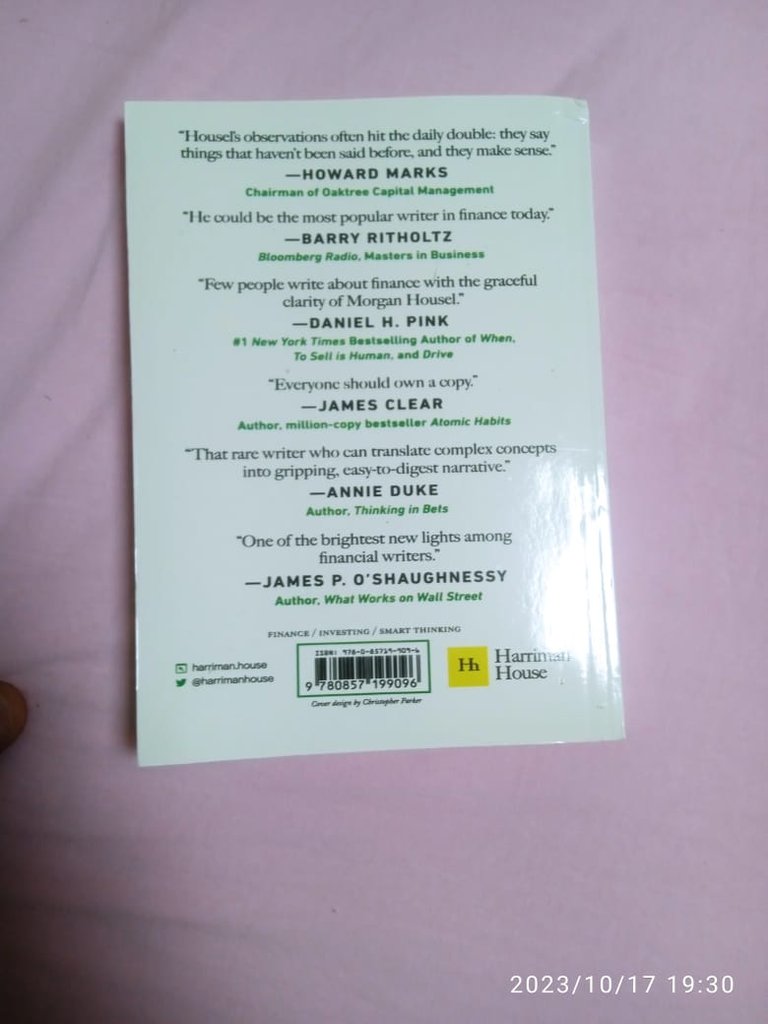

Haven't discovered this part of me, I resolved to build a personal shelve strictly focusing on areas of personal development and global politics. Hence I made the bold move of ordering my first batch of books. And guess what? They just arrived! Why this is a "baby step" towards actualizing the resolutions, there's been this feeling of fulfillment ever since I got the books.

So my first and new collections are:

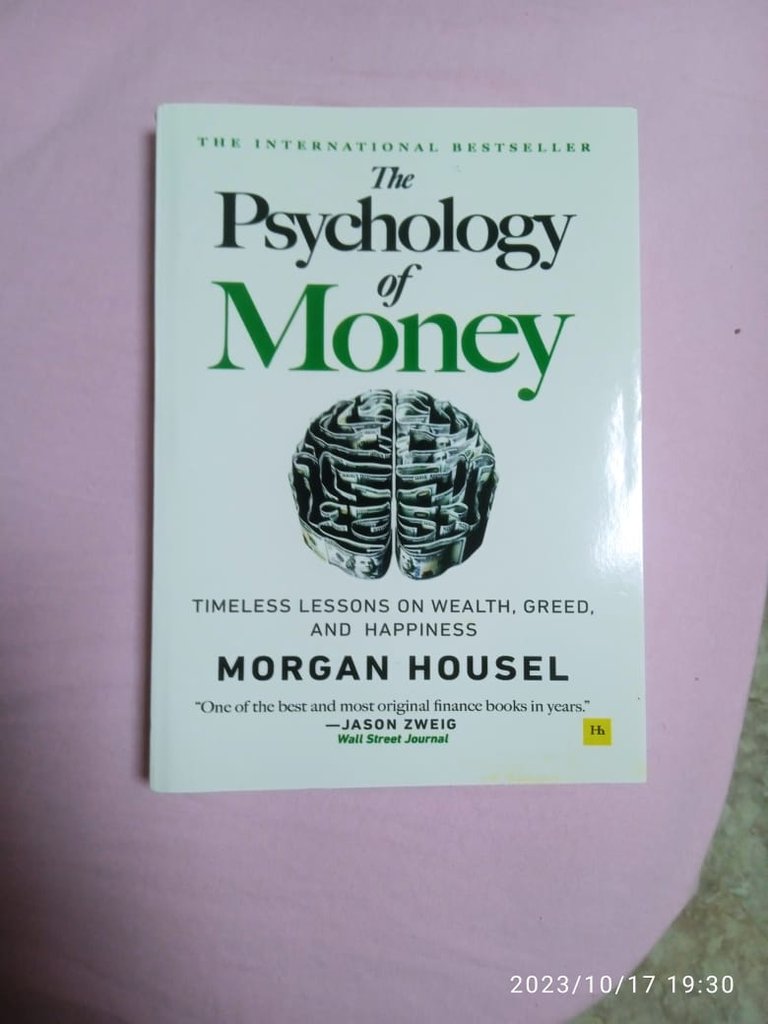

The Psychology of Money by Morgan Housel

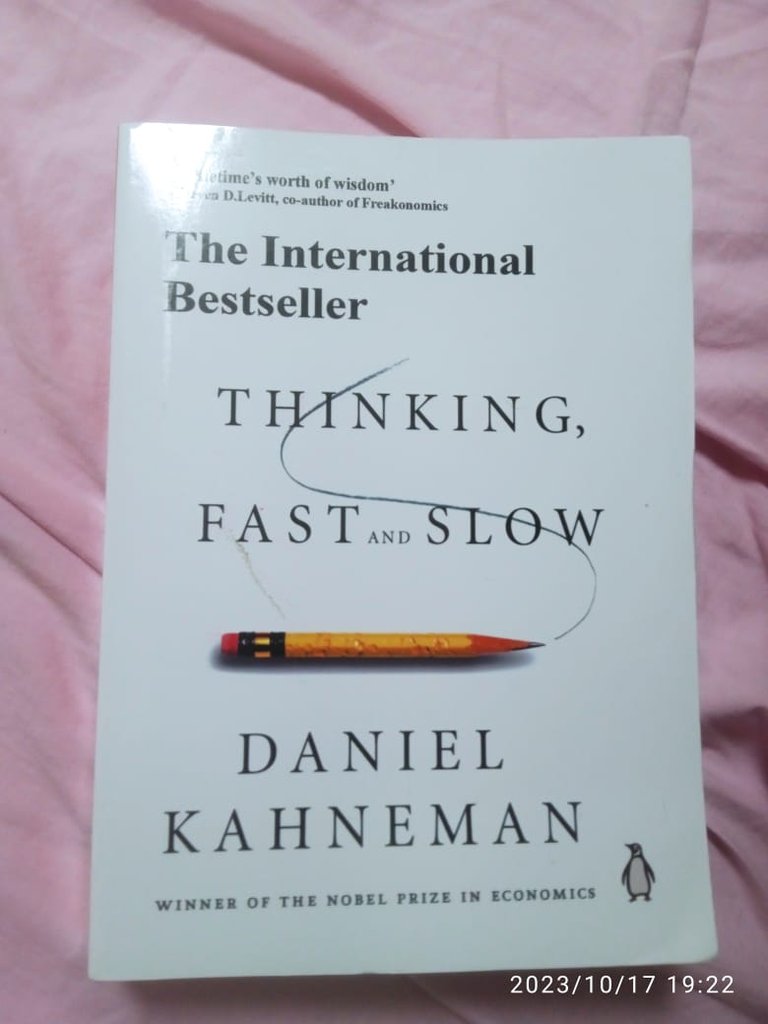

Thinking Fast and Slow by Daniel Kahneman

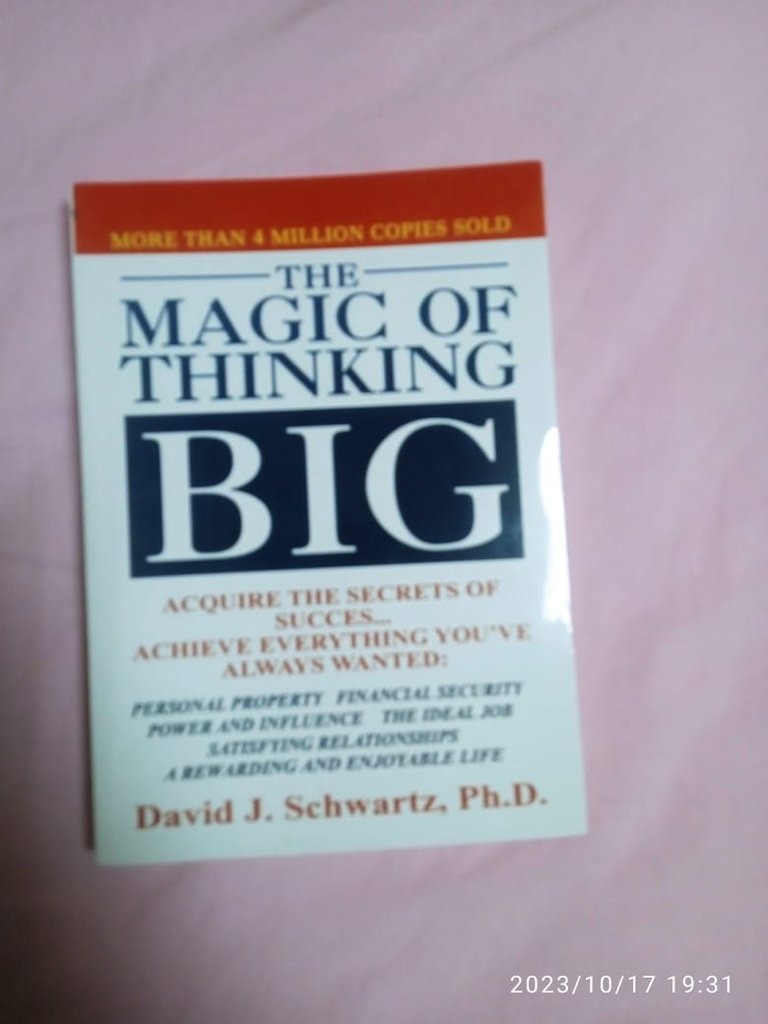

The Magic of Thinking Big by David J. Schwartz, Ph.D.

So far, I have gone through the introductory part and chapter one of The Psychology of Money and I must confess that the book has in store for all looking for financial prudence and stability.

Garnished with real-life stories, the intro of the book focused on the story of Ronald James Reads - An American Philanthropist, investor, janitor, and gas station attendant and Richard Fuscone - A Harvard-educated Merrill Lynch executive with an MBA. Here, Read with know formal education ended up very successful than Fuscone who studied in the best of schools, and has an MBA!

The stories, in my view, served to buttress the key message the intended to pass across to the readers; Financial success is not a hard science but a soft skill controlled by one's behavior rather than one's intellect. This soft skill, he referred to in the book The Psychology of Money.

A summary of chapter one - with the title No One's Crazy, passes the message that the financial attitude of anyone is solely influenced by environments, opportunities, and personal experience! Hence, One can spend a million dollars on a party while the other can spend that million dollars in buying shares/stocks but none of them is crazy! In essence, Your personal experiences with money may not make up maybe 0.00000001% of what's happened in the world, but maybe 80% of how you think the world works!

While I haven't gone far with the book, I am certain I have the value of my purchase! It's gonna be a long read but I am in for it!

Congratulations @chidubem26! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 9000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: