So, the other day I talked about using the theory of Cyclical Spending in relation to my small town bakery. And it is indeed the perfect timing to explain my approach in parts of the stock market, using the German industrial companies.

Fat years and lean years - Cyclical Stock

As most of you know, there are a lot of cyclical branches of economy. Semi-Conductors are the latest stellar example, being talked about a lot. But there are others, and one of them is the German industry. Now, Germans are not as big in stocks as the US, and both companies and investors have different approaches than the emotional/bot driven US-Stock-Economy. But every so often, the German industry is pronounced dead and never to recover, only to rise like a phoenix after a couple of years.

The most recent downturn started with a stellar year in 2022. German industry was booming, production capacity was lower than demand, everything was great and would always be that way. Then, 2023 came along, and suddenly growth turned to reduction. And 2024 was even worse.

My cyclical experience

I personally started buying my first German industry stocks in the beginning of 2023 – big mistake, I wasn’t aware of the cyclicality back then, and after getting great results from my 2022 buys, I was a bit cocky. I got nice dividends (most German companies pay once a year), the stocks rose a little – and then started to go down.

In the middle of 2024, I started buying German industrials again, but only my two favorites, Wacker Chemie and ThyssenKrupp. Small savings plan, some limit-buys, the bottom would be there eventually – I hoped. This was my first time doing a conscious cyclical investment. I was a bit scared, same as I was in my first super-negative year.

Catalyst - Government Spending

Now, Germany is a slow moving politically environment. Everything is about compromise. And Germany is very, very strict about debt – no, they don’t use the Anti-Cyclical Government Spending, they rather spend what they have, not a dime more.

And then, a party gets elected that promised to not even think about touching the “Schuldenbremse”, the “Brake on debt”. Luckily (in this case), they’re not one to keep promises, so they’re not even constituted yet, but actually want to change the constitution (which the Schuldenbremse is anchored in) with the current/old parliament in order to spend 500 billion dollars on military and infrastructure. Guess how the stocks reacted since that was announced this week?

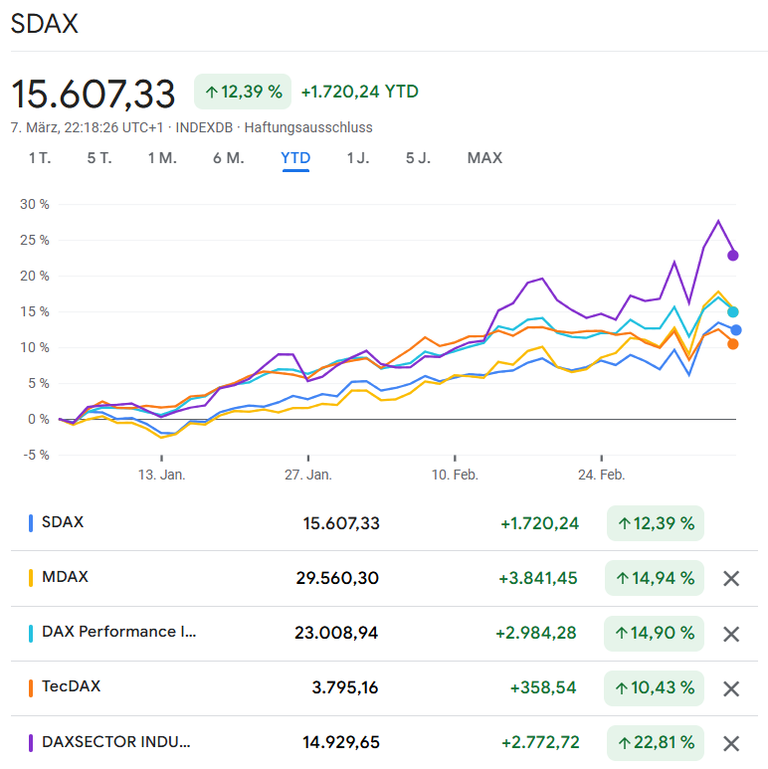

They skyrocketed, with exception for the Friday where they all fell quite a bit (as always after a rocket up). This culminates the YTD performance:

DAX is up 15% year to date (40 biggest German companies)

MDAX is up 15% year to date (Middle companies)

DAX Industrials are up 23% year to date.

SDAX (smallcap) and TECHDAX (tech, obviously) are only up 12.5% and 10.5% respectively.

So, industrial are outperforming the main index, and outperforming tech – yes, that happens. But this is a little bit of “timing the market”, not as much as trading, but one does have to follow the long cycles and more-or-less predict the lows and highs. And stick to it in the lows, waiting for the next impulse or catalysator that suddenly makes the stocks move drastically.

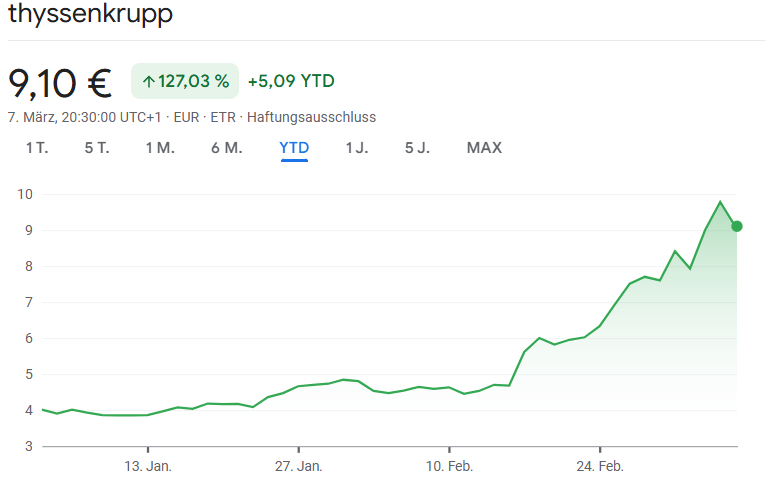

Hart wie Kruppstahl

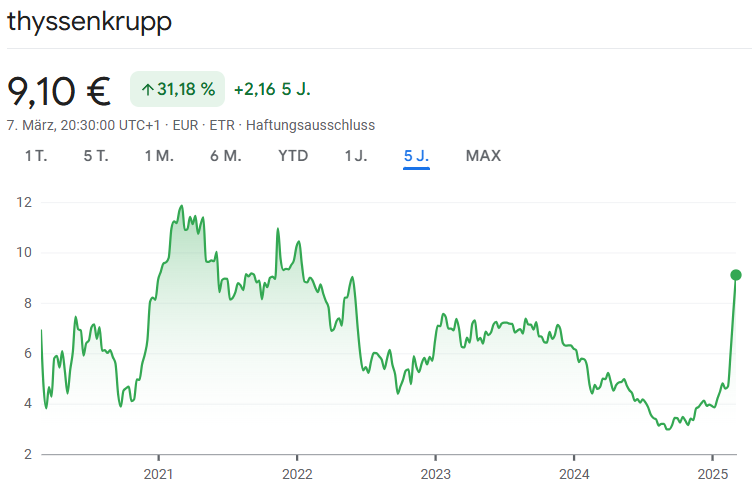

Example is ThyssenKrupp. A dead stock. I did a deep-dive into them a couple of years ago, and they have all it takes to become strong again in the future (there is risk, though, as always, no financial advice here, do your own research etc.). I was up 50% at one point. Then I was down 50% for a while. I collected dividends in the meantime. Now, they suddenly rocketed up 125% year to date. Because they provide a lot of what is needed for both infrastructure and military. And as always – the stock market knows first. The stock started moving way before the “Sondervermögen” (extra spending) was announced, before the elections even.

That doesn't mean TK is a great investment. Not at all. The long term shows that it has been dead money forever now. But I'm still up 80% on them - and I know that I will have to sell them eventually, and I actually sold a bit when it was just shy of 100% return for me. This is not a decade-long investment. This is a cyclical investment. There are many other stock in the German market that are way better for the long term.

Conclusion

Cyclical investment is not for everyone. I've done it once now, and at least with one of my picks it works perfectly (we'll wait for Wacker Chemie...), but it is indeed not for everyone, and I think it's a lot more complicated than other styles of investing. It definitely very different from investing in my business in a cyclical manner.

Congratulations @beelzael! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 3000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP