Nobody is encouraged to save anymore

Recently I made a post that I went ahead and Stake it All! Stake it All! with my Hive-Engine tokens. Just a couple of days ago, American Express sent me an offer about a savings account.

If I put in $25,000 in their *High Yield Savings Account, they would give me $500 on top of that. Sounds like a great deal, until I saw the 0.40% APY. Sure, they provide all of this hype about how theirs is the best and show you a calculator (that doesn't really work) on how if you just put in $1000 and $150 a month, over 6 years you'll have a future balance of over $150,000! Woo hoo!

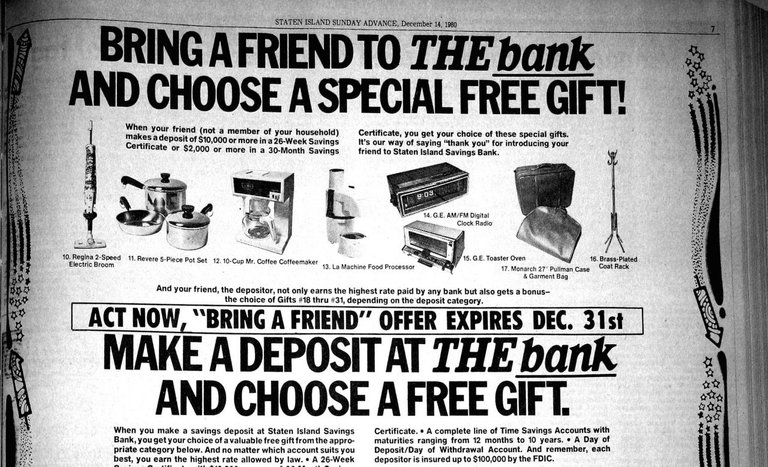

But, they didn't even offer up a ubiquitous brown digital alarm clock by G.E..

For those of you born after 2000, there was a time back in the 1970s and 1980s when saving money actually was a wise decision. You could actually make a 10% or higher return on a savings account. You could even make up to a 20% on a Certificate of Deposit (CD).

But, those days are gone. I was actually surprised to see the above ad for a CD that offered more than 1% from back in 2018. But, that is huge compared to what you can get now.

Come on! 0.55%?

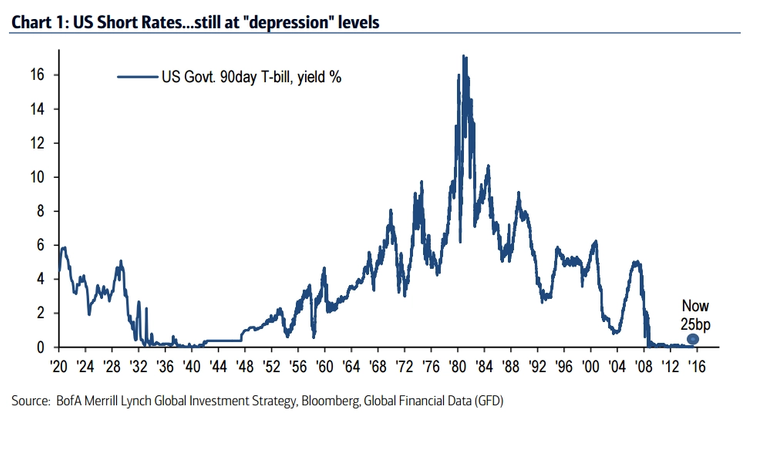

So, you might be asking, "What happened?". Well, the Federal Reserve happened. Back in the 1990s, Alan Greenspan kept lowering interest rates in order to keep the economy out of a recession. When the recession was done, interest rates went back up and leveled out at a reasonably strong level. A 5% return on savings is what we should all expect, at a minimum.

This was a monetary policy to try to prevent the high inflation and slow growth of the 1970s, which was termed "Stagflation". The early 1980s benefited from those high interest rates and turn-around economy with high returns on savings, so people invested and the economy grew, until the late 1990s, when the Federal Reserve decided to increase interest rates during the Y2K spending boom. And when the economy crashed due to no more Y2K spending and the fear of 9/11, they kept dropping the rate until made it pointless to save money. However, it made it a great time to get mortgage, until interest rates shot up in 2006, which lead to real estate crash of 2008 on the wave of ballooning mortgage payments.

There hasn't been an increase in the Federal Reserve Interest Rate since 2006. And now, we are currently hovering around The Great Depression era levels. Some European banks actually doing negative rates. This is great if you are borrowing, but not so great if you are saving.

It's almost as if the Powers That Be want everyone to not save, but to keep on spending and going into debt.

Oh...they do. They want you to get into debt so that you need stimulus packages, family relief and Universal Basic Income. They want you in debt so that they can offer up a Great Reset.

Putting your money in a bank savings account will not provide the savings that you need. However, having at least 2 months paycheck worth of cash in your bank account is wise advice and everyone should try to do so. Beyond that, eliminate your debt and put your money into investments. If you are young, do riskier investments (like cryptocurrency), if you are getting close to retirement or are risk averse, there are mutual funds that can be tailored to when you plan on retiring (if we really ever get to retire). If you are unsure, seek out good trusted financial advice, but common sense is what most people need. Moving debt from credit card to credit card to ride the 0% train will only get you so far if you aren't paying down that bill.

Live within your means, don't go chasing Lamborghini waterfalls.

Let the positive energy sing!

More Power to the Minnows!!

Now Playing

Rising Star | dCity | Splinterlands

Banks used to be safe places to put your money.

I never heard of anyone having any problems that weren't immediately worked out with a bank.

Today i hear of banks grilling you for taking out too much money.

Banks closing people's accounts.

Banks moving people's money without consent.

And even, banks taking people's money, freezing accounts, locking accounts.

Banks tellers seem a lot less friendly then they used to be.

You should put it all into bitcoin because we know your nestegg isn't anywhere big enough to retire

Retirement is a pipe dream.

The goal now is let your money work for you instead of sitting dormant in the bank, also we should create a balance between investing and savings.

We can save in fintech apps that have more interest rate than banks

Upvoted!

Manually curated for #informationwar (by @truthforce)

Delegate to the @informationwar! project and get rewarded

As bad as this looks we can look at the bright side that poor interest rates from banks have encouraged people to start investing and taking personal finance seriously

Agreed!

Minus the"great reset" part, I agree that the goal of the government is to have you spend more. At its core, if the federal reserve turns down the interest rate = borrowing money is cheaper, turn it up = borrowing becomes expensive.

So, if spending is down, they lower interest and let folks borrow more (savings rates will follow suit, hence not good for saving and hopefully you spend instead). If spending is high, they will turn up the interest knob so borrowing becomes more expensive and hopefully slows spending and savings start.

The goal is to find what's the right setting on the knob to keep inflation down but people still spending.

I very strongly agree with your point about creating a margin. One lesson many folks should take away is to have an emergency fund to buy you some freedom from the next paycheck or two. Ideally, 3 months is a good goal, next is 6. If that's to hard, One study I read notes that a good base e-fund goal should be $2346, from there just keep going.

Lastly, if you are trying to find a decent interest rate - online banks are the way. Discover Bank ftw! From there, Treasury I Bonds are pretty good interest at the moment (7.12% but subject to adjust every 6 months) but are limited to 10k max purchase per year abut if you pull before 10 years, you'll eat a three mother interest penalty. (Eg, in for 18 months but cash out, you'll only receive 15 months worth of savings). Not a bad price to pay when the interest is great!