30 / 05 / 2024 - 180 Day (LP) Rewards Contract goes live at 40% APR

For those following Threshold Guardian Gaming Guild since 2022, you will know that we created our Swap.Hive Liquidity Pool (LP) 2 months after minting our Token.

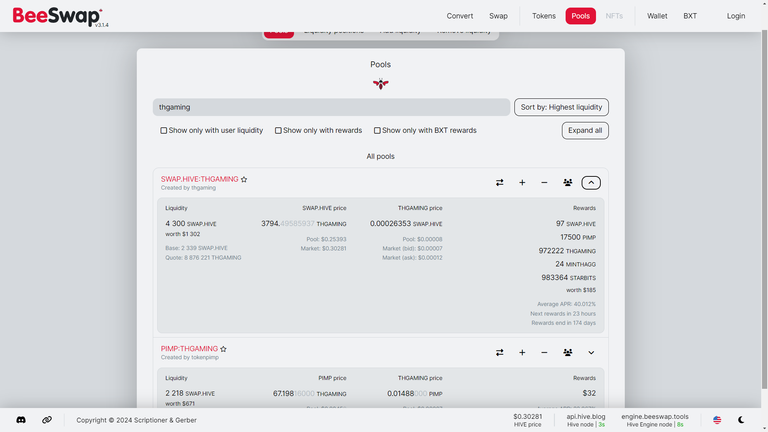

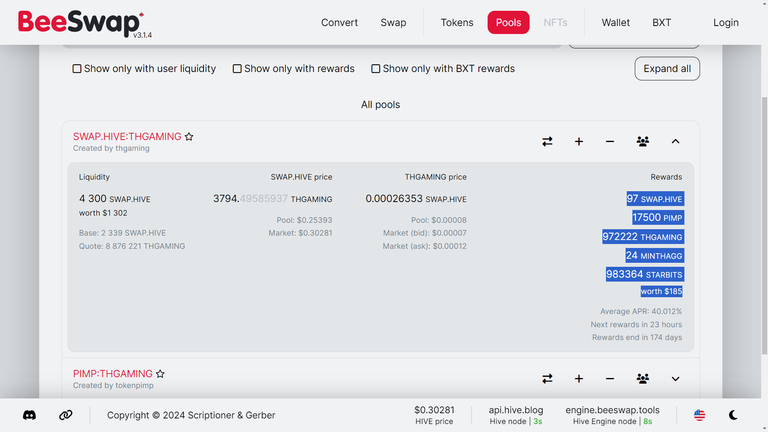

Every 6 months, we re-enable our Liquidity Pool Reward contract and inject Layer-2 Tokens into the pool to enable Liquidity Providers to earn passively while supporting us! For those providing Liquidity the current Reward APR (Annual Percentage Rate) is sitting at 40%.

This Liquidity Pool offers a place for investors to swap $THGAMING Tokens for $SWAP.HIVE (Hive Engine's Layer-2 Swappable version of $HIVE) which can be withdrawn / converted to $HIVE at any time.

$PIMPPimp Discord with many Blockchain leaders attending to pitch their project or discuss their latest Game / dApp developments.Huge shout out to @pimptoken for once again contributing to the THGAMING Liquidity Pool Rewards with 18 000 $PIMP Tokens being injected, about 275 $HIVE's worth! is a Curation, Dividend and Tipping Token, run by @enginewitty, which has a thriving community gathered around it, as well as weekly Investor / Gamer meetings in the

Our Liquidity Pool Rewards

- As mentioned, the SWAP.HIVE:THGAMING Liquidity Pool offers instant swaps of $THGAMING for $SWAP.HIVE, or vice versa. A Rewards Pool Smart Contract automatically distributes rewards to Liquidity Providers every 24 hours.

[Above] Providing Liquidity at a 50 / 50 Split of $SWAP.HIVE and $THGAMING will earn you liquidity rewards in all of the rewards tokens listed. Add liquidity yourself on the dCity Beeswap Platform or on the Tribaldex Dieselpools Frontend. There is also a $PIMP:$THGAMING Pool if you're a @tokenpimp and @thgaming supporter, so we'd recommend adding Liquidity to one of our Pools if you like earning a passive income of Layer-2 Hivechain Tokens!

Liquidity Pool Contributors

We have been saving up our layer-2 tokens, and—with the help of our partners—have injected our LP with many rewards tokens for this 180-day reward period. At the time of writing, we have added the following tokens into the reward pool...

A huge thank you to the following Tribes / Games who have Contributed to the LP Rewards:

- Pimp Hive Community

Our largest Pool Supporter, a huge thank you to $PIMP for their generous contribution! Be sure to join their Gamer / Investor AMA's every Wednesday in the Pimp Discord Server, which is attended by some of Hive's most influential Leaders and Investors!

$PIMP - By @tokenpimp - Dividend, Tipping and Curation -

There are a ton of ways to spend those Starbits over at https://www.risingstargame.com

$STARBITS - By @stickupboys on behalf of @risingstargame- THGaming Hive Community

We have supported our own Pool with $THGAMING, $SWAP.HIVE and $MINTHAGG (Miner) Rewards.$THGAMING - By @thgaming -

We hope you enjoy all of these rewards and thanks again to everyone providing liquidity to $THGAMING. We appreciate the support and as always this liquidity is rewarded.

Guild and $THGAMING Developments

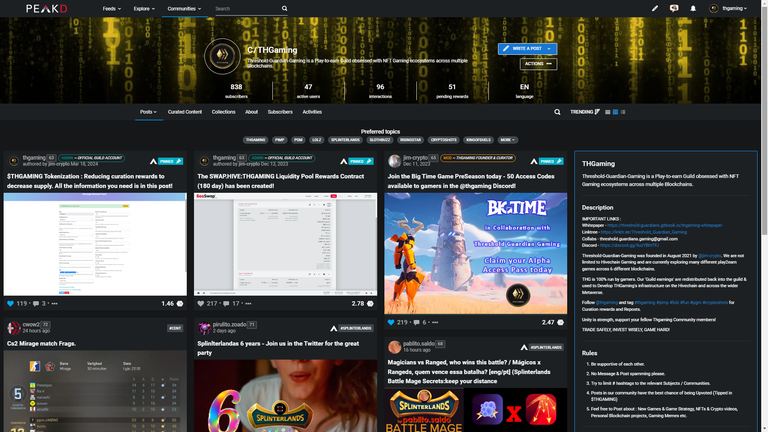

The THGaming Hive Community (seen below) has over 800 Subs so feel free to post all gaming and crypto related articles in there!

At time of writing, the $THGAMING token is sitting in 10 908 $HIVE wallets including 47 THGAMING Whales : accounts holding more than 100 000 $THGAMING Tokens (Liquid or Staked) not counting LP Liquidity Providers. Many of the whales are influential Hive members and have access to a private channel in our Discord.

Due to strictly controlled distribution mechanisms, only 6.25% of $THGAMING is currently minted (circulating) with plans to ramp up the distribution as use cases increase and crypto (Hivechain) adoption improves.

our community will allow your blog posts to accrue $THGAMING curation rewards when upvoted (tipped) by users holding staked $THGAMING.$THGAMING has been upgraded to allow staking, delegation and curation rewards on hive blogging platform posts. Utilizing the hashtag #thgaming and/or posting in

Growth across our main Social Media Channels:

- Hive Community - 838 Subscribers

- Twitter - 496 Followers

- Discord - 476 Guild Members

[Below] Our Discord Server is the heart of our guild and continues to grow every week. We have channels for many popular games and places where our members can share their Hive blog posts from our favorite Hive communities & partner platforms.

For more information about $THGAMING use cases and developments, please read this post:

$THGAMING Token - 2 Years on the Hivechain!'

What is a Liquidity Pool (LP), and why should you care?

A 'Liquidity Pool' offers Liquidity to a pair of tokens by providing a swap pool (smart contract) where two or more tokens can be traded off of the open market.

The token swap prices in the LP vary if one token is being 'swapped for' more than the other, and this volatility enables traders to purchase tokens at reduced prices. As with all trades, there are risks involved. It's important that you thoroughly research every token and trading strategy before making any purchase / swap trade.

LP DEFINITION: A Liquidity Pool can be thought of as a pot of cryptocurrency assets placed within a smart contract which can be used for exchanges, loans and other applications. In traditional finance (Centralized Finance or CeFi), liquidity is provided by a central organization such as a bank or a stock exchange.

If you'd like to learn more about LP's, please read this excellent Blog Post by Alejandro Gutierrez - Operations Lead at Defactor.

Liquidity Pool Risks:

The first major risk with Liquidity Pools is the fact that token prices may decrease. As with all cryptocurrency investments, the prices of Layer-1 or Layer-2 crypto is dependent on the market, and what goes up may also come down. As we are in a very precarious 'Bear Market' at the moment, it is risky to invest fiat (traditional money) into crypto. We are advising investors to dollar cost average into crypto or use already existing crypto holdings / positions. As the saying goes, "never invest more than you are willing to lose." If you choose to invest, please research the project thoroughly, and look at crypto/tokens with long-term growth potential.

The second risk in Liquidity Pools is called 'Impermanent Loss' which refers to token volatility caused by the ratio tokens are invested at: in a 50 / 50 value split. If the price of one token goes up or down drastically, your share (number) of the other token will likely also change. This loss is called 'impermanent' as your investment should return to normal when the value of both Tokens returns to their original 'ratio price point'. Stable Coins like $USDT or $HBD usually suffer from very little impermanent loss thanks to a typically low price volatility. Still, all stable coins have some risk of becoming unpegged and losing their original 'dollar value'.

The last risk doesn't happen very often, but we still feel it should be mentioned. There is a chance that the DEX or smart contract is hacked or compromised allowing fraudsters to 'clean out' the LP's. Our Liquidity Pool is built using Tribaldex Dieselpool Contracts, and none of our guild devs have access to the underlying code.

Liquidity Pool Advantages:

Liquidity Pools provide crypto to the DEX (Decentralized Exchange) offering stability to that exchange and the layer-1 or layer-2 Tokens placed in those Liquidity Pools.

Most Liquidity Pools will REWARD their Liquidity Providers with tokens through a smart contract and provide a percentage of all swap fees to LP Providers (which gets added straight into their positions).

LP's offer a place for investors to swap tokens off of the open market, so tokens can often be purchased for cheaper than they would on the DEX. This is especially true for sought after tokens that people are HODLing. Arbitrage traders will take advantage of price variations between open market and LP's to make profits.

Wrap Up

As always and MOST IMPORTANTLY, do not spend any money / crypto you can't afford to lose! If you would like to join THGaming and explore the #metaverse with us, our social media links are below.

Trade safely, game hard!

Linktree Official - All Social Media links