#Introduction

PayPal a global giant in Secure Payments and Money Transmission announced a new stable coin today.

This News caused a lot of buzz in cryptocurrency oriented news channels today. Many were calling this new token the vehicle which would drive mass adoption of cryptocurrency and spark a Bull Market.

Body

Ethereum Blockchain

The new stablecoin is an ERC token, so it will be hosted on the Ethereum Blockchain.

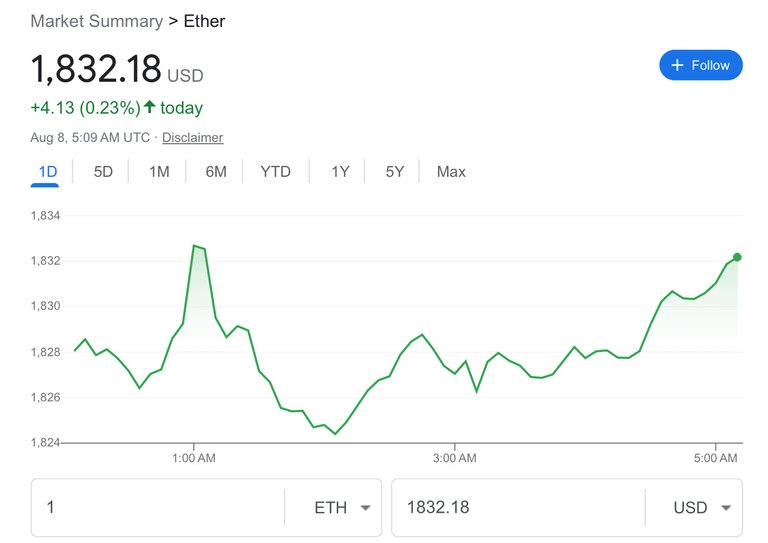

Surprisingly the price of Ethereum moved very little , about 0.4% upward for the day, about 4 dollars on a token priced at 1,832.00 US Dollars.

Ethereum is the second largest cryptocurrency, by marketcap after Bitcoin, but it’s main claim to fame is it’s Ethereum Virtual Machinemor [EVM] software infrastructure, which allows it to run Smart Contracts.

These made DeFi or Decentralized Finance possible, the fastest growing economic and financial phenomenon in the history of the world. It went from millions of dollars in market cap to billions of dollars in one year. A 1000x increase which has never happened before.

[Source: DeFi Statistic Reports]

However Ethereum processes transactions slowly compared to more modern blockchains or credit card processors, and transaction fees on Ethereum for a single transaction can cost anywhere from 50 dollars US to 1000 dollars US during peak demand or business hours.

[Source: Ethereum Proof of Stake White Paper]

And although the change in Concensus Methodology methodology or otherwise known in banking circles as settlement accuracy assurance, the improvement in speed were geometric 2x, 4x, 8x and ultimately 64x. But the increases in transaction volume were increasing exponentially by powers of 10, like 10 squared , 10 cubed and ultimately 10 to the sixth or one million X increases in transaction volume. So Ethereum will never increase it’s speed enough to satisfy the volume demand, which further inflates transaction costs, which are already to high.

[Source: Ethereum Proof of Stake White Paper]

Thus while nearly 100% of all decentralized finance was on Ethereum in 2019, almost 50 percent migrated away from Ethereum in subsequent years to blockchains with faster transaction times and lower transaction fees. These retail investors moved to Binance Smart Chain, and Polygon Blockchain to name a few.

[Source: DeFi Statistic Reports]

Stablecoins

source: investopedia

So while Stablecoins are very profitable due to transaction fees, and very price stable due being backed by cash or securities like US Treasury bonds. That may not be enough to create demand for this PayPal stablecoin, and lead to mass adoption.

#Conclusion

Summary

I think PayPal’s new stable coin will serve it’s purpose well, letting PayPal do same day settlement of large cash transactions between Money Transmitters the same day, instead of Day one plus 4 days, which happens now.

However because the stable coin operates on the Ethereum blockchain, it will never reach mass adoption because transaction fee prices are to high. You can’t buy Starbucks for 8 dollars and pay 50 dollars for transaction fees.

Instead the masses will gravitate towards faster, and cheaper blockchains, like Hive and its stable coin HBD or Hive Backed Dollars.