Continuing with the documentation of my talk on NFTs

In the last post, we established that an NFT should be unique, limited in quantity and mined on layer 1 if possible. We looked at the collection "Autoglyps" as an example, which is doing particularly well right now.

Now my question to you:

I can no longer see from Open Sea's statistics how much the Autoglyphs cost shortly after Mint, because it only goes back a maximum of 90 days, but it can be assumed that they were much cheaper than they are today.

So if you had the opportunity again with today's knowledge to buy an autoglyph for say 0.001ETH, would you do it? Probably you would.

And in fact, some NFTs that cost an unimaginable amount of money today were almost given away shortly after the Mint. So it's about getting the right information at the right time. And for the Autoglyphs, Bored Ape Yacht Club or Cryptopunks, I guess the ship has sailed, unless you're worth millions.

I do have some good news, though:

What technical condition must an NFT meet in order for it to be considered one?

In layman's terms, it must constantly communicate with the chain, the chain must constantly ping the NFT or vice versa. @Satren explained at the first Hivecamp that this has already led to overloads of the ETH chain and that NFTs have been lost at times.

This can happen if a chain is basically not suitable for mass adotpion. ETH is constantly being re-scaled, but it has considerable technical gaps.

Sharding, what is that and what can it do?

It would be better to take a chain that is designed for mass adoption right from the start, because it can do #sharding out of the box, for example.

In simplified terms, sharding breaks up the blockchain into shards depending on the workload and reassembles them at the other end. It's like beaming the transaction, more about sharding here.

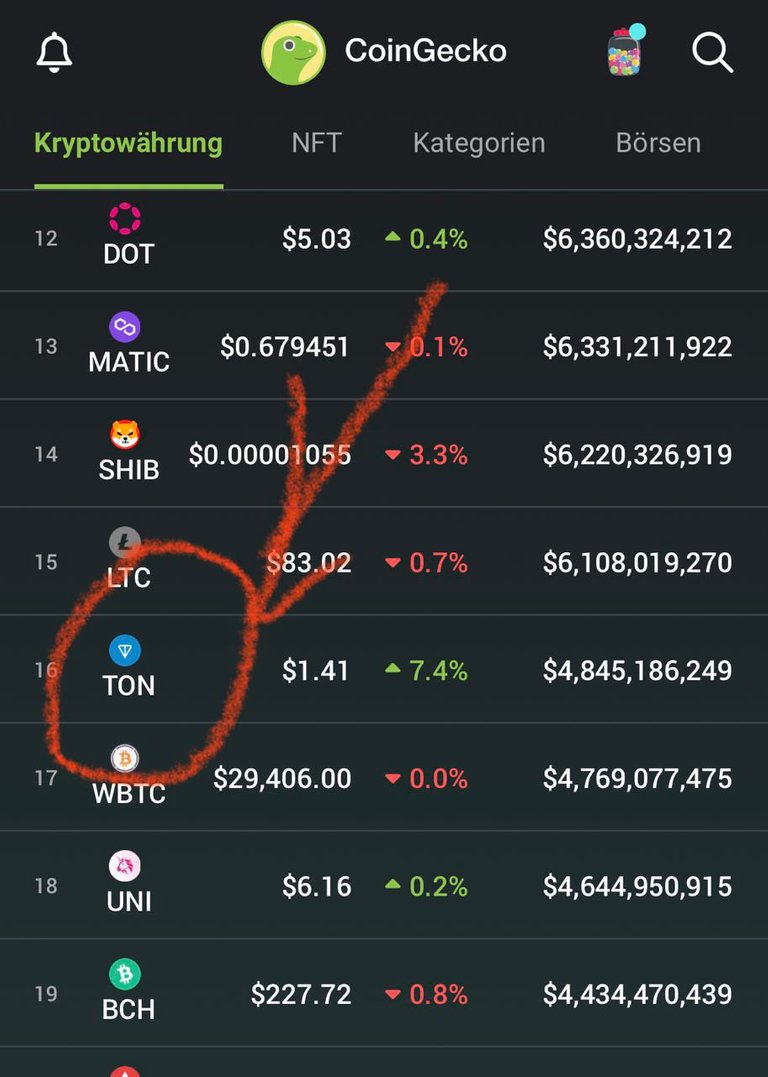

Let's go back to our beloved #Coingecko and have a look there: The market cap must be large enough, smart contracts should run on the 1st layer and the chain should support #sharding if possible.

And there is really only one chain in the top 20 that comes into question: I have to correct myself again after the lecture, because we were still in the top 20, now top 16! Soon Top10?

The Open Network, the blockchain project of Telegram Messenger

TheOpenNetwork, TON for short grew out of Telegram Messenger, the world's second largest messenger after WhatsApp with around 700 million users, is closely interwoven with it, yet independent and decentralised.

I have already written about TON elsewhere, but here I want to talk about NFT and why I think TON is particularly suitable for it.

If we look at ton.app, we will see that after little more than a year of existence of this chain, 551 Dapps have already been created and we can find 59 Dapps in the NFT section.

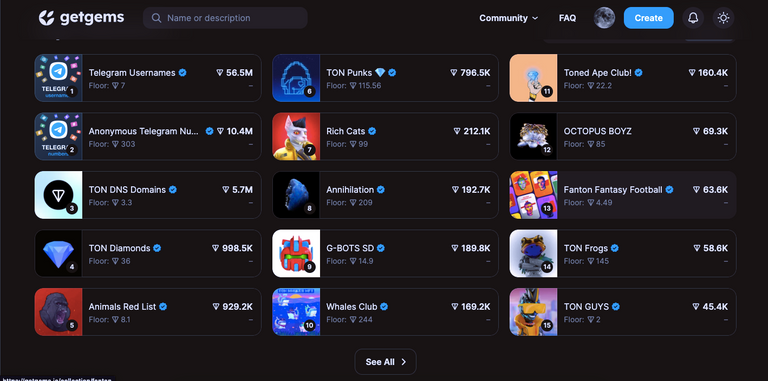

Getgems.io currently the best marketplace for NFT on TON

The biggest marketplace at the moment is getgems.io. It is similar to #OpenSea but I find it much more transparent and clear.

Here are the current TOP Collections:

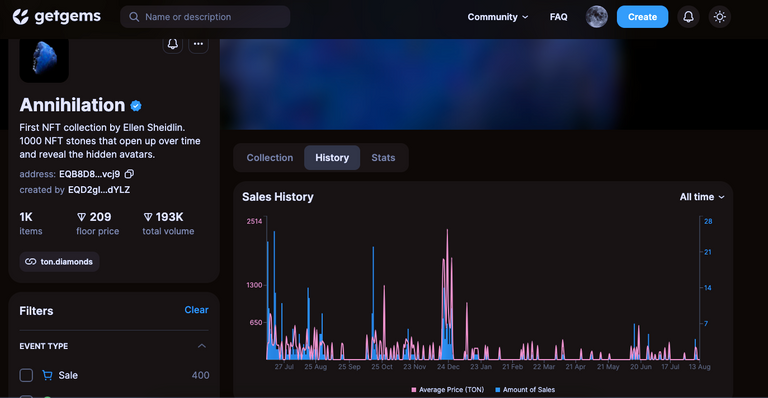

I find the No. 8 "Annihilation" of the current shooting star of the NFT scene #EllenSheidlin remarkable. If you go to the collection, you can see the total sales from the Mint until now under "History".

History of the collection "Annihilation" by Ellen Sheidlin]( )

)

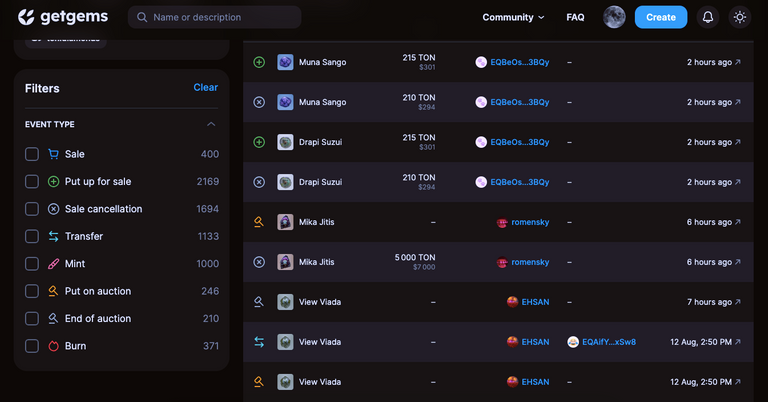

You can also see how many NFTs were minted, put up for sale, auctioned, burned, etc. !

Overview of the NFTs in the collection "Annihilation"]( )

)

Furthermore, there are detailed statistics for every single NFT. In this collection the cheapest NFT is also already at 209TON, not too late to get in, nevertheless not quite cheap.

For less money, there is also a Ton Diamond for 33 TON. In this collection you can also buy some exclusive rights on the Chain.

So you see, even in the NFT things go up and down and not just steeply upwards. Nevertheless, the collection mentioned has sold over 190k TON in less than a year. That's something.

How do you get TON?

There are 2 types of wallets, cusdotical and non custodical. The former is done via a Telegram bot by simply typing the prompt @wallet in Telegram. You connect the wallet to your Telegram account and immediately have full access to the TON chain.

In this wallet there is also a P2P market where you can buy TON without KYC against fiat. Otherwise, as usual, by credit card or at one of the exchanges listed. The disadvantage, however, is that you do not receive a passphrase for this wallet.

As a non cusotical, i.e. with a passphrase, I recommend Tonkeeper, available in the AppStore or GooglePlay. This app also has a browser where you can call up all the TON apps and immediately connect them to your wallet.

Outlook for the next post

So much for today. We have learned a lot. In the next post (so there will be at least 4 or even 5 in total in this collection) I would like to introduce a completely new social network on TON, which is based entirely on NFT.

It is important to build up a community before you start mining. People have to show that they are willing to invest something, even if only a modest amount at first. Otherwise it's all a waste of time and effort.

In return, however, the first ones will get exclusive rights, e.g. they will be the first to know when, how much and at what price the mines will be mined. Further insentives are on the agenda.

So stay tuned and see you in the next post.

image 1 Source https lancepagan Blog medium blog 3 December 2018 trx qrl gtc the threeletter names sit alone at the top haverhulk private ETC.

nonsense!