*These things should already be ingrained in our minds when it comes to finances. Sadly, most of us don't even have a savings plan. Fortunately, we can use our benefits as an employee to grow our wealth wisely. Read on to know more.

Hello Hiveans! I hope that you are all well. I shared a conversation I had with a couple of young adults in the last blog post (not the actual convo but just the gist and theme of what we talked about). It went longer than what I usually post, but it was worth it because I wanted to explain in detail the importance of saving early on in one's adult life and illustrate the financial consequence the compounding effect will have with the passage of time. The Pag-IBIG fund is a good way to illustrate these concepts in the length and context of a blog post. Most people are already familiar with the fund because it shows up as a deduction in their payslip so I needed only a few words to describe the fund.

This is my follow up to the previous post and if you haven't read it ---> What if I told you that the price of three Starbucks Chocolate Chip Cream Frappuccinos can help you retire a millionaire in the Philippines. Would you believe me?

Well begun is half done

Still on the topic, part of the convo that we had was how to jump-start the process of building your nest egg at the onset of your professional life with me sharing that the bigger the amount one puts in at the start of your earning life, the bigger the amount you will have once you decide to hang up the gloves and run for senator, similar to boxing great Manny Pacquiao. Well, not everyone can earn millions of dollars in a single night, but some of us can decide to maximize the earning potential of our savings portfolio. Calling it a savings portfolio is intentional on my part. Why, Juan? Why not just call it savings accounts? Are you just trying to use big words to impress us? Well, yes and no. Yes, because one should have savings held not only in a bank account, but in other institutions as well. I, for example, have started to save a small amount in a cooperative. I plan on putting in small amounts in this account until I reach my target for this institution. It gives me a high return on my money through interest and dividends, and I get to connect with other business people in our area. I also utilize their services my business endeavors. Again, yes, I want to impress upon you, dear reader, the notion that more savings is good in the long run. No, I'm not trying to impress you in the sense of bragging or boasting that I used such words.

Going back, the main point is to start strong and just let it rollover. Similar to a time deposit rollover, this means that whatever you have at the starting line is the one that will get interest income for you. The bigger this starting amount, the bigger the interest, the bigger the snowball rolling down the hill once it gets enough momentum. In other words, your initial deposits will earn interest, the interest plus your initial deposit will earn more interest and so on. It's simple, it's easy (with very minimal effort on your part), and it's doable. Unlike trying to save from the money you earn, this one will have the natural barrier of not being easily used for whims and impulse buys.

Opening up another Pag-IBIG earning opportunity

Discussing it further, we explored other options on how to build up this part of one's retirement portfolio, we ended up talking about MP2. For starters, what exactly is MP2?

*MP2 or the Pag-IBIG Fund MP2 Savings Program.

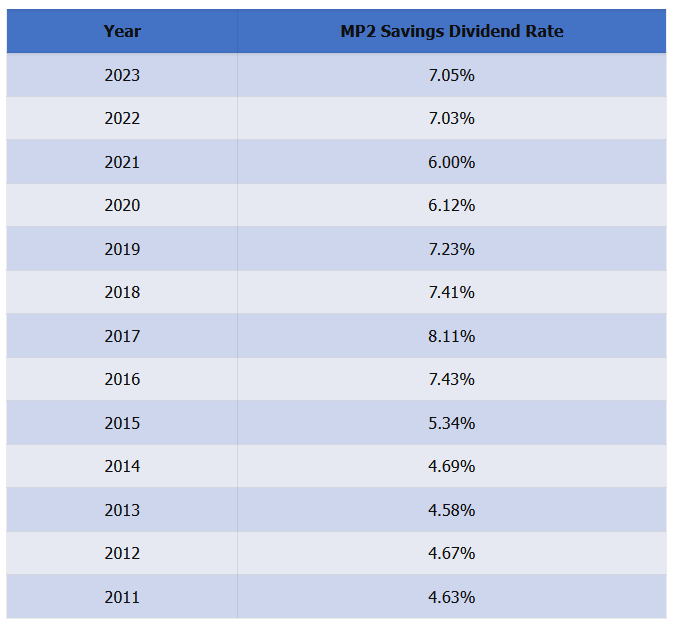

The real kicker when it comes to savings in the Pag-IBIG Fund is that there a second option that gives out "higher dividends". How high?

*Screenshot from the Pag-IBIG website.

As you can see from this table, they do have higher rates than the regular Pag-IBIG, which leads us to the question, "Why not just save here instead of the other one, Juan?" Well, this is a voluntary savings scheme that has a 5 year maturity. You can either get the dividends yearly or all of it at the end of the five year maturity period. Savings can be done with a one time deposit or minimum of 500 pesos monthly deposits. After the five year period expires, you may opt to open another one and just put in all or part of your money there. If it was me, I'd like to add on whatever total I have and add in some extra cash that I have.

Again, using the median number of 6.12% found in the table above for simplicity in our example, we can easily check how much we will get after 5 years:

| Voluntary savings amount | 1Yr @6.12%APR | 2Yrs @6.12%APR | 3Yrs @6.12%APR | 4Yrs @6.12%APR | 5Yrs @6.12%APR |

|---|---|---|---|---|---|

| 500 pesos | 6,367.2 pesos | 13,124.07 pesos | 20,294.47 pesos | 27,903.69 pesos | 35,978.59 pesos |

Which one is better?

To compare, our 5 year MP2 savings number of 35,978.59 gives us a higher return on the money we saved. Compare this with the 5 year regular Pag-IBIG total of 28,362.68 and we can easily tell that this is a much better with the MP2 as an additional savings option. You have to renew it every five years but that is still passive income with great returns, if you don't mind going through the trouble of renewing it once-every-five-years. The base savings amount of 500 pesos is the lowest amount. Again, we can go up as high as financially possible in our personal situation and in the context of your own wealth building strategy.

IMO, the best case would be to have two Pag-IBIG accounts working hard to make money for you. Since you are already automatically enrolled if you are an employee here in the Philippines, you can opt to add an MP2 account for better returns on the money that you save. A few percentage points might not be much when you look at it now, but 20 or 30 years down the road and you could be seeing massive growth depending on the dividend rate. Looking at the trend, we can see that it is highly possible to get even higher yields in the future from the HDMF.

Conclusion

And, I will end today's blog with this. As you can see, there are differences to how much we can earn with passive income and adding just a few pesos really makes a big difference. Give up one or two bottles of coke 1.5 every month and you can see your portfolio grow ever bigger than without that extra effort. This small sacrifice on our part can be the difference between a small retirement fund or a comfortable life with a nice nest egg for the things that we will need during the later years of our life.

Thanks for dropping by and visiting my blog. I really appreciate you spending your time here. Good vibes to all. Wishing you a productive and financially rewarding day!

Love and peace,

@juanvegetarian

--

*I used a Canva template for the thumbnail image above, you may check it out here if you are interested.

Was tempted to start MP2 but then the returns were like.. meh I could do better. Already contented with the regular one even if it's just a few thousand peso difference.

It's basic passive income for sure. There are many options available for the more financially literate. 😎 !DUO

You just got DUO from @juanvegetarian.

They have 1/1 DUO calls left.

Learn all about DUO here.

I don't have pag-ibig yet, can I open an account kahit di pa ako employee?

Not sure if you can coz the fund is for employees but you can check with them. 😎