*This is a good list of things that we should be aware of to increase our financial literacy. I did not really learn much about handling finances in school. Sad to say, I learned from actual experience and losing money on wrong decisions, impulse buying, scams (yes, that too), maxing out multiple credit cards, etc. It was a host of losses that led me to understand the value of money and how to maximize it.

**These four cannot be emphasized enough: we can't save if we spend more than we earn; investing in different things helps us manage risk and grow our wealth; regular savings and investing in low risk financial instruments will make us rich slowly; and, researching about these things are the foundation of a happy, healthy financial outlook in life.

Time flies so fast.

I've been onchain now for five years. It's crazy. I mean, if Hive was my girlfriend, it would already have been a long term relationship and I might already be thinking about the next step. LOL. Similarly, Hive also involves not a relationship but relationships with the people here on the blockchain. People get together to form real life connections here, share one's thoughts and express feelings through one's blog, play games, and even earn real money. The last one - real money - I've been thinking about lately.

So, I had a nice conversation with a couple of young people about finance and investing. One just started work while working on his thesis, which was the only subject left so he could graduate and earn his degree. The other one was a sophomore in his management accounting course. Being the "well-meaning" uncle that I am, I immediately brought up the subject of finance and mistakes that I've made during my younger days.

Savings and Shelter

Long story short, I told them that one of the mistakes that I regretted not doing was increasing my Pag-IBIG contributions on the get-go. I told them that since I started working when I was 15 years old, I could have been a millionaire by now already with just my contributions to this fund.

For those who don't know, the Home Development Mutual Fund (HDMF) is the government entity that manages housing and savings for Filipino workers. Also known as the "Pagtutulungan sa Kinabukasan: Ikaw, Banko, Industriya at Gobyerno", hence Pag-IBIG.

The contribution rate for the fund is 2% of the workers' salary up to a maximum of 10,000 pesos. 2% of 10,000 is 200, which is a reasonable deduction; less than a large cup of coffee from my favorite coffee shop. The employer matches this contribution, so the "fund" gets 400 pesos in the worker's favor.

If we do this for one year, then it's 400 x 12 = 4,800 pesos. Doing it for five years equals 24,000. Ten years = 48,000. And, so on. Assuming that the worker follows the norm and retires at 60, he or she, will have saved a grand total of 192,000 pesos with no breaks and started working at 20 years old. Not much of a retirement nest egg, if you ask me. LOL.

*Table #1: 30 Year Pag-IBIG Contribution Table 🚀

| Contribution | 1Yr | 5Yrs | 10Yrs | 20Yrs | 30Yrs |

|---|---|---|---|---|---|

| 400 pesos | 4,800 pesos | 24,000 pesos | 48,000 pesos | 96,000 pesos | 144,000 pesos |

*I used 30 years because not everyone can work for 40 years straight, especially the younger generation.

The Power of Compounding Effect

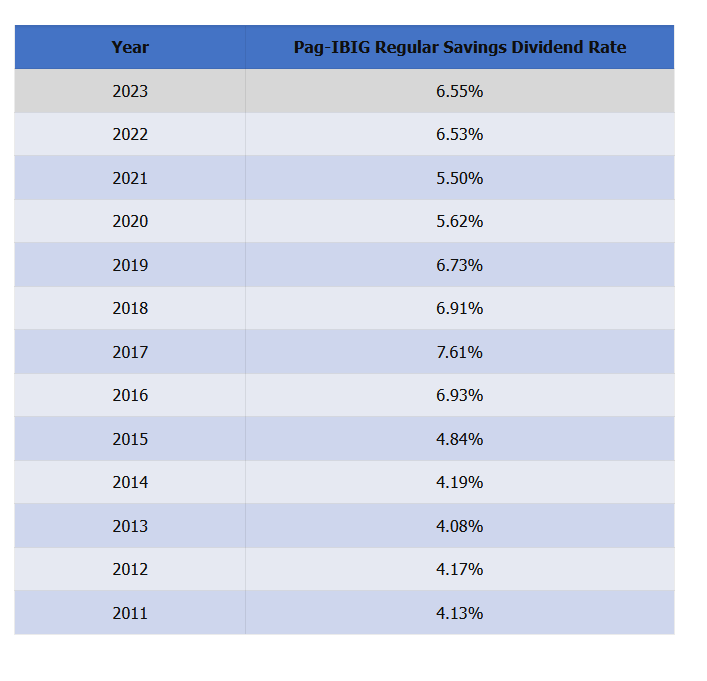

Here is where it gets interesting, Pag-IBIG invests 70% of invstible funds in bonds, gov't securities and housing finance. 70% of the annual net income is given back the fund holders proportionate to their total contribution. The table below (from the HDMF website), shows the dividend rate from 2011 to 2023.

For simplicity's sake, let's use the median 5.62% as the dividend rate for our example and see how it goes.

*Table #2: 30 Year Pag-IBIG Contribution Table with dividends 🚀

| Contribution | 1Yr @5.62%APR | 5Yrs @5.62%APR | 10Yrs @5.62%APR | 20Yrs @5.62%APR | 30Yrs @5.62%APR |

|---|---|---|---|---|---|

| 400 pesos | 5,069.76 pesos | 28,362.68 pesos | 65,642.87 pesos | 179,052.3 pesos | 374,986.8 pesos |

As you can see, there is a marked difference even for just 5 years. Getting 28,362.68 versus 24,000 without compounding. That's a 4,362.68 pesos difference or 18.77% higher than the total contributions you and your employers made. Essentially, this is great passive income because you exerted minimal effort. The employers' HR deducted the amount automatically while Pag-IBIG did the heavy lifting of investing in quality accounts, then distributed 70% of their income to the members holdings. Exciting, right? For me, passive income is the best.

Three Chocolate Chip Cream Frappuccinos can make me me a millionaire? You must be crazy, Juan!

I'm really more of a Coffee Bean & Tea Leaf biased these days, but my answer is yes. Four Hazelnut Lattes if you frequent J.Co Donuts. Many people that I've talked to did not know this, but you can actually increase the contributions you make to the Pag-IBIG fund. Mandatory contribution for the company is fixed at 200 pesos per month but you can opt to increase your part of it. Just go to HR and they will take care of the rest. So, where does two or three cups of blended coffee in a month take you?

Basically, adding another 400 pesos to the mandatory deduction of 200 pesos doubles the amount you will get after 30 years. So, 374,986.8 pesos x 2 = 749,973.6 pesos. Crazy, right? This is the power of compounding and helps reduce your coffee intake, which might be better for your health too.

Now, how much does my young friend take home every 15 days: around 9,000 pesos. Can he contribute a little more if he wanted to? Yes. Will he contribute more? Only time will tell. Honestly, making an additional 600 pesos to the mandatory 400 pesos will be very much worth it in the end. It makes the yearly fund contribution 12,000 pesos from 4,800 pesos. How much will adding 600 pesos affect the total fund balance after 30 years: 937,466.9 pesos. 62,533.1 pesos shy of 1 million. Not bad for a nest egg, right?

Conclusion

Personally, we contribute a lot more than than what is mandatory. We discovered this later on in life and it would have been nice if we started doing this when I was mopping the floor and cooking chicken at McDonald's. I wasn't a vegetarian then, but I could have made more use of the compounding effect, which would have made me an instant millionaire when I retire. Passive income and the compounding effect are the backbone of a healthy personal finance, especially if you are still young. I had a blast conversing with the young ones so that was a win for me.

That's it for now. Thanks for using your precious time to visit and read my blog. I hope that you learned something from this. At the very least, I hope that you were entertained. Have a wonderful day ahead. Enjoy the sunshine and let the good vibes accompany you throughout the day.

Love and peace,

@juanvegetarian

*I used/edited this Canva template-1. Please check it out and support the Canva artist if you so desire. Thanks!

Honestly speaking, and i know some people will hate me for this, but i dont believe in government-backed investment schemes. With so much news about the Marcos administration lately and how they use funds from these contributions, i'd rather invest my money somewhere else. There are alot of emerging ebanks that offer similar interest rates. But then again, it depends on the investor's preferences.

I get what you mean. The government can meddle with it and politicians aren't the most trustworthy group when it comes to public funds but it is still more stable vs ebanks for now. I also try to take advantage of the high interest rates these banks offer, but if you look at which of the ebanks are profitable then you will see the difference and why they are offering such high interest rates. Also, the Pag-IBIG fund managers are really good. But it's still your money and you can do whatever with it. You are right, investor's preference pa rin. 😀

Wow, that's a significant difference! How did you manage to achieve such a high return on your Pag-IBIG contributions? Did you invest in any specific Pag-IBIG funds or did you simply rely on the default options? I'm curious to know your strategy, as I'm looking to maximize my own returns as well. Share your insights, please!!!!!

It's really simple, add as much as you want to the mandatory Pag-IBIG deduction, ask HR to change it. That's it. No fancy strategy here, just simple math. 😄 !PIZZA 🍕🍕🍕

I'll talk with the HR now, first thing in the morning. Thank you, Juan!

Welcome. Glad to share my experience. Good luck with HR. Don't forget to dyor. It's good practice to check with other sources if this is a good idea. 😎

I also wish I have done this when I was younger.

!DUO

You just got DUO from @sudeon.

They have 1/1 DUO calls left.

Learn all about DUO here.

Yes, it's a mistake that cost us but we can still reach our financial goals in other ways, right? !PIZZA

Thank you for sharing your knowledge about savings. We Filipinos are enticed to acquire debts rather than financial assets, which is quite sad. 😞

Welcome po. I !LUV sharing about personal finance especially to my kababayans. I know how difficult it is to break away from that cycle because we have been so accustomed to it. Glad to know that there are many who now know the importance of saving and planning for the future. 😎 !DUO

(1/1) sent you LUV. | tools | discord | community | HiveWiki | <>< daily@sydney27, @juanvegetarian

You just got DUO from @juanvegetarian.

They have 1/1 DUO calls left.

Learn all about DUO here.

Congratulations @juanvegetarian! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 70000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks for the badge, @hivebuzz. 😄

That's great @juanvegetarian! We're excited to see your progress on Hive! We can't wait to see you achieve this next one!

BTW, join us in making Hive more fun! Check out our funding NEW proposal and consider supporting it.

Thank you!

$PIZZA slices delivered:

(2/5)

juanvegetarian tipped sudeon @juanvegetarian tipped @jessonb-world