A debated issue in the business world is that within their objectives they must establish their accounting procedures, being able to establish their own practical criteria to record the tax on the great wealth based on what is established in the law under study, taking into account that it is a tax not deductible from income.

The wealth tax generates certain negative effects on the economic system, and an example of this is the growing number of empirical studies that are analyzing and finding that inequality has a negative effect on economic growth and its sustainability.

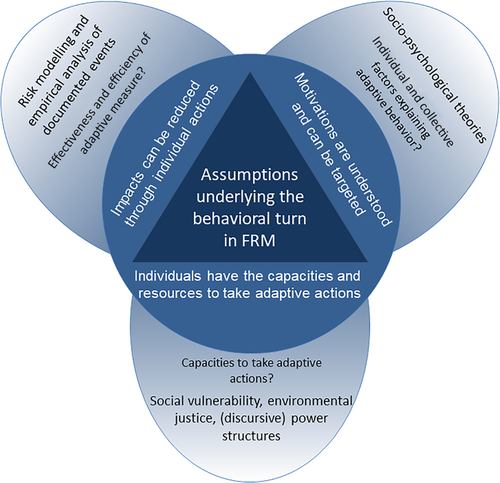

However, it is fair to recognize that, despite the progress made, there is currently a lack of data and theoretical apparatus to assess which weighs more, the inefficiency of the tax or the inefficiency of growing socio-economic inequalities.

Determine the impact of this Wealth Tax as a non-deductible expense, focusing it as an appropriate tax policy instrument to continue to be used, because it could be said that it would affect the profitability of the company, since it is taken into account as a separate expense that must be made by the companies subject to this tax, regardless of the taxpaying capacity of the same.

Used TurboTax to file my taxes and overall had a positive experience. The process was much easier than I expected because TurboTax provides step-by-step instructions and explains everything clearly. It calculates my taxes, checks for errors, and even suggests possible deductions that I might have missed.