This setup is a wonderful setup and works. You can call it whatever you want, you could call it wave 2 in Elliott Wave (which it is actually but doesn't necessarily have to be) but I like the Pinball metaphor myself.

How it works:

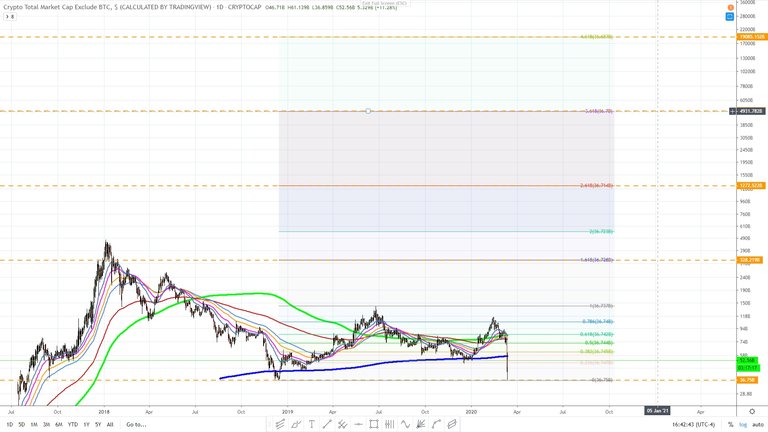

- After a period of time when the market declines there's an impulsive rise in price.

- The price declines and takes out the weak hands but doesn't break below the previous low.

- After the price declines taking out all the weak hands, the price rebounds and takes out the previous high.

- The price then surges big time sucking in everyone.

- The target is then 1.6x or 2.6x or 3.6x the distance of the first low and the first high or the distance of A to B in the charts below.

- I find that the optimum blastoff in price is achieved when the price is close to the previous low, however doesn't have to be as seen with TSLA. Regarding TSLA I was looking at buying out of the market puts with a short expiry but didn't in the end.

- Oil was a decade long consolidation with a reaction to the upside.

- If you go back in time on the Dow Jones you'll find this setup all over the place and varying degrees of time.

I should also add that since the resent downturn, my previous analysis is thrown out. This setup works and is proven when the high (letter B) is broken to the upside.

Also...... it works in reverse.

You could also call this setup lazy persons ........ Elliott Wave.

All data and information provided is for informational purposes only. Trend Wizard makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis. I document this stuff for personal reasons as a log and share with the community...... only because I'm a nice person.

So in ending........ Use critical thinking and think for yourself.