The uranium market is currently undervalued relative to its:

- necessity and size in the energy sector

- large-scale, baseload-capable carbon emission-free energy source

- cyclical-low valuation exacerbated by the 2011 Fukushima disaster

- national security and strategic issues between source countries and consumption countries

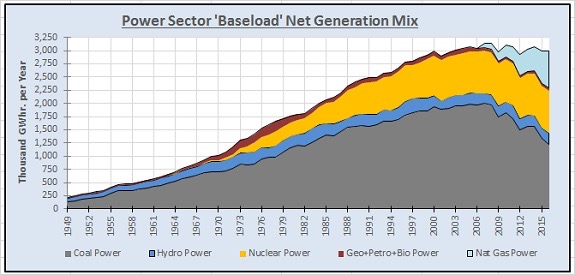

Total Power Supply

Nuclear energy accounts for 10% of global energy consumption, 20% of American energy, 18% of advanced economy energy consumption and 55% of carbon-free energy in America.

It is vital to our lives.

Nuclear power is the ideal energy source for baseload energy production. Baseload energy is the steady, reliable energy that needs to constantly be put on the energy grid.

Source: EIA MER Table 7.2b. Note: NG + Other = natural gas + other gases, and Bio + Geo = biomass (wood + waste) + geothermal. Via energycentral.com

Hydropower does well as a carbon emission-free, baseload energy source. However, if all environmental impacts are assessed through the lens of energy consumption, hydropower isn’t quite as innocent as most think. Damming rivers causes irregularities of normal water flow. Examples of things impacted by this irregularity include, but are not limited to, natural fish migration, seasonal sediment flows that affect a plethora of species and water quality and temperature due to more stagnant water.

Nuclear is much better suited to be the keystone of clean, efficient, reliable, low-impact energy production for the planet going forward.

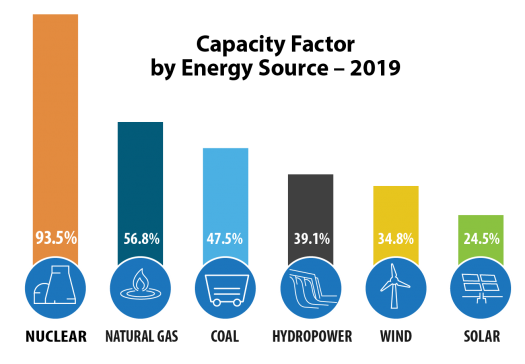

Nuclear’s capacity factor of 93% stands head and shoulders above all competitors.

Source: US Energy Information Administration

Capacity factor is the measurement of energy output over a period time relative to maximum possible energy output.

“Nuclear power plants had a 9% share of the total US generation capacity in 2019 but, actually produced 20% of the country’s electricity due to its high capacity factor.”

-Office of Nuclear Energy 5/1/2020

Nuclear holds the best combination of reliability, efficiency and low environmental impact of any energy source.

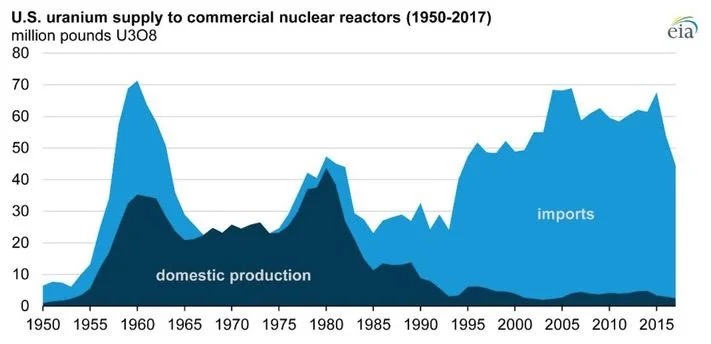

Small Domestic Market

The size of the American uranium market is minuscule relative to its consumption.

Source: EIA.gov

In 2019, 42% of US uranium purchased came from more adversarial countries—in this case Kazakhstan, Russia and Uzbekistan. 39% of purchases come from stronger allies in Canada and Australia.

The foreign reliance on uranium imports, coupled with 20% of domestic energy production coming from nuclear energy, opens up America to supply chain and geopolitical risk.

This risk has been recognized across the political aisle.

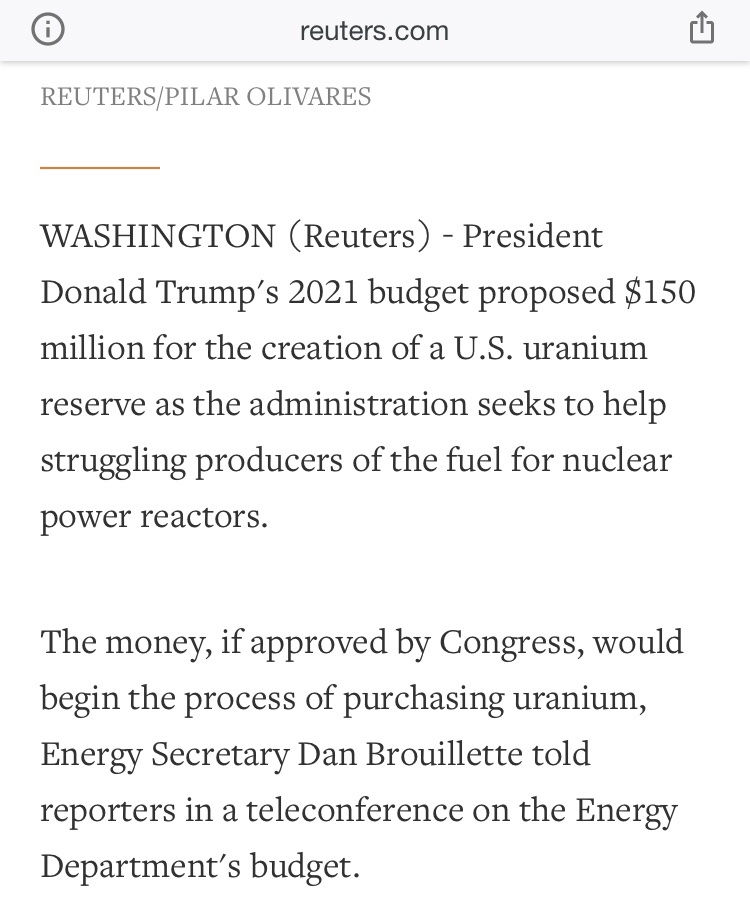

https://www.google.com/amp/s/mobile.reuters.com/article/amp/idUSKBN2042JM

Biden’s energy platform has signaled for continued support of the nuclear sector.

Source: https://joebiden.com/clean-energy/

Also mentioning the importance of securing the supply chain of clean energy assets:

The potential benefits for the small, US uranium producers are as obvious as they are necessary.

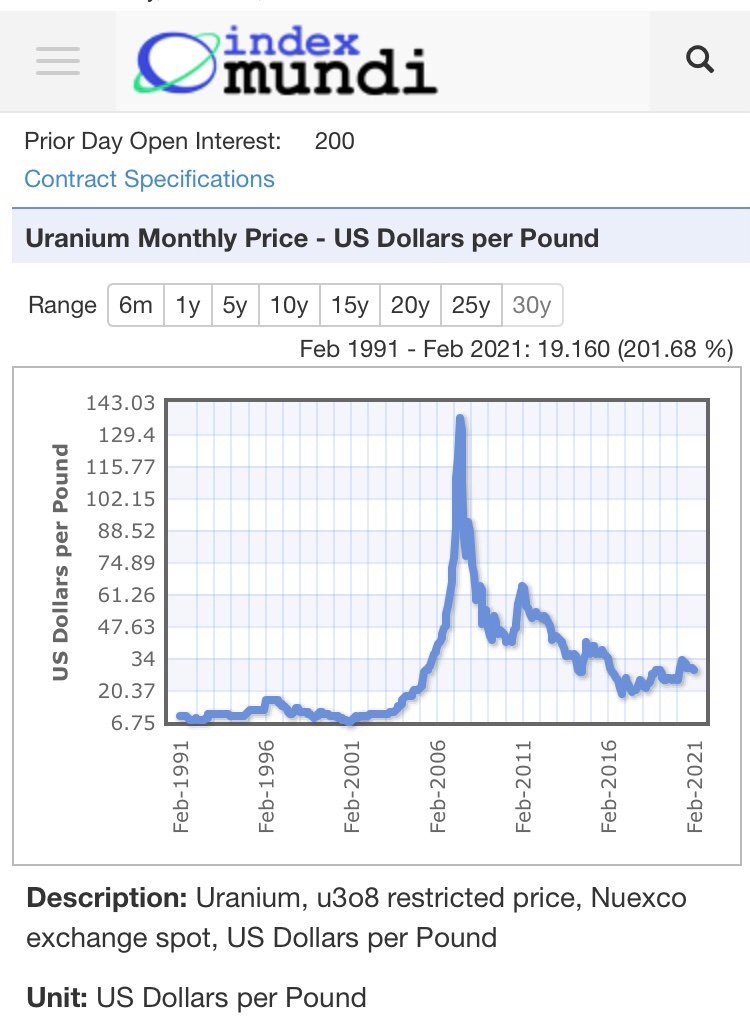

Cyclical Low in Spot Price

Commodities tend to rise and fall in a cyclical manner. Uranium is breaking out of that cyclical low and rising to meet the demand.

The 30-year chart of uranium shows the staggering highs it is able to reach as well as the staggering drops.

Source: https://www.indexmundi.com/commodities/?commodity=uranium&months=360

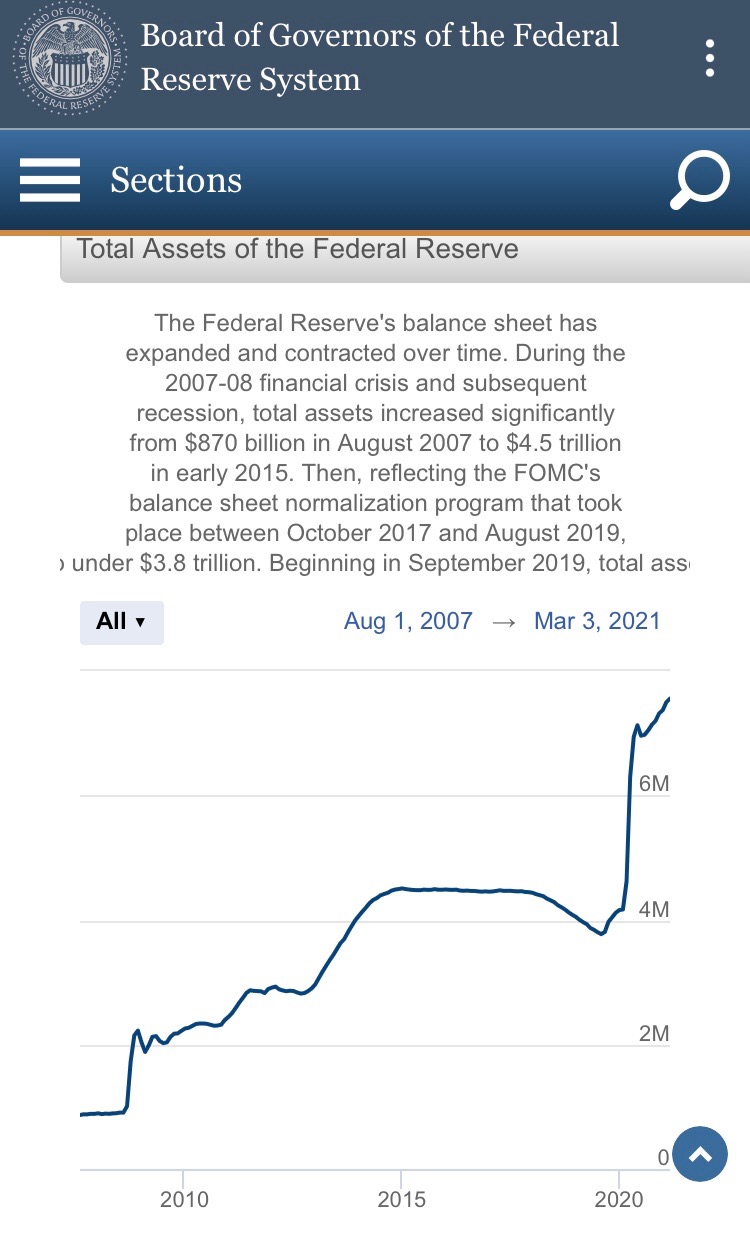

The uranium price shows even greater undervaluation when looked at relative to the US Federal Reserve balance sheet:

Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

The monthly all-time for uranium was in June 2007 at $136.22. That same month, the Fed balance sheet was $0.87 trillion.

Uranium price ($/lb)-to-Fed balance sheet (in trillions) = 157

The monthly bottom for uranium since that peak happened in November 2016 at $18.57. Fed balance sheet at the time was $4.45 trillion.

Uranium price-to-Fed balance sheet ratio = 4.2

The uranium price as of March, 2021 is $27.75. Current Fed balance sheet is $7.15 trillion.

Uranium price-to-Fed balance sheet ratio = 3.9

Even with the recent nominal run-up in uranium over the past five years, it is more undervalued in the macro environment today than it was at its dollar-measured low.

The uranium-to-Fed balance sheet ratio’s high in 2007 priced with today’s money-printing environment would come to a valuation of $1,122 per pound of uranium. That would constitute a 4,043% return on just the uranium spot price.

This is by no means a price target. It is to display the degree of over and undervaluation of uranium to the macro environment.

The cyclical drop of uranium price after its 2007 high was heavily exacerbated by the 2011 Fukushima nuclear disaster in Japan, which was brought on by the 9.0 magnitude Tohuko earthquake. This was the strongest earthquake in Japan’s history and 4th-strongest recorded earthquake in history.

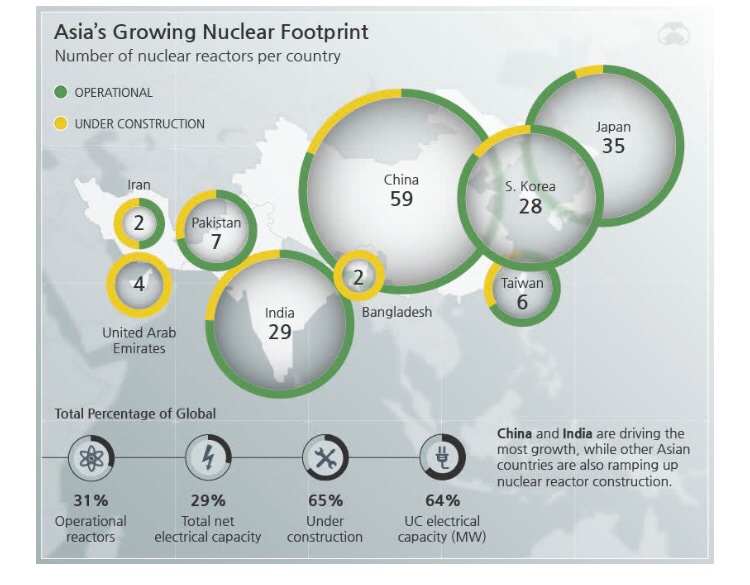

The Fukushima disaster precipitated a slew of nuclear plant closures globally. Specifically Germany, Belgium, Italy, Spain and Switzerland had begun to phase out nuclear. In the same time span, China, Russia and India have greatly expanded their construction and plans for nuclear to accommodate their growing energy needs.

Source: https://www.visualcapitalist.com/mapped-the-worlds-nuclear-reactor-landscape/

Older nuclear plants generally had a planned life cycle of 25-40 years. However, license renewals of many older plants have shown a longer life cycle in the range of 40-60 years.

A brutal, decade-long bear market, which can be conceptualized as a forest fire, has burned away the deadwood of poorly-capitalized companies with fiscally irresponsible management teams. To survive for that long and through that low of a commodity cycle shows the surviving mines have profitable assets and ability to adapt to supply shocks.

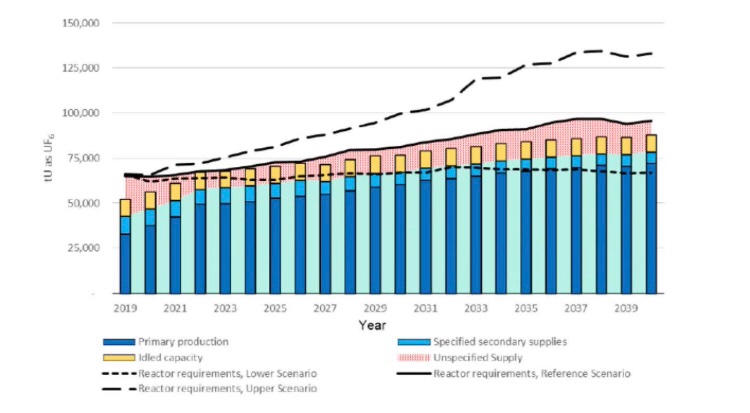

With such shock to demand in a short time, coupled with a precarious investing landscape, the spot price of uranium sunk low — low enough where it caused enough demand to be taken offline to preserve reserves. The uranium market is now in a supply deficit.

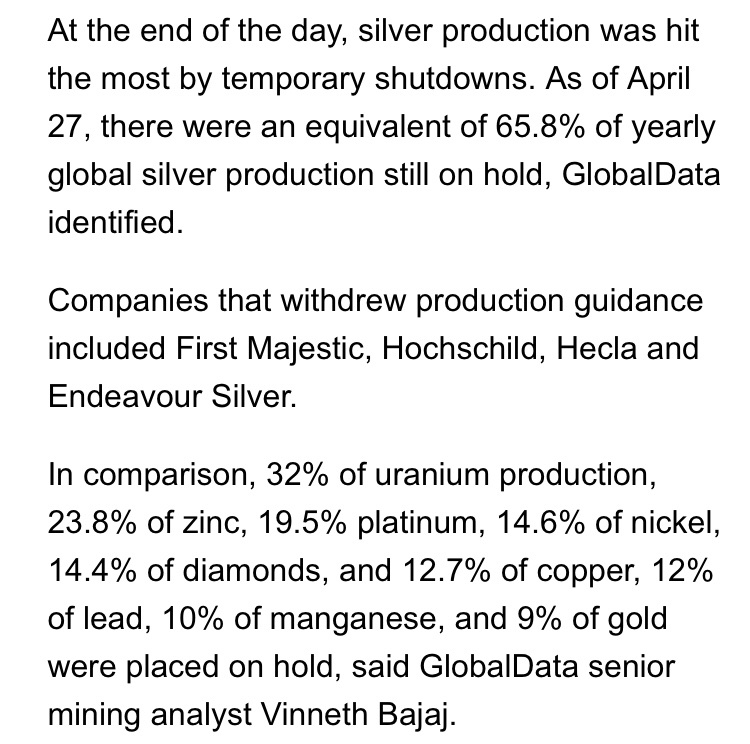

The supply shock brought on by closures and curtailments from COVID19 hit uranium more than any other commodity, except silver.

Now, how to invest in the nuclear market? You can’t buy and store pounds of uranium physically without the eventual onset of cancer or, more likely, a visit by federal agents first. There are uranium ETFs that track spot price, but to obtain a leveraged position, the mines and exploration companies are a better option.

This is by no means financial advice; the following is my personal portfolio’s uranium holdings and why.

Energy Fuels, UUUU

My largest uranium holding is Energy Fuels for a multitude of reasons. The following slides are from their latest investor presentation which can be read here: https://filecache.investorroom.com/mr5ircnw_energyfuels/725/download/2020-03%20Corp%20Presentation%20%28FINAL%29.pdf

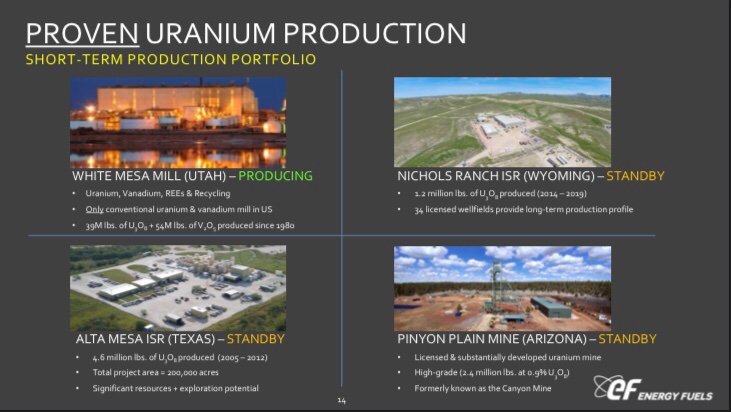

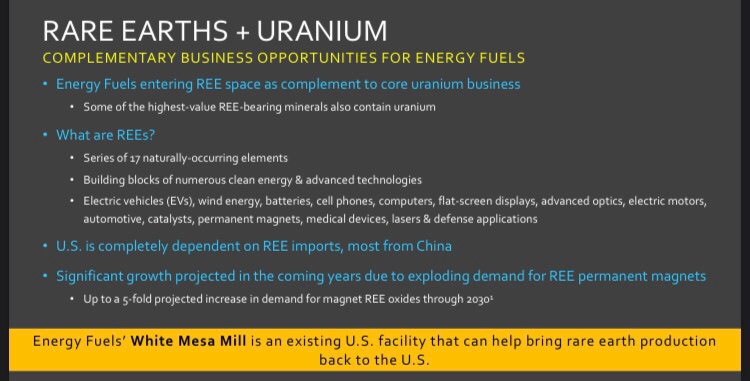

UUUU is the largest US producer of uranium and a soon-to-be producer of REE (rare earth minerals), falling in line perfectly with the geopolitical need to secure supply chains of vital materials.

Their current mine portfolio has market-producing, low-cost uranium to take advantage of the current market landscape, as well as multiple assets that can be started with the onset of higher prices.

UUUU’s entry into the rare earth minerals market cements their importance domestically especially in an environment of trade wars between the US and China, who controls 90%+ of current REE supply.

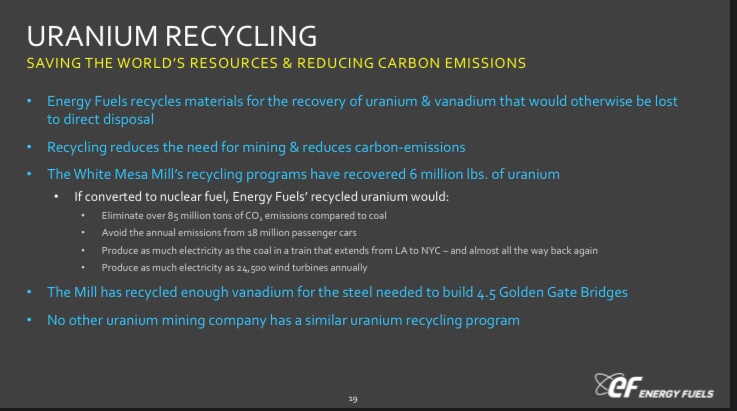

Energy Fuels’ commitment to efficiency and environmental protection benefits their financial health as well as the environment.

The most attractive aspect of UUUU is their current debt position, which is zero. In fact, they have $53.7 million of marketable securities and supply of uranium and vanadium on their balance sheet. This allows for major financial flexibility and possible mergers and acquisitions going forward.

Denison Mines, DNN

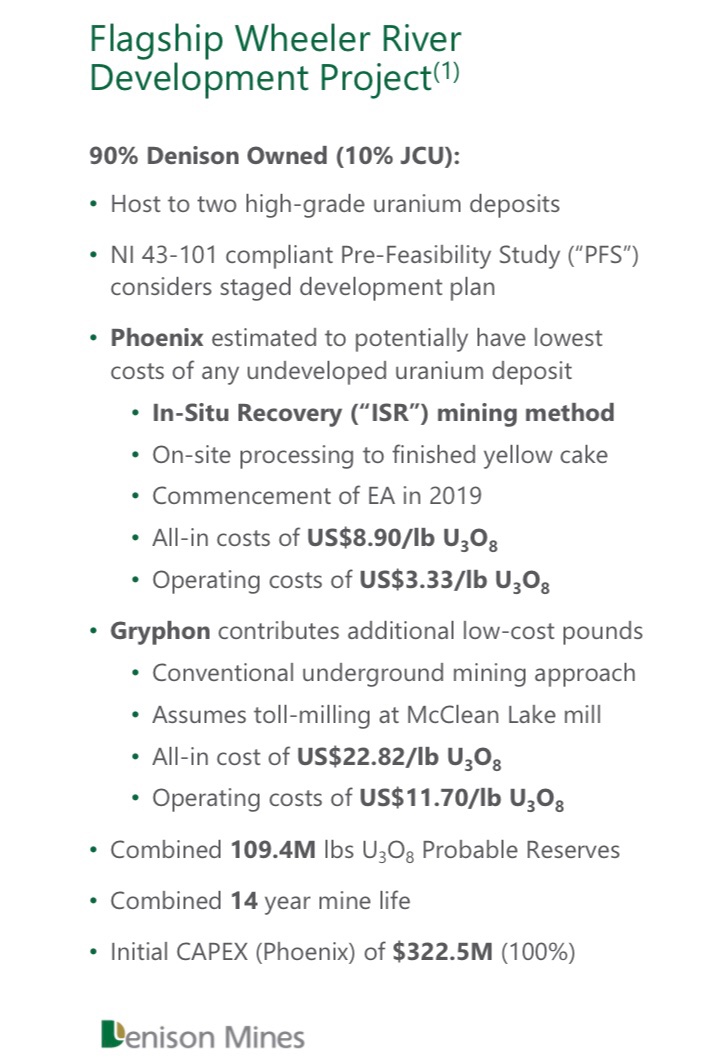

The Canadian-based operations of Denison hold high-grade, low-cost extraction of uranium. Their Wheeler River project holds uranium pounds in the ground with an all in sustaining cost of $8.90 /lb. This price point gives DNN major leverage to the uranium spot price.

I also hold minor positions in URG and UEC for diversification purposes.

The major risk facing the nuclear industry is another Fukushima-like disaster that would cause widespread fear and a pulling of investment in new plants and mines.

The uranium investment thesis:

- cyclical low exacerbated by Fukushima disaster

- supply/demand fundamentals

- ideal energy candidate for reliability and global environmental emission goals

The North American uranium mine thesis:

- securing domestic and ally country production

- low-cost, financially-healthy mining operations

- diversification in REE production

Outside of a black swan type event, the uranium market is primed for an explosion.

Excellent and well-researched post!

Man you seriously need to stop voting so much with the central account. Or at least get rid of a part of the stake because I haven't been able to cast a single vote worth more than 0 for the past 12 days even though it's supposed to be worth around 60 REVX.

That's 60 tokens per day from 10% curation or more than 700 tokens lost in curation during the two weeks I've been unable to vote.

Quality and comprehensive writing!

With funding, the knowledge scaled could create projects that could greatly improve society and earn the creators deserved praise.

Go Niche uranium investments.