DXY is starting to rise again after the recent decline

Economists at Societe Generale are of the opinion that the DXY US dollar index still has an upward momentum.

The US dollar is a serious opponent against a myriad of fiat currencies this year.

A wide range of fiat currencies such as the euro, pound sterling, yen, yuan, Australian and Canadian dollars suffered from the dollar's strength.

On September 27, the US Dollar Index (DXY) hit a high of around 114.8, a high not seen since 2001.

As a reminder, the DXY is an indicator that is used to measure the value of the dollar against six different fiat currencies.

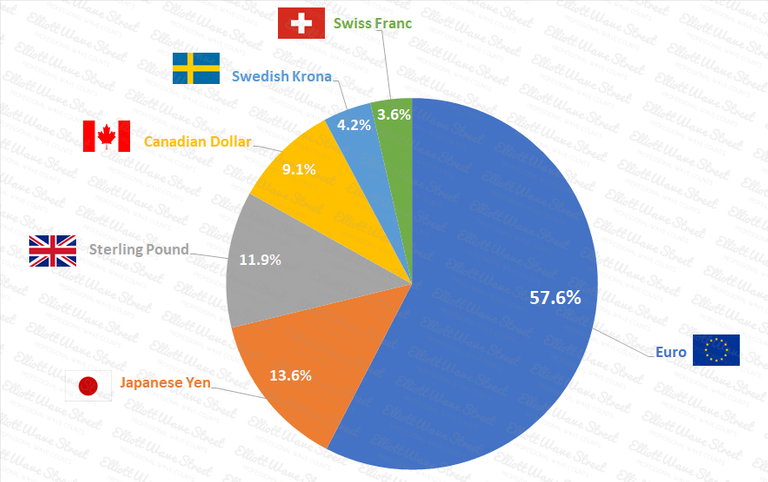

The basket of banknotes traded against the US dollar consists of the European Union euro, the Swiss franc, the Swedish krona, the British pound, the Canadian dollar, and the Japanese yen.

However, the basket of six currencies is not evenly distributed, with the euro making up 57.6% of the basket, and the yen being the second largest component at 13.6%.

The index gives traders, analysts and economists a fair assessment of the dollar's strength against a basket of foreign currencies.

US Dollar Index DXY starts to rise towards the highest levels again:

DXY was introduced in 1973 when US President Richard Nixon removed the gold standard and dissolved the Bretton Woods Agreement.

At that time, the DXY US Dollar Index initially started with a base of 100 and the index has risen significantly since then, reaching an all-time high in February 1985.

Economists from France-based financial services firm Societe Generale believe DXY is heading towards the 114.8 range after the recent decline.

Where they reported that the rebound towards 113.60 and the peak near 114.80 is not ruled out.

They also stated that a break below the 110 area might indicate a deeper pullback.

Currently, the five-day metrics show the euro is down 2.39% against the US dollar, the Japanese yen is down 1.02%, and the British pound is down 3.19%. An ounce of gold is down 1.04% against the dollar this weekend, and silver is down about 2.47%, but it's still above $20 an ounce of pure silver.

The global cryptocurrency market capitalization of all existing cryptocurrencies has gained 0.03% in the past 24 hours and the cryptocurrency economy is currently valued at $940 billion.

Stock markets closed in the red on Friday afternoon with the Nasdaq down 3.8%, the Dow Jones Composite losing 2.05%, the New York Stock Exchange down 3.34%, and the S&P 500 seeing a 2.8% drop in value.

More than $1 trillion was wiped out from the US stock market on Friday, more than the size of the entire cryptocurrency economy.

Posted using Tribaldex Blog