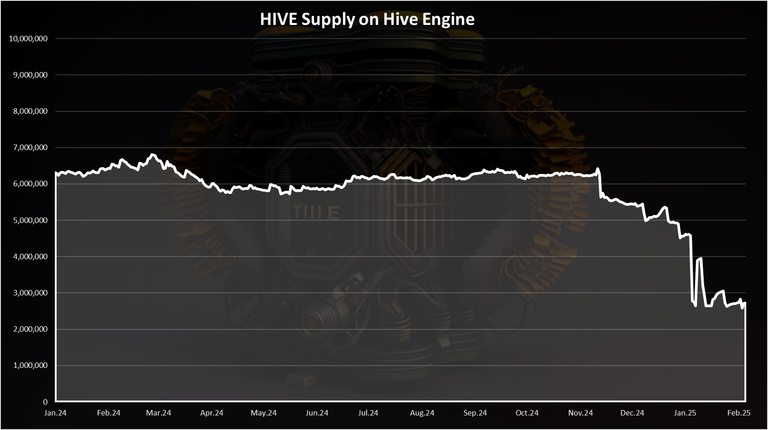

I'm curently working on HIVE on exhcnages report and I have noticed that the amount of HIVE on Hive Engine has dropped.

Here is the chart.

This is both, Hive Powered and liquid HIVE.

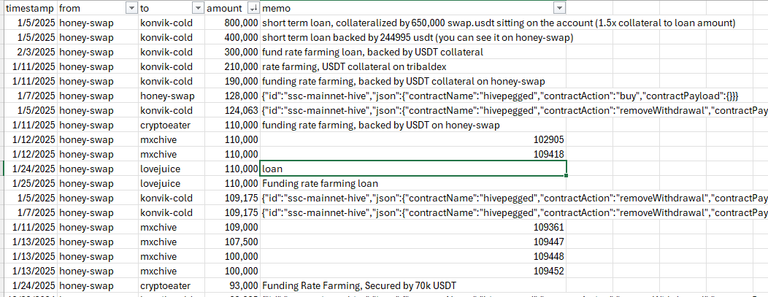

We can see this happened at the begining on January 2025. I looked into the transactions from HE and the biggest one are these:

The first conclusion is this is a it is stated in the memos ... users are making loans from HE then depositing them on Binance and farm the fudning rate on futures that have been recenlty listed for HIVE and there was high APR, more than 50% at some point.

Totaly dont want to FUD Hive Engine, also cant realy tell whos funds are these, are they users funds, or maybe company funds, Splinterlands funds? etc ... Maybe they are under custody of Hive Engine... just wanted the wider community to be awere and maybe also the team behind HE give more clarity what is happening here, and whos funds are being lend out.

The slowdown is separate from the Hive lending.

The slowdown is caused by the account shaggroed deciding to maliciously inject 300,000 transactions in 35 minutes. This caused the chain to slow down. Witnesses are attempting to deal with it.

The Hive lending is completely separate. I own a substantial amount of Hive. I am lending Hive underneath the quantities that I personally own or have keys to. This Hive is used to farm rate funding on futures contracts. The lending is backed by my private Hive, my private collateral, swap.USDT collateral that you can see on the honey-swap account, and other Hive to which I have keys to.

I appreciate the concern. I've attempted to have some transparency around this. The two issues are mutually exclusive from each other as far as I know. To the best of my knowledge all funds are safe.

Thanks for the clarification! Wish you a soeedy recovery.

A bit weird, judging by a few of those mxhive memos it also seems like it could be the same person as the accounts/memo's seem to be so close to each other.

Exchange is using customer funds to gamble? What could go wrong...

And now the side chain is having problems.

Not only the funding rate on the future but the APR of flexible earn is also very high, sometime it's more than 40%.

I believe that everyone has done this, taking advantage of binance's APR, I even left a bit of hive there, in the future, after the yield is taken everything and make a big power up.

What people are concerned with isn't that everyone's doing this, it's that they're wondering if this is being done with customers hive without their consent. Some memos there also mention things like collateralized loans, i.e. if price of hive were to drop by 1.5x they'd have to return it to get their "collateral back", how that collateral is being held is also uncertain. Just a lot of different questionable activities just to take advantage of the hive apr on exchanges, let alone the risks of those exchanges themselves locking people out or disabling withdrawals could then lead to hive-engine becoming insolvent, etc.

Either way, not sure this is worth the risks someone is taking and someone is allowing to be taken.

Ahhh damn, I understand the situation better. I'm still a bit of a layman on some points and this kind of conversation is great for learning. Thanks for explaining this in more detail. Regarding the risk of brokers blocking withdrawals or being banned like Binance is in some countries that I've seen the news, I'm worried too, that's why I want to leave a maximum of 200 or 300 Hive.

Interesting, very interesting. I hope they don't take too big of a risk with this approach.

FFS, first the attacks now this.. just what we needed more drama and uncertainty 😅

I did see some massive loans from honey-swap to users I didn't understand. Felt trying to figure it out would just be a headache.

Yea, there is close to 2M HIVE in the screenshot above ... dont know the details eighter