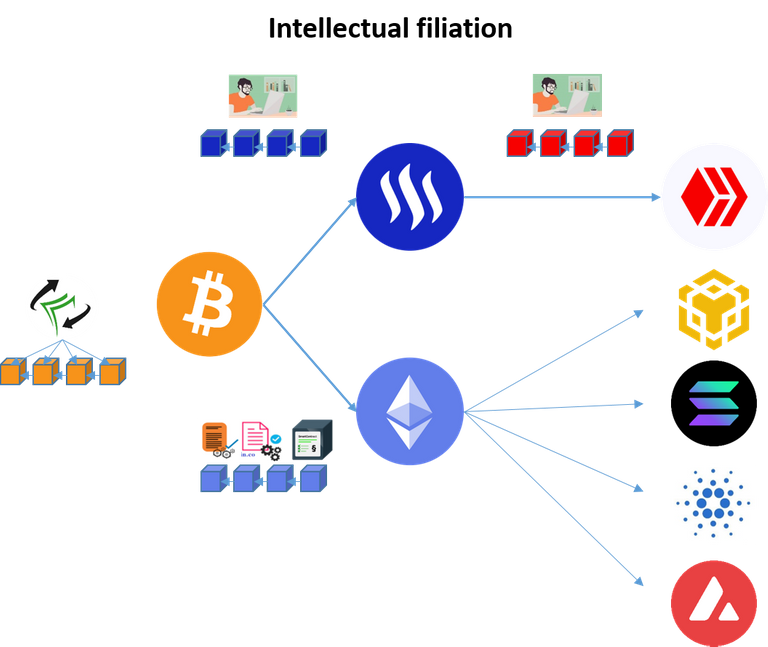

Hive** features an unique, advanced economic system - the "most advanced", according to a 2018 analysis in "The Economist". The reason Hive is unique is the different intellectual path taken by the creators of its precursor, Steem, more than six years ago and illustrated below.

The common ancestor, Bitcoin, used a "blockchain" to serve its functional goal: a peer to peer electronic cash system. Seeing the power of the blockchain pattern, the Ethereum team decided to turn it into a platform for general purpose applications, user-designed "smart contracts". In contrast, Steem's creators stood firmly by the approach used by Satoshi Nakamoto: the functional goal came first, and that goal was to build a "content creation and curation platform". Today, in terms of variety, all the new generation blockchains (or almost) use the Ethereum approach, linking a blockchain data structure with a smart contract execution engine. Hive, in turn, shunned user-designed smart contracts and remained true to the original Steem architecture.

An outsider will thus need to approach Hive with an open mind and not assume it will find many similarities with other blockchain systems (save for Steem), as most other blockchains have followed the intellectual lead of Ethereum.

In particular, two features stand out immediately when describing Hive:

- Free transactions

- Reward pool

A more detailed explanation of the Steem mechanism can be found in this paper I wrote several years ago. Although many parameters were changed and others were introduced by Hive, the overall picture remains useful.

Free transactions

Very few other blockchain systems were built from the ground up in order to offer free transactions. Those which were are outliers, such as Nano and IOTA, or have a relationship with Steem / Hive, such as EOS (all three were designed by Dan Larimer). Free, zero-fee transactions are an extremly powerful feature as they allow an user to start using the system with no initial capital outlay. That means a newcomer can start using the a blockchain "dApp" (application) straightaway, without having to buy crypto. Actually, on the hive blockchain, users never have to buy HIVE, which gives power to simple users but is not necessarily well-regarded by investors.

As a downside, free transactions also make the system somewhat more vulnerable to attacks, thus needing honest actors and / or additional protection from the legal system (whereas Bitcoin has been built to not need to rely on the legal system). I have argued that this trade-off makes sense, as it allows community-building.

As Ethereum took inspiration from Bitcoin, I have explained in a previous paper why the Ethereum "smart contracts" actually sit very awkwardly with the legal system, from where the "contract" term has been borrowed. Given the many scams which pullulated on Ethereum and related platforms, "cunning code" would probably better describe these programs.

Reward pool

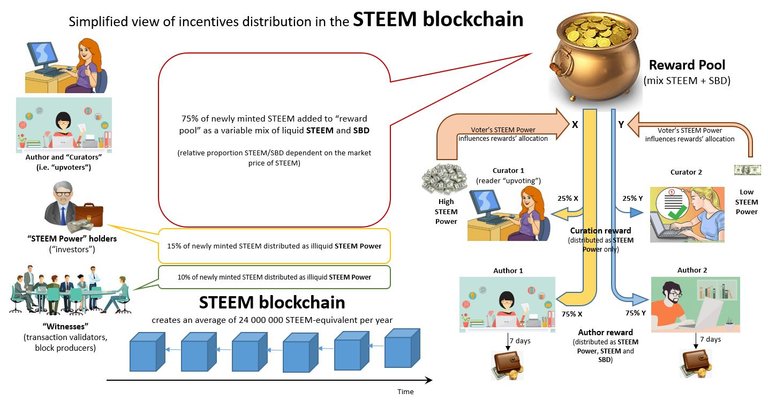

Bitcoin and Ethereum (and almost all their intellectual progeny) reserve all the newly minted coins to the "miners" / "validators" - people who operate the blockchain, as an incentive to stay honest and keep the network safe. The decade-long demonstration that "economic incentives" can foster human collaboration on a scale only law was able to achieve previously was one of the greatest contribution Satoshi Nakamoto made to the progress of humankind.

The downside of this design is that, governance-wise, these systems turn out to be "computocracies", where the power is not in the hands of the users but rather in those of a new nomenklatura of computer-savvy techies.

Steem had the audacity to reverse that balance with a radical change: it kept only 10 % of newly minted coins for those operating the network (thus further diminishing the potential of the network to resist censorship and increasing its need to rely on honest actors and, potentially, the law). It allocated 15% to those providing "capital", the "investors". And it kept the majority of new coins (75% for Steem, 65% for Hive***) for the users, those creating and curating content. How these coins from the reward pool are directed depends on two things:

- How users "vote" on chain (on-chain governance)

- How much stake voting users avail themselves of.

Note an important subtlety: it's not about "how much stake users own", but about how much they can "command". And here is where the concept of "delegation" takes a whole new dimension and acquires new meanings.

Indeed when mentioning "Delegated Proof of Stake" (DPoS), the consensus used by bitShares, Steem, Hive, EOS and other blockchains, most people only think of the process of electing block validators. And indeed, this is the first use of the DPoS.

But in Steem and Hive's case, the "delegation" mechanism, a type of "secured lending", is further extended with the power of directing the coins located in the reward pool. That mechanism allows division of labour which is arguably the most important step in the emergence of the human civilisation. Thus users with little capital but available time ("labour") can be "delegated" Hive Power (HP) which they can use to more effectively "curate content" (rank content by perceived quality and allocate rewards from the reward pool) or perform other decision-making activities (such as voting on the "decentralized fund" allocation) whose effectiveness increases with the stake applied. This is also explained in the article on Steem crypto economics I wrote almost 4 years ago (and illustrated with a short video) but it takes some to fully understand.

Show me the money

After what amounts to a lengthy introduction, we come to the "meat" of this paper.

You are "an investor"; that is, you bought Hive, moved it to a blockchain account (rather than keeping it on an exchange) and "powered up". The latter is the Hive lingo for "staking": locking liquid Hive in a built-in smart contract where it is seen as "Hive Power" (1 Hive = 1 HP)****

The default choice is to keep the HP there and earn the "inflation rate" (currently 2,92%). The benefit is that you can use that HP whole influence when picking "witnesses" (validator nodes), when voting on the various "development proposals" vying for the 10% of newly minted coins in the DHF (decentralized hive fund) and of course when "curating content" (signaling what posts you enjoyed and getting "curation rewards" for yourself in the process), among other things.

But perhaps you are too busy to do much of that and too "return oriented" to be happy with the meagre 2,92%. Then you can "delegate" fractions or all of your HP through another built-in smart contract: your HP will then become usable by other users (the "delegatees") who might have more time on their hands to put those HP to work (gentle pun: HP is also an abbreviation for "horse power").

As there are several actors who are willing to receive HP delegations and share the resulting yield, you might be wondering whether they are all equally good, or else, which ones to pick? I have in any case. I used to have a truckload of HP delegated to a single service, @tipu. But I noticed the return kept getting smaller and smaller. So about one month ago I decided to embark on a research mission, with the objective of finding out: what are the best delegatees?

Start line

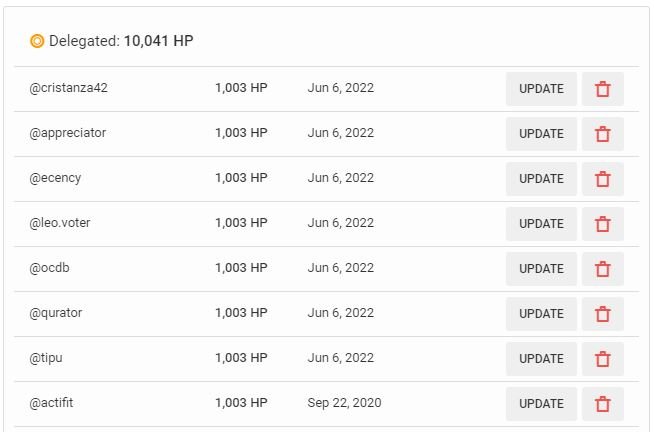

At the start line, on June 6th, I delegated 1000 HP each to the following accounts:

- @tipu

- @ecency

- @qurator

- @ocdb

- @leo.voter

- @curie

- @cristanza42 (through the @dlease marketplace)

- @appreciator

- @actifit

If you have other such worthy delegatees to recommend, do not hesitate to make suggestion in the comments.

I'll discuss each of them in separate posts, but let's start by saying that one month later, @curie had not returned anything in any way so I cancelled the delegation (it doesn't appear in the above screen capture done today, where you can also noticed that the 1000 HP from June have become 1003 HP thanks to the 2,9% inflation).

That leaves 8 competitors to compare.

Finish line

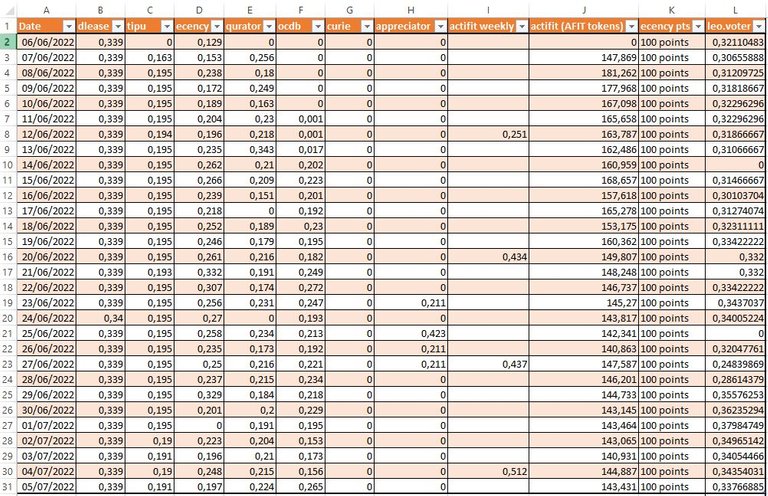

One month later, I would not be doing these great delegatees a service by simply ranking them by return, so I plan to analyse them in detail in a dedicated article. But can't let you hanging either (I'm not Netflix) ...

I can say that @ecency is the best overall, in my opinion, especially if you do have some activity and contribute original content to the platform (on which you can use ecency "points" to boost your article). However, ecency points are no crypto asset and are not tradeable. You can't use more than 500 per article and they bring no guarantee, so the "points" income is not very scalable.

You can get good returns through @dlease but the marketplace is not deep enough for a large amounts of HP and you have little control over the quality of the activity: expect some delegatees to use your delegation to maximise financial return at the expense of quality.

@leo.voter offers nice returns too but they are not in HIVE but in a L2 token, LEO, which you'll need to exchange on a Dex That adds extra work and risk as the liquidity of these L2 tokens is usually low.

@actifit is a nice social delegatee which suffers partly from a similar set up: it returns HIVE and HBD weekly (in moderate quantities) and supplements that return with its own L2 token, AFIT. However that token arrives locked, unlocking is paced and the market for AFIT is illiquid.

Among the next three, @ocdb, @qurator and @tipu, all focused on quality content, @ocdb appears the best but you'll have to take into account a 7 day shift for the returns to start arriving.

The last among the eight, @appreciator is a bit mysterious: it returned a little HIVE and also gave a sizable vote to one of my articles. However, I have no idea why to that article in particular and what articles it votes, so I prefer underweighting it in an allocation.

Here is the Excel sheet where I did my (amateurish) accounting.

Note that I took into account the return for @ocdb until July 12th (assuming tomorrow and Tuesday it will be similar to today). For actifit, I approximated each HBD returned to about 2 HIVE. I took a bid price from Tribaldex to attempt a conversion of AFIT into HIVE. I used @ecency's own estimate of the value of the "points" and I used approximate conversion rates of LEO into HIVE.

Conclusion

I am turning this month-long observation into an allocation which I am going to execute and monitor and will report on in a future article. However, there is a conclusion already: "delegation" in the Hive ecosystem, a type of "secured-lending", supports real social and economic activity rather than financial speculation.

Thus the returns it generates are healthier than those of the typical crypto platform and in the general meltdown of the past three months, it showed!

** Steem is the original blockchain which introduced this economic mechanism design. Hive diverged from Steem in march 2020. An article analysing the difference in fortunes between these two very similar blockchain eco-systems is warranted.

*** Hive has added a DAO-like "decentralized fund", not unlike older blockchain systems such as Decred. The 10% of newly minted coins which are directed there are redistributed to projects selected by the stakeholders.

**** Staked or "powered up" HIVE is actually converted internally in a different cryptoasset called VESTS. But that is only of academic interest, you don't need to worry about that

Useful post as usual. 👍

I suggest adding @curangel to your research list 🙂

that's a good idea.

Thanks !

@discovery-it is another that gives decent returns.

Ok, thanks, I didn't know about this one

Hi :)

How much APR they are giving currently?

@sorin.cristescu - I love these types of breakdowns with the explanations. They work well for folks like me that are still learning all this blockchain and crypto stuff each day. I have delegations towards a few of those on your list, so it was interesting to see this from your vantage point.

I'm here by way of ListNerds where @drlobes shared it.

!CTP

Wonderful ! I need to understand better what ListNerds is doing

You may also consider adding @stemsocial to the list, although the ROI is not the best, probably by far. The reason is that we focus on quality, and work within a niche in which there is not enough activity to use all available VP. Hopefully, in the future this will improve.

This being written, feel free to give us a try ;)

You know I'm delegating to @stemsocial but as you say, there isn't enough STEM content yet on Hive to put too much HP to work on it. Stemsocial needs different investors, not those interested in ROI

I actually didn't even check. Sorry about it. I didn't want to complain or whatever.

I agree, but for that we need first to build a product, and for that I need a dev to help, and for that we need investors to pay for the dev... I guess you see the problem :)

I very much appreciate your post and your calculations, I was actually looking for a comparison like that to decide where to allocate my HP and how much I could expect to get in return.

I'm looking forward to read more about your research and I'm curious about the follow ups of this comparison!

I've changed my allocation and applied it to a larger amount of HP and will do a follow-up

I have a delegation to curie through dlease which has 10.12% interest over the year. I've had it for about 18 months now and I see it as a way of furthering my reach on supporting content creators. It is also a little better in terms of interest than I would do by curating directly, should I have the time.

Ok, so basically I should watch dlease for when curie comes back to ask for delegations there, delegating directly will not work. Thanks for the clarification

Wow, such an insightful article. I love it that you did the analysis on the delegation's rewards, this is really valuable information for any Hiver interested in this kind of passive income. I'm also eagerly waiting for the detailed analysis that you have planned.

I'll send a mail on listnerds in about an hour(pe la ora 12, RO time), we'll see if this will bring more comments and/or votes from other users, and in about 7 days' time, I'll share with you the payout that I'll receive from this.

Excellent, I think the email channel is not used enough by our community

We have a small update in the works that may interest delegators, to be announced soon. :)

Great work! Im looking further to more.

Thanks!

Great article, @sorin.cristescu ! Lifts the veil behind the curation aspect of Hive!

!HBIT

Thank you ! And I hope it invites people to look closer and perhaps choose to invest. Although it's not an easy to understand mechanism, an increasing price of Hive "crowds in" other activities

Truly one of the most useful posts I read in a long time Huge THX !CTP came here through listnerds

Do you feel that sharing this post on ListNerds! made any difference or not that much really?

It looks like it did make a big difference, absolutely !

How did you do it, practically speaking? This ListNerds thing is obscure to me, didn't have time yet to DMOR

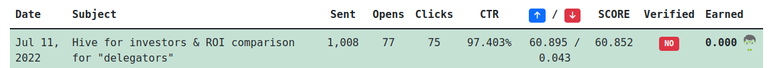

Practically speaking, on ListNerds I send 2000 mails with your article but due to some current bugs only around 1000 of them reached an audience, out of that 1000, 75 people followed the link to see your article and some of them voted me on the ListNerds platform.

In about 5 days I'll see if the mail "got verified" meaning that enough people with a bigger stake voted me(which most probably will) and then I'll see how many ListNerds I'll get for this operation.

Keeping count of my ListNerds staked, the interaction with other listnerders that started to kown me lately and the return on previous mails sent I hope I'll receive around 600 ListNerds currently priced at around 0.2 Hive each on HiveEngine. Things are a bit more complicated but I tried to explain it as easy as I could. LN is a new token and its price is not stable yet, weeks ago its price was near 2 hive each but with all the crypto prices crashing and the need for some users to sell some of the gained tokens, it came down to 0.2

Unstaking LN takes 10 weeks.

If you decide to join, maybe you'll want to use my affiliate link, it could give me some commission on your potential future purchases on the platform.

drLobes#6382 if you want to reach me on Discord, I'm on Telegram & Whatsapp also.

I subscribed using your affiliate link. My first stupid question: this is a mailer which sends automatically to all ListNerds members ... but can I also manage my own custom lists (some e-mails I want to send only to some people I selected, not to all Listnerds members) ?

NO, you can't select to which people your mails are send, they are sent randomly or follow some rules that I haven't studied yet.

Congo pongo. Smooth pitch. !BEER

NO congo pongo here!

View or trade

BEER.Hey @drlobes, here is a little bit of

BEERfrom @dlmmqb for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Dear @sorin.cristescu, sorry to jump in a bit off topic but may I ask you to support the HiveSQL proposal?

It lost its funding recently and your help would be much appreciated to keep the HiveSQL service free for the Hive community.

You can do it on Peakd, Ecency,

Thank you for your support!

Thank you so much for the information. I definitely learned a lot.

You're very welcome

Thanks for your contribution to the STEMsocial community. Feel free to join us on discord to get to know the rest of us!

Please consider delegating to the @stemsocial account (85% of the curation rewards are returned).

You may also include @stemsocial as a beneficiary of the rewards of this post to get a stronger support.

Yay! 🤗

Your content has been boosted with Ecency Points, by @sorin.cristescu.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Thank you for explaining so much so well. !BBH

Great job my friend well indepth informative post👍

@sorin.cristescu

You should check out the We Are Alive Community it has some great projects and you could get a great return on your investment for delegations just talk to @flaxz

Have the best day

!ALIVE And Thriving

!BBH

!CTP

!LOL

!MEME

Made in Canva

Credit: cmmemes

Earn Crypto for your Memes @ hiveme.me!

@sorin.cristescu! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @benthomaswwd. (11/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

lolztoken.com

Long time no sea.

Credit: reddit

@sorin.cristescu, I sent you an $LOLZ on behalf of @benthomaswwd

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(2/4)

Congratulations @sorin.cristescu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 46000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

BBH stands for ... Brown Brothers Harriman? 😄😄😄

Bitcoin Backed Hive - BBH is a token on Hive-engine that is maintained by @bradleyarrow and he backs it up by Bitcoin.

Mostly used for a tipping bot but if you want to know more just ask the man, they've been around for a while.

!BBH 10

!ALIVE

!CTP

@drlobes! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @bradleyarrow. (10/30)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

The rewards earned on this comment will go directly to the people( @no-advice ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.