Hello, SPIer's. Today is Sunday and we end the SPI week with our weekly dividend payment this evening and every Sunday at 21.00 GMT.

What is SPI?

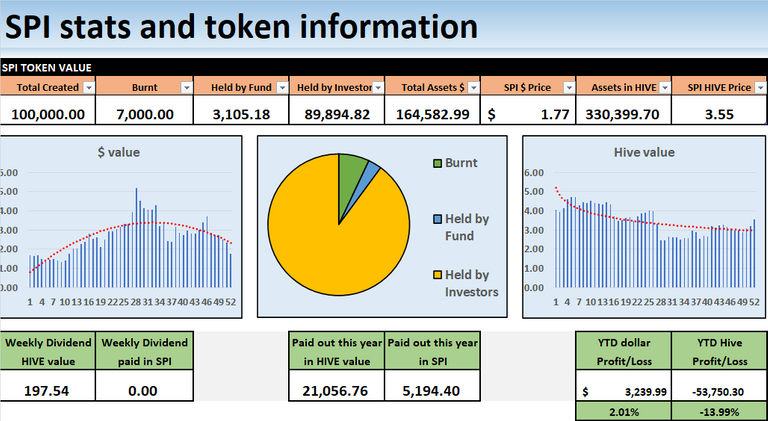

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, on STEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% more SPI's every year from weekly dividends. We raised $13k from issuing SPI tokens for the first year which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens/accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Handcapped to roughly 94,000, no more can be minted are issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We dont FOMO are chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Let's have a look at this week's on-chain HIVE earnings.

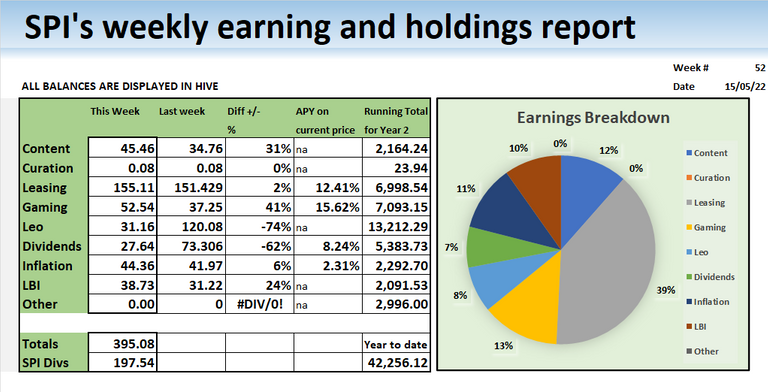

Earnings this week are pretty standard with what they have been for the past few months. This being the last week of the year means we issue 100% of earnings this week so double dividend. The market has taken a turn for the worst I'd expect we'll see these affect earnings from next week onwards.

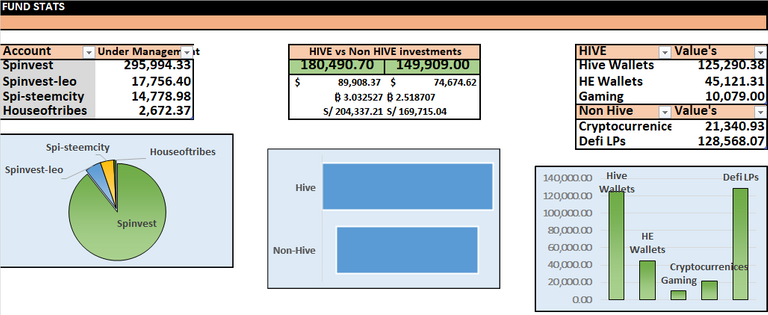

Total dividends paid out this year have been equal to 42,256 HIVE. Based on today's SPI fund HIVE value this is equal to 12.78%. Total HIVE income has been 84,512 HIVE.

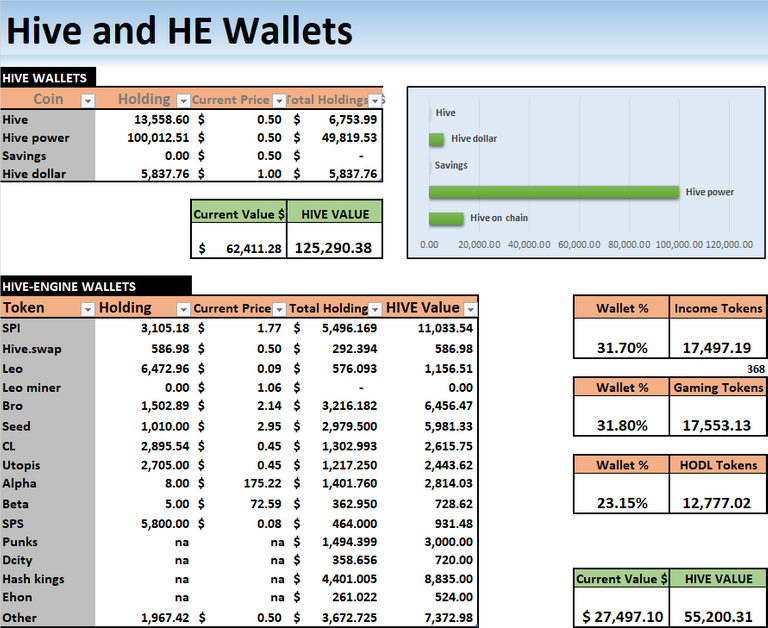

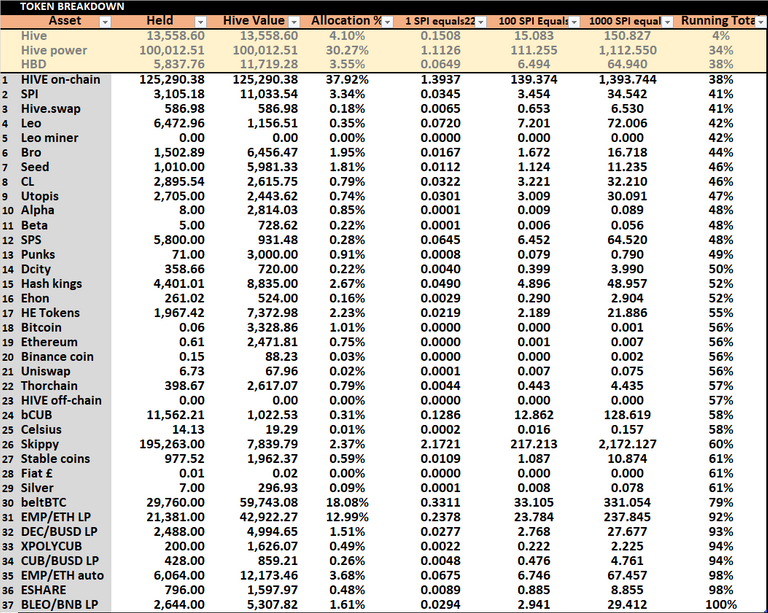

We finished last year holding 95,859 HIVE and 0 HBD, we have increased our HIVE holdings by 17,711 to 113,570 and we now hold 5,837 HBD in our HIVE savings wallet earning us 20% per year.

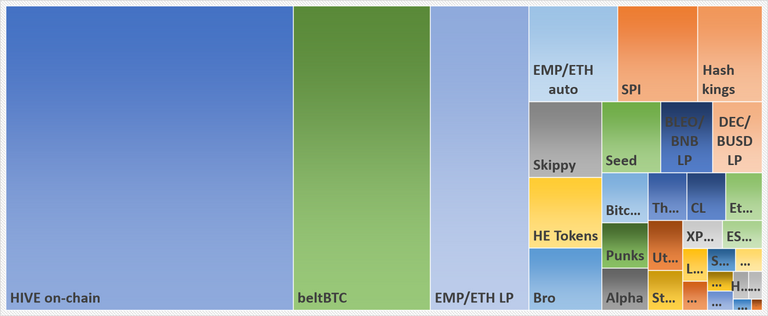

Our HIVE-ENGINE wallet was worth 106,000 HIVE at the end of last year which has taken a hige hit this year as the price of HIVE increased and our HE tokens were worth less in terms of HIVE. I've have also sold off a large numbers of holding including APLHA and BETA pack tokens, BRO tokens and UTOPIS. I added SEED and PUNKS. We finish this year with a HE wallet value of 55,200 HIVE.

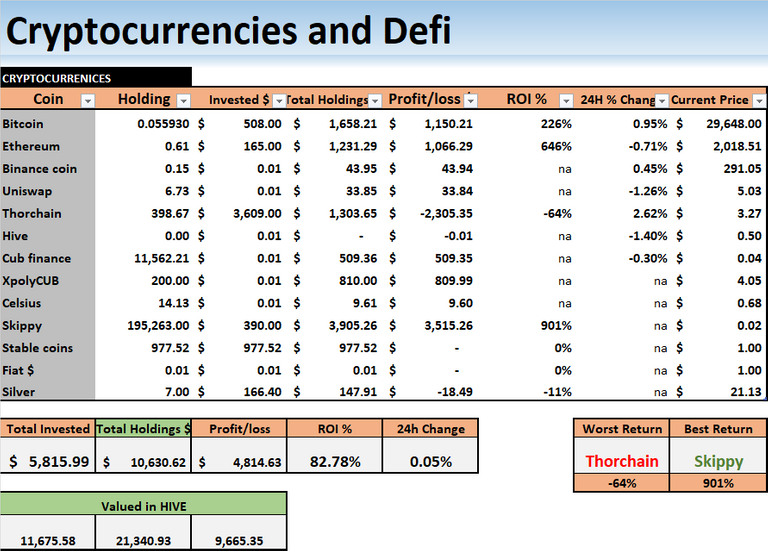

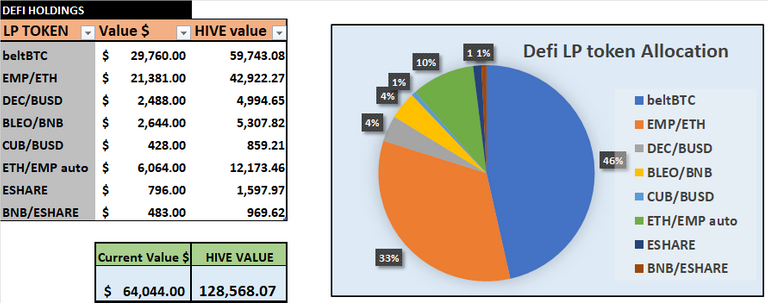

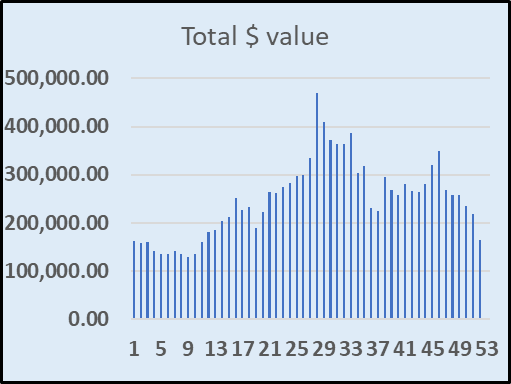

With defi being the hot thing this year, we have got involved and most of our holding are now part of LP tokens earnings us farming rewards. In total, our non HIVE holdings were worth 222,271 HIVE last year. The price of HIVE last year was pretty much the same as it is today at around 45 cents but BTC and ETH are down alot from 1 year ago. We finish this year with non-HIVE holdings of 149,908 HIVE.

I will continue to keep most of these LP's in place as they are producing around $1000 per week for now. These numbers will drop as we go further into hebear market but for now, things are ok. I am considering to cash out our BTC being selling off 0.05 for 20 weeks and converting it into a stable token to wait for the market cycle bottom. I think im more likely to just hold it and wait for a really high BTC/HIVE ratio, last bear market, it went 250k HIVE for 1 BTC and we all know HIVE will hit at least $1 again next bull market so seems like a good trade to wait for, might take 2-3 years but we can earn a little from the BTC I the meantime. We hold a large amount of our ETH through EMP which has been hit by the current red markets. Its peg dropped to 0.92 3-4 days back but has since recovered to 0.96 and is still recovering.

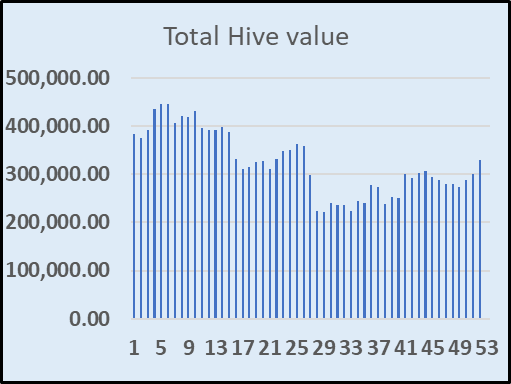

Not a great end to the year. The past few weeks have been brutal and basically wiped out our past years growth and put us into the negative for the year. Our dollar value increased by 2% but our HIVE value dropped by 14% equal to 53,750 HIVE. The main reason for this is because the price of HIVE is around the same as it was this time last year but the price of everything else is down around 30%. I expect in the coming year, the price of HIVE which is our biggest holings will catch up and it's decline will be greater than BTC and ETH, our 2nd and 3rd biggest holdings. This will result in a higher HIVE fund value.

We can see from below that HIVE and HBD make up 38% of our holdings worth 125,290 HIVE. We have 3 other holding worth more than 10,000 HIVE, they are BTC and ETH twice.

Here we are at the end of year 3 for SPI and our 2 complete year on HIVE. We have seen pretty much all our profits for the past year wiped out in the past few weeks with the market getting crippled but we still finish with a small-dollar profit and we actually pulled back alot of HIVE in the past 2 weeks as we went from minus 100,000 to ending on minus 50,000.

We're heading into year 4 knowing that the markets are likely to decline as we go further into the bear market. This is still SPI's first market cycle but being birthed during the bear market has told us that most of our future growth will come from what we can invest in and build during these times. My main failure has been not acting on being able to sell at the right time. I was able to predict when the markets what top back in 2020 in a series where I used to do weekly SPinvest videos but I was way off on my price predictions. I would have never thought that $67,000 was BTC's market cycle top but it was and thought it going to correct some and then moon to pass over $100,000.

On HIVE, we will continue to build into our HBD balance as I expect the price of HIVE to decline for the next 12-24 months and preserving some of our HIVE earnings in HBD could turn very fruitful when or if HIVE trades for under 20 cents again. There are no plans to introduce any new projects under SPinvest in year 4, i plan to grow out and build use cases for projects we already have set up. Eddie-earner will release a new miner token soon with the hopes of that adding 15-25k HIVE to our holdings. I would like to use bear-bonds which are a token pegged to HBD to create an income token much like EDS but focus on HBD and not HIVE. Based on EDS's mining model, bearbond tokens could pay out a 25-30%+ weekly HBD dividend while offering instant liquidity. I do have plans for 1 new project at the start of year 5, I think it will be integrated into bearbonds as a saving bond with a fixed term.

As for non-HIVE holdings, i have already been converting harvests into stable tokens for the past 5 weeks and we were able to build a balance of over 5000 HBD and around $1000 BUSD since then. We are currently earning around $400-600 per week, this was $2000 only 2 weeks ago but that is the markets. I would expect these weekly earning to drop as we go further into next year but i will continue to convert most non-HIVE earnings into some form of stable token and build a stockpile so when everything is down 90%, we can go shopping and play the waiting game.

I have never tried to sugarcoat things. The markets are down and this is going to be the trend for the next 18-24 months. As I said before, this will be SPI's first complete market cycle and we are prepared for these times. You will not see me panic selling anything, I will build reserves in stable tokens and when the time is right, we'll buy up lots of new investments and build on ones we already hold. Do you think things are cheap now? Wait until BTC is trading for under $15k, HIVE at under 15 cents. That might sound like crazy prices but not based on what happened in the past. BTC only has to go down 50% from where is today. We are not question in for rough times ahead but this all part of the game. SPI is already in an unlosable position as i dont ever see SPI every dropping to under 1 HIVE are under 13 cents in value. This time in 4-5 years when the next bear market is confirmed, im sure we'll beable to say SPI's will never drop to under 3 HIVE are 50 cents each as we grow, compound and build at all sages of the market cycle.

Thank you to everyone for there support throughout the year. Year 4 for SPI will be all about preserving wealth with focus on savings over investing.

Thank you for taking the time to read through this weeks SPI earnings and holding report. We post every Sunday to keep our investors up to date so please follow the account if you would like to track our progress.

Hmm, actually I think this is a healthy place to be and it reminds us not to be complacent or to take things for granted. Things go up and down, we've seen that this year: we were showing a $320k fund earlier this year, at the end of the year, it's about half that now, but actually, these are only points in time, and only really relevant if we want to cash out at those moments. And it happens that this dip coincides with our year end which makes it look like losses. But this was a fund that started with $13,000 and, even now, when the market is truly rekt, its value is $164,000. We still hold those assets and we still hold the fund's earning power.

The dividends through the year have been equivalent to nearly 13%, that's pretty good going as that is additional benefit to the fund's overall value.

Not sure if this is a joke 😂.

My preference would be to spread the risk a little and keep some, sell some. Our BTC earns and our ETH is bringing income.

And there's year end double dividends - yay! 😍

Thank you for a fabulous year's work, great to hear next year's plans are about consolidating and saving with @eddie-earner, EDS and @bearbonds pushing forward 🍻

We're in a good place, my have good holding and unlike other fund tokens that are backed 80-90% by HE tokens or games, we'll remain strong and liquid.

Typo and corrected, thanks for pointing it out 😁

Glad to hear you approve of plans for Eddie and Bearbonds. The next 2 years will be focused on saving and building for the next bull market.

Thanks for sharing this information with us. We will continue to hold our SPI’s and EDS.

Great news, Both are excellent tokens. SPI will grow in value over time and EDS will provide you with a nice HIVE income :)

SPI looks like a useful token. It also has HBD and Hive. I should buy and stack up !

Posted using LeoFinance Mobile

It's a fund token. 100% owned by it's token hodlers. You own 1% of tokens and you own 15 of everything listed above in held assets.

Thank for your kind words and feedback

That seems like a solid plan for the bear market. Although I am not really sure if 18-24 months is how long it will take. I am also keeping some firepower in my HBD savings incase Hive dips further but I don't mind using liquid HBD to increase my HIVE slowly.

Posted Using LeoFinance Beta

IMO the bullrun starts around the same time BTC halves rewards and ALTS are always a few months late to the party.

Deffo holding some HBD now for converting into HIVE will pay good yields for you.

Y SPI is trading at below actual token price on hive engine?

!PIZZA

Posted using LeoFinance Mobile

That's the million-dollar question. I have no idea but it's pretty much always been like that. The funny thing is SPI is one the only tokens to offer a direct buyback for 95% of actual value. lol.

People are literally selling at 50% loss got my order filled. Even if i use buyback at 95% value i am already 2x in few days.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

dealhunter tipped spinvest (x1)

@forsakensushi(10/10) tipped @spinvest (x1)

Please vote for pizza.witness!

Great update. I'm already frothing at the mouth at the prospect of shopping at more discounts.

Ah, HIVE at under 15 cents, BTC for under $15k, ETH under $700, DOCE under a penny, ahhhh it's gonna be so good and not next bullrun, we're gonna cross over a million dollars. We peaked at $470k this bullrun from $14k funding 30 months before. We're gonna kill this next marketcycle and profit from both ends of it.

Thanks for checking the post and dropping some feedback.

oh yes! :)

I picked up the cheap ones on the market. I don't care about dollar price, let's just focus on solid management, like you have been doing, for me its all about the price in HIVE, not just today but throughout the HIVE price cycle.

Keep up the great work!

Posted this on the wrong account. But my comments still stand!

I want to acquire more HBD, but I dont see any passive sources, Im looking forward to your passive hbd token big time!

!PIZZA

!LUV

!LOLZ

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-0.00000001 BTC (SWWAP.BTC)

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

Cause they're always Kraken

Credit: reddit

@spinvest, I sent you an $LOLZ on behalf of @forsakensushi

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(9/10)