Hello SPIers, We recently did a buyback for 2500 SPI tokens and now we need to decide what to do with them. In this post, we'll explore the 3 options we have.

The SPI token buyback

For those who are not aware, SPinvest will buy back any amount of SPI tokens at 95% of their book value. This is a rare thing within HIVE where the actual project will provide exit liquidity but SPI is built differently. We're a fund backed up by actual assets so our marketcap is not equal to what the last token traded for multiplied by circulating supply. I want to see investors lock in profits and thats why we've offered a buyback deal from almost day 1. We just redistribute the tokens for someone else to make money 😎. Simples.

The Recent Buyback

A few days ago, an OG SPI holder decided it was time to liquidate and take some profits so they sold back just over 2500 SPI tokens. This investor had bought around half from the market during SPI's first year and the other half were received as dividends and team rewards. Based on the avg SPI selling price of $0.17, this investor put in $220 to buy 1300 SPIs and then time to earn/receive the rest. We paid out 4500 HBD for these tokens so the investor locked in an over $4200 profit from his $220 investment. We cant begrudge a smart investor for locking in a 19x dollar profit. Even if we only count the 1300 he bought, they would be worth 2300 HBD and he'd still be 10x up.

What are the options?

When the fund buys back tokens, it holds them as an asset. This results in the SPI price token dropping by a fraction because we pay out money from the fund while still having the same circulating supply. Less money in the fund & same supply = Lower token price. It's not noticeable to investors because the token price naturally swings up or down 1-6% a week.

It's not easy to get alot of SPI at 1 time or even over a long time. I think it would take months to but 2500 SPI from the market at the book value price. For this reason, we need to think about how the best use them. We have 4 options.

1/ 🔥Burn them🔥

This is the first thing that comes to mind for many. Burning them would recorrect the SPI price and reduce the circulating supply. This option is ok but I'd prefer the tokens to be circulating.

2/ 🪂Airdrop them🪂

Pretty simple, we airdrop these to SPI token holders. Would work out very ballpark to people would receive 1 SPI for every 50 SPI held. This option is ok as well.

3/ 💲Sell them💲

Ideally, we could sell these off in under a week on hive-engine but thats never going to happen. Last year, I put 1200 up for sale and they sat for 2 months selling only a few hundred. People don't want to buy SPI because they think it is too late. Most think a project can only pump in the first few years which is ridiculous. Would I like to sell them? Yes. Do I want to have to write posts shilling them for months, No.

4/ 🤔Use them🤔

There's always going to be a whacky idea but check this out. Recently we have been exploring the idea of creating an SPI2 token, something that is pegged to SPI that could be sold allowing new investors in while raising more funding to invest.

Just as an example, if we were to create a SPI2 token that was valued at 1/10th of 1 SPI, we could use the 2500 SPI we bought to back 25,000 new SPI2 tokens. This would be transferring (tap, tap tap on the keyboard) the assets backing 2500 SPI into 25,000 SPI2. After the transfer of assets, the 2500 SPI are burned because they have nothing backing them.

What do we do with 25,000 new SPI2 tokens? We airdrop them to SPI token holders at a ratio of 1 SPI2 for every 4 SPI held. Why? Marketing mostly, we airdrop to all the investors that have already been with us and seen the results first-hand.

That's the options

Right now, I plan to sit on them for a few weeks and then decide what to do. Please share your feedback below, it will be very helpful. I think I will end up putting them on the market and see how many sell. We might get lucky and catch a whale out shopping, haha

Getting Rich Slowly from June 2019

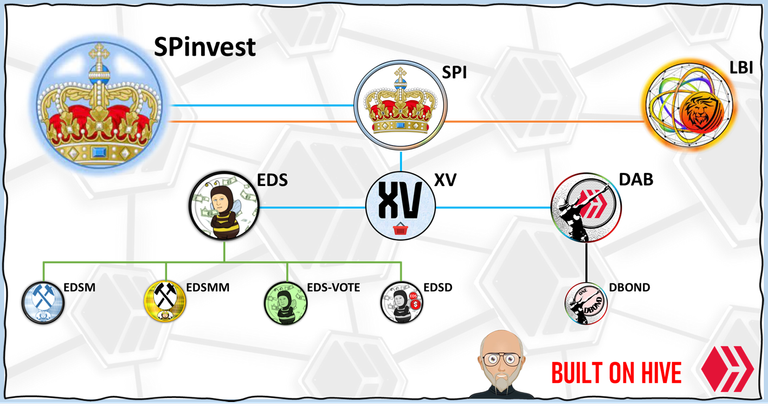

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

i say u sell them to me 👍👍

$4500 and we got a deal :)

I'm for 1 or 2 since 3 likely wouldn't sell them all (but toss them on to see) and I'm not a fan of 4. The other token would need a PR backing to give it legs and reason for trading.

The other token would be SPI just in a lower denomination. I get that some people dont like the idea all the same. Between 1 or 2, I'd prefer 2 to keep them in circulation.

Thank you for your feedback 😎

Offer them to a whale at a discount, they will give big upvotes to SPI posts to help their investment. 😁🤣

If it were only that easy. On any other chain, a project that done over 10x profit in 4-5 years, we'd get $500k easily. I've thought about creating a wrap SPI on another chain (BSC) just to raise more funds, lol. Too much work and not enough knowledge, haha

For some reason both pops and I are digging the idea of the SPI2. It would both reward the OGs and long term investors that have been supporting since the early days and also allow new investors to get involved if an SPI2 is launched and it's decided to sell some SPI2 on the open market as a perk for launching. I also like option 2, but 4 just sounds the best. No matter what you decide to do, we will most certainly be in support

Personally, I like 4 the best as well. The main thing putting me off SPI2 is that we could do the work to set it up and then only sell 20k HIVE on the open market which is nothing into a 550k HIVE fund.

As said, i will leave them and see how im thinking in a few weeks. I'll update whatever i decide. Thank you as always to you and your father for the continued support 😎

I was a fan of SPI2 so I like option #4. I think a lower denomination SPI might attract new blood that cant get into the present SPI or think it is too late.

Isnt the fund breaking a whole lot of securities laws selling units to investors with the expectation of profit? Is there a legal structure to the fund or any mechanism so it is trustless or has a multi sig wallet so someone couldn't just take the assets? I deff would be worried about structuring it correctly if you have not yet since the govts are cracking down on these types of things if they are not registered and if they do the fines would prob kill the fund.

If any us partners it would need to technically file a us tax reutrn as a partnership as well and if ever caught the penalties are terrible liike a few hundred a month per investor in the fund for 12 months.

They prob would be securities if any mgmt fee is charged. You may be able to get away with it being a investment club but still would need to account for us investors technically and if they do figure it out deff not good for penalties with US and foreign accounts there like 10K min per failed filing of certain assets transfers and holdings.