We all know that the housing market is in a bubble but when you talk to the average person they are blind to the current economic situation. Even mainstream news about the housing market bubble potentially bursting goes unnoticed. For fun I thought I would look up the number of homes for sale and homes that have been foreclosed on or are in the process of foreclosure in major markets around the US. I thought I would start my own personal stomping grounds first the Midwest.

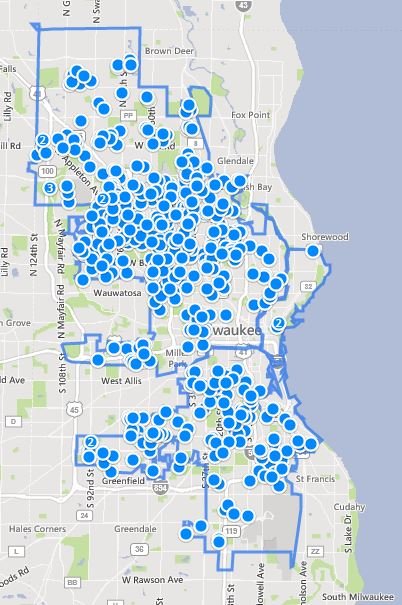

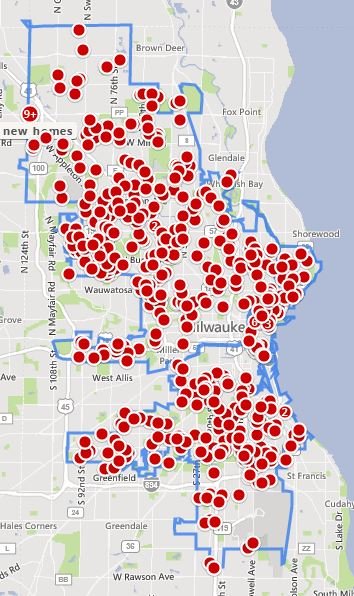

Milwaukee, WI - 3,532 houses available

Homes available that have been foreclosed 1,799 - What happens when banks decided they need to start dumping these homes?

Houses for Sale 1,733

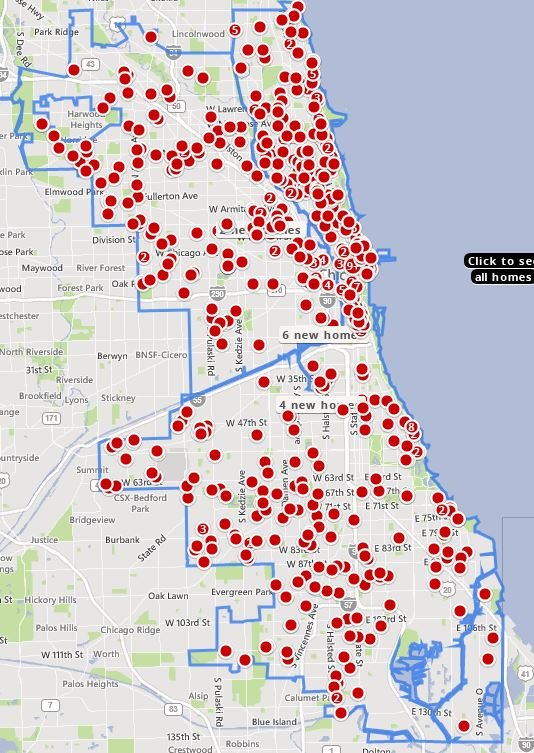

Chicago IL - Total Homes Available 15,975

Houses Foreclosed - 5,319

Houses for Sale - 10,656

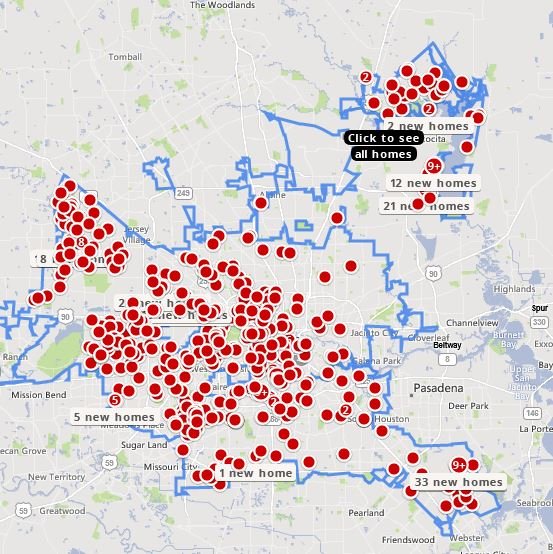

Houston TX - Homes available 11,283

Houses Foreclosed - 1,428

Houses for Sale - 9,855

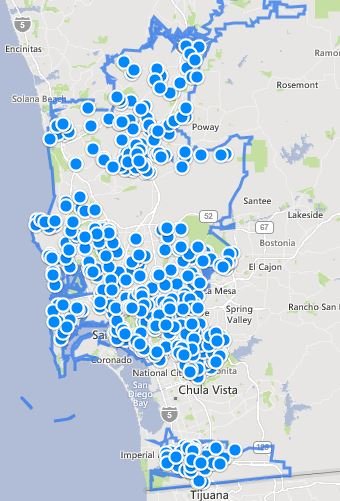

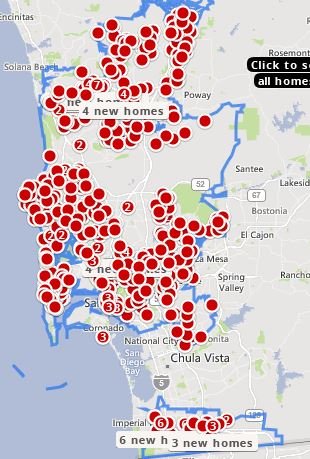

Lets move to the West Coast and look at what I perceive to be a more affluent city in San Diego

San Diego, CA - Homes available 2,875

Houses Foreclosed - 960

Houses for Sale - 1,915

Lets go try the East Coast now and see what happens.

New York City, NY - Houses Available 37,072

Houses foreclosed - 16,335

Houses for Sale - 20,737

It does not matter if you look at the Midwest, the South, East Coast or the West Coast, every major metropolitan area has a glut of homes for sale. Yet we are told the housing prices are going up due to lack of inventory??? What happens when the banks that own all the foreclosed houses decide to dump them on the market for pennies on the dollar because they need cash? When the Banks start liquidating some assets for cash we could see major shake-ups in the housing industry.