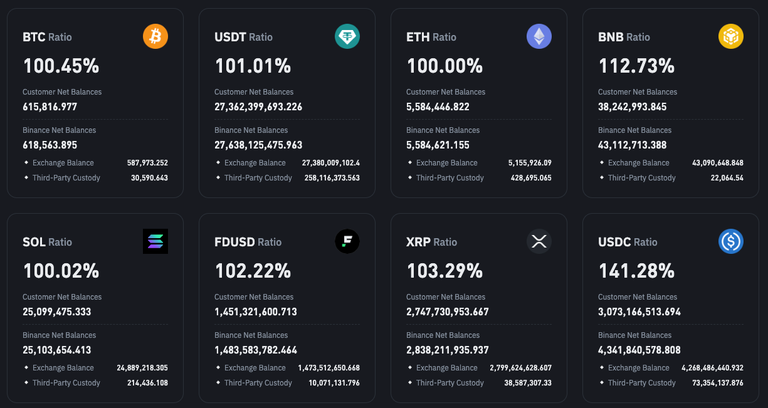

Proof of Reserve, Binance as of Feb 12 2025

Proof of Reserve, Binance as of Feb 12 2025

Is Binance Utilizing Customers' Funds for Their Own Benefit or Manipulating the Market?

Most experienced middle-to-high-level crypto traders and investors have likely asked themselves this question several times. Many may consider it a highly possible scenario, but there is often no concrete evidence or willingness to investigate the matter deeply. Others might believe it could happen because there are powerful entities in the world that seem to have the ability to bend principles for their own benefit.

As cryptocurrency continues to mature—despite ongoing issues and instances of manipulation—many users are beginning to examine these concerns more seriously, looking for detailed evidence and analysis.

During the last crypto market crash, which caused several billion dollars in liquidations, Binance transferred significant amounts of ETH and SOL to the market maker Wintermute. A quick calculation based on Binance's Proof of Reserve data shows that Binance now holds a very small amount of Solana and Ethereum. At the time of the crash, Binance appeared to have low reserves of these coins but still sent more coins than it seemingly possessed to Wintermute.

This raises an important question: "Did Binance, or has Binance, been utilizing customer funds for their own benefit while manipulating the market?"

Recently, the founder of Binance, CZ, has become more active on social media, frequently sharing his comments on various platforms. Meanwhile, a critical deadline is approaching: Binance must pay an enormous fine of $4.3 billion to the U.S. Department of Justice (DOJ) by March 2025.

Which path will Binance take? Will it be able to sustain its operations over the long term as it has so far?