Content adapted from this Zerohedge.com article : Source

Reversing an almost century -old policy, Hungary is bringing home the gold.

The Hungarian Central Bank is repatriating the gold from London. This is following a trend that started in 2010 where a number of central banks decided that storing the gold outside one's borders was riskier than housing it at home.

Hungary is adding itself to the list which might add to the confidence people have in this European country.

The leadership of the Hungarian National Bank (MNB) has decided to bring back home Hungary's gold reserves.

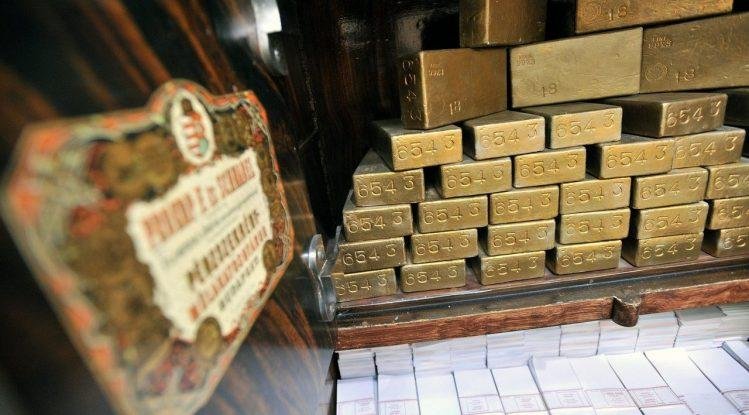

Up to now, 100,000 ounces (3 tons) of the precious metal were stored in London, which is in total worth some 33 billion forint ($130 million) at current gold prices.

The decision seems to be in line with international trends as storage of gold reserves out of the country is now considered risky by more and more central banks. Austrian, German, and Dutch central banks are among those who have recently decided to repatriate their gold reserves. According to MNB, this may also further strengthen market confidence towards Hungary.

MNB has been holding gold reserves since its foundation in 1924. Towards the end of World War II, it had been transported to Austria on the famous Gold Train, captured by the Americans, then repatriated in full in 1946.

The highest amount Hungary has ever had was around 65-70 tons at the beginning of the 70s. At the end of the 1980s, however, a decision was made to decrease gold reserves to the lowest possible level and rather to invest in sovereign debts, which as a consequence of the collapse of the Bretton Woods system are considered safer, more liquid and potentially of higher yields. At the beginning of 2010 this tendency changed again and central banks started to accumulate gold as a potential response to the financial crisis.

The Largest gold reserves in the world belong to the US and Germany, while in comparison to other Central-European countries Hungary has one of the tiniest amounts of the precious metal; for instance, Romania and Poland both have 103 tons, and Serbia has 13 tons. Since 1992, Hungary's activity has remained steady, as the MNB hasn't bought or sold any of its gold reserves.

Non-adapted content found at zerohedge.com: Source

It's very wise for Hungary to do this, just as it was wise for the Germans to ask for their gold back. In the event of another crisis, countries that don't have physical possession of their gold are at risk of having it confiscated by the host countries. The confiscating countries would cite national security as justification for the confiscation, and might provide compensation in the form of fiat currency, but that would only provide scant consolation. Countries need to have physical possession of their gold. The U.K. was really stupid to sell most of its gold at close to the bottom of the market some years ago.

I think that this is no brainer. Since the amount of gold is not that significant compared to other countries holdings. It all could change if other countries do the same and not only from London, but from US as well where I don’t belive they keep as much gold as they say. This would definitely make an impact of gold prices. When it comes to gold real amount being held in US that’s another question. We know that central banks actively suppress the price of gold. How central banks use gold lending to manipulate their balance sheets, and also to manipulate the market for precious metals. For example there is this gold swamp technique which bank of London and Federal reserve bank of NY are practicing for decades. Let’s say that $200 million in gold was made available to the Bank of England, which it would then sell in the market for sterling at the price that it wished to get. They put the sterling currency into an account in London on behalf of the Federal Reserve Bank of New York. So what really happened was gold disappeared from New York and ended up as cash in the UK sect in London. But, for accounting purposes, the Federal Reserve Bank of New York showed a gold receivable where gold used to be. In other words this gold is still in NY bank, but it’s in London’s bank as well.

This is a good move from Hungary.. the country needs it's gold reserves stored where it can see it for closer inspection. Though the gold reserves would be safe for the government in exile to carry on with if Hungary got attacked.. one could never be sure of how safe the gold was in London. The Gold could be sold off or loaned out at a time Hungary needed it. I feel it's much safer in the hands of the government of Hungary.

Having the gold in a respective country would make it easy to quickly and easily be exchanged on location for currency to be used to pay urgent bills.

I think Hungary made the wrong decision to reduce their gold to the lowest possible amount to invest into something else. Gold is very secure investment in times of crisis.

I believe we will see this happen more and more often as countries realize how vital is to store gold within their borders.

In times never before so uncertain with big voices talking about going back to the gold standard, smart countries and smart individuals should, in my view, accrue as many bullion and coins they can afford.

Adding to your post, not many know that the 3rd country with the greatest gold reserve is Italy with 2451 tons. Unfortunately part of it is stored in the US.

Speaking of which I remember reading that the majority of America's reserves have been sold, but it could be untrue.

Peter Schiff will be very happy. People collecting their gold to strenghten credibility. Would you consider this a bullish sign for the precious metal ?

How much would you like to bet that Hungarians actual physical gold is also several other nations physical gold. They like to sell gold many many times when it’s stay in the vaults & never leaves

Nice thought 🙂

Wow...amazing posts, lots of gold 👍👍👍

Wouldn't it have been wiser and safer to bring the gold in silent and make the announcement after it is safely home? Maybe I have been watching too much movies but it wouldn't be funny if part of the gold never gets to it's destination.

very strong security, Biggest deal transfer to central bank.I am glad to know about the knowledge of sport and how the processed done.Thank you

Germany londom no problem for gold haven

Wouldn't it have been wiser and safer to bring the gold in silent and make the announcement after it is safely home? Maybe I have been watching too much movies but it wouldn't be funny if part of the gold never gets to it's destination.

Something big is happening from behind the scenes. There is strong evidence that we are going back to gold standard and abolish fiat currency.