Venture capital

Venture capital is a type of private equity,a form of financing that is provided by firms or funds to small,early-stage,emerging firms that are deemed to have high growth potential or which have demonstrated high growth.Venture capital firms or funds invest in these early stage companies in exchange for equity or an ownership stake, in the companies they invest in.Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. The start-ups are usually based on an innovative technology or business model and they are usually from the high technology industries,such as information technology,clean technology or biotechnology.

Invest with EQUI

EQUI is unification of a new cryptocurrency with an innovative investment platform,built on Ethereum Blockchain technology,EQUI disrupts the traditional venture investment market and empowers the crypto community to join the next generation of venture capital investors.Utilising EQUItokens,investors will be able to buy stakes in emerging, entrepreneurial companies and benefit from great investment returns and rewards.

EQUI will source the best investment opportunities in real world assets,next generation technology companies and ventures with the capability of revolutionising markets.EQUI will champion innovators and support them by providing extensive business knowledge,guidance and insight to enable their venture to flourish.

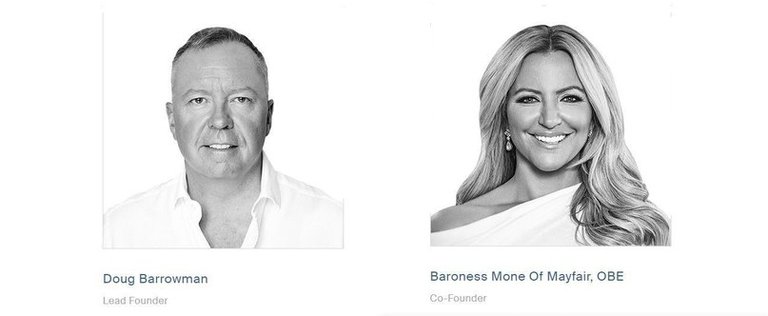

An Experienced Team In Venture Capital

Doug Barrowman, the Lead Founder, has over 30 years of experience in investing in startups. Doug serves as the Chariman for Aston Ventures, an experienced London based venture capital fund, and draws upon extensive connections within the venture capital industry.

Baroness Michelle Mone has experience in not just investing in start-ups, but actually creating her own businesses that have gone on to do exceptionally well. So much so that she was made a Baroness by Her Majesty the Queen of England. She is widely recognized in England as an award-winning Entrepreneur, but has also won awards in the US. She created a lingerie empire that is now famous worldwide, winning the title of World Young Business Achiever at the Epcot Centre in Florida.

All other key team members have extensive experience in entrepreneurial-ism and start-up funding.

Token Utility

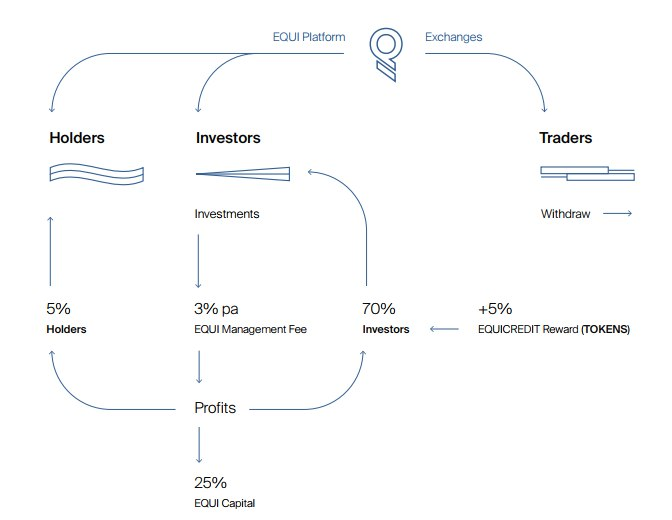

Holders of EQUI tokens will have direct exposure to the profits of the company. On the EQUI platform, investors can choose the ventures they wish to be a part of, and thereby gain a very generous 70% of generated profits. The thing I like about the proposed platform is that investors can themselves choose which startup companies they want to expose themselves to. Rather than relying on a basket-index of all accumulated investments like traditional hedge funds, on the EQUI platform token holders choose where to allocate their exposure.

In my opinion, 70% is a very generous profit share, with most dividend-paying projects on the blockchain usually returning only 20%-50% of profits, and not allowing the flexibility to choose investment exposure as will be possible on the EQUI platform.

There is also a fantastic system whereby people can invest in the future of the EQUI platform itself without undertaking any investment risks. By simply holding tokens on the EQUI platform without allocating them to specific investments, investors will receive a 5% increase in their EQUI credits based upon the number of EQUI tokens they hold. This is similar to how a “proof of stake” dividend paying coin might work, except no staking is required, and it allows those who believe the value of EQUI itself will go up to gain additional tokens whilst they hold the tokens for long term investment.

Details of the ICO

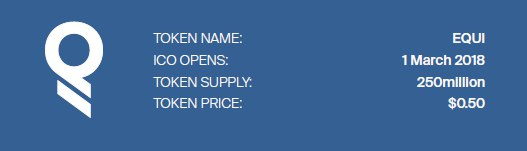

There will be a total supply of 250 million EQUI tokens, priced at $0.50 USD each during the ICO. Investors with large capital ($100k minimum) can join the pre-sale which will run from 1–8 March 2018 and receive a 25% bonus on their issued tokens. The main public ICO doesn’t have such minimum investment restrictions (only $100), and will run from 8–31 March 2018. The public ICO will have an initial bonus of 15% for early-birds which will last for one week, so make sure to register early.

The thing I like most about this ICO is that a large proportion of the tokens are issued to investors — 65% to be exact. The tokens that are allocated to the team also have time-vesting restrictions. The thing I feel most confident about though is that this team has experience with other venture capital companies, so the likelihood they will abandon the project just to dump their tokens is incredibly low.

More Information:

Website : https://www.equi.capital/

ANN Thread : https://bitcointalk.org/index.php?topic=2888110.new#new

WP : https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

Twitter : https://www.twitter.com/equi_capital

Facebook : https://www.facebook.com/equi.capital

Telegram : https://t.me/equicapital

My BCT link: https://bitcointalk.org/index.php?action=profile;u=1416848

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@georgecunningham_85507/equi-bringing-traditional-venture-capital-to-the-blockchain-d54509855b21