ICOs and Venture Capital: How are they related?

Today, a startup has two choices for fund raising; ICOs and Venture Capital. ICOs are a new way to raise capital for companies; they issue a token which is sold in an ‘initial coin offering’. Venture Capital is also very similar, VC funds offer start-ups or small companies capital for cashing out on long term growth. It looks inconspicuously similar; investors give money in the short term to make profits over the long term on a company. However, the differences are huge. Firstly, companies which offer ICOs do have some project in which the token is used by the users. When the user base grows, the limited supply of the coins pushes the value of the token higher.

After a point, the user base growth and token value growth become proportional. Thus, it’s profitable for investors to purchase the token beforehand. Then, they can sell it for profit when the price increases over time. Venture Capital also works in a similar way; investors expect a percentage or share of the company. Investors then sell these shares on the market for a higher price. The difference is that a token isn’t a share. Although it does look strikingly similar to shares, it’s not the same. That’s why ICOs do not have to go through the SEC of a particular jurisdiction for launching an ICO.

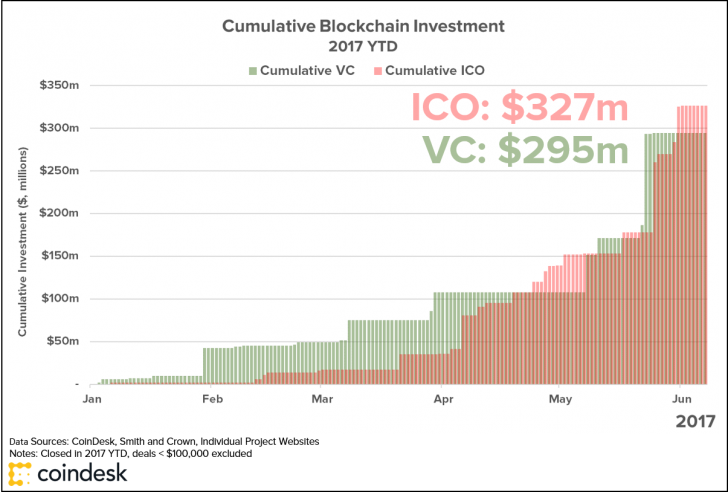

ICOs and Venture Capital: The Numbers

In August 2016, Angel and Seed VC Funding was at $280mln and ICO funding hadn’t started until then. In less than a year, in June 2017, ICO funding was at $550mln whilst VC funding hadn’t grown and was still under $300mln. That’s how fast the ICO wave started and has created a buzz in the startup world.

This gives people the opportunity to scam investors on the internet by launching a fake ICO. Since it’s not regulated, the token could devalue and the “founder” will have pretty much gotten away with millions. That happens with most small ICOs, th eir token quickly devalues due to the uncertainty of the project. However, if one was to develop a great white paper with the in depth explanation of how the token is integrated and will increase in value over time, it will bring a lot of investors. Now that the US has started regulating ICOs and the China ICO Ban is in place, we will definitely see a lower number of scam ICOs happening right now.

eir token quickly devalues due to the uncertainty of the project. However, if one was to develop a great white paper with the in depth explanation of how the token is integrated and will increase in value over time, it will bring a lot of investors. Now that the US has started regulating ICOs and the China ICO Ban is in place, we will definitely see a lower number of scam ICOs happening right now.

ICOs and Venture Capital: Is ICO the New Venture Capital?

Just in the past week, Paris Hilton and Floyd Mayweather promoted ICOs on their social media. During the growth of ICOs, we saw Dennis Rodman promoting a Cannabiscoin. However, how much of it is still legal or profitable? Not much and now celebrities who promote ICOs are giving power to fake ICOs. Another issue with ICOs is that they need high security. Quite recently, there was over $7mn stolen from an ICO which had shabby security.

This goes to show how secure an ICO needs to be for it to resist any attempt to break in. Even though ICOs are a great way to raise capital, they still have many different unknowns which need figuring out. We can definitely expect companies to organise many different ICOs but they might be riddled with doubt and security concerns. Therefore, ICOs aren’t really the new venture capital but they have the potential to take over the industry in the future.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://wikicrypto.com/icos-new-venture-capital/

Congratulations @bigjem! You received a personal award!

Click here to view your Board of Honor

Congratulations @bigjem! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!