Distributed Credit Chain – decentralized financial system aimed at solving problems, first of all, in the credit sector of the economy, as well as in the financial sphere as a whole.

In short, the essence of the system is that everyone can create a profile, apply for a loan, and get the required amount of money under much more advantageous interest than in traditional financial institutions , banks, credit brokers, in other companies, without being dependent on their centralized solutions.

A quick overview of the platform I did earlier, check it out by the link to be aware.

I strongly advise you to familiarize yourself with white paper of the project, and now we will discuss in more detail the main aspects of this company to understand how much it is promising to invest its investment funds.

Project Management and Team

Head

Stewie Zhu – SEO-specialist of the company. He is a well-known businessman from China, a specialist in financial and technical startups, educated in leading universities in the world, including Oxford University and Yale University. He is engaged in educational activity, is a candidate of sciences in the sphere of finances. As for the management experience, he held the position of General Director in the company so-called Tech, as well as the company Taicredit, which is operating in the field of lending.

Team

Stone Shi – leading programmer in the company. In addition to competence in the field of programming is an advanced expert in financial research, risk assessment, and other areas.

Daniel Lu – the main innovation in the company. He has a great experience in the activity of commercial banks as well as asset management. Expert in mathematics and finance. He was educated at the University of Leipzig as well as at Yale University.

As a result, the management team has, first, a huge amount of knowledge in the financial sphere, and secondly, considerable experience in banking, credit activities, which in the context of consideration of the project is a definite plus.

Market size

Volume of the market

The volume of the world market of consumer crediting is complicated for exact calculation, but its sizes reach trillions dollars and grows year by year.

Product

Product Development Stage

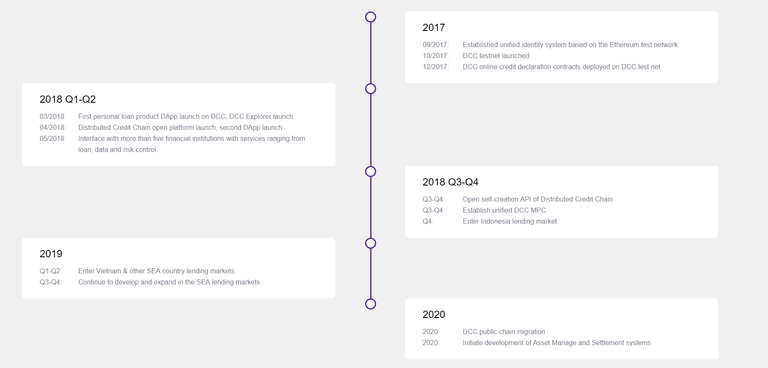

Actively developed, the launch of the working product will be carried out at the end of 2018. The company has big plans for 2019 and 2020, when the first intervention will be on the Asian market, and then on the world.

Product attractiveness for customers

As far as I can tell, the solution offered by the system is extremely popular both for the consumers of loans and for the outstanding parties. Simple clients will attract primarily a low interest rate, as for credit institutions, the big advantage for them will be the availability of a common database of borrowers, enhanced opportunities for rapid analysis of each client, which Will significantly save time for their decision to issue a loan.

Ability to copy a product

At the moment it is difficult to clearly judge this factor, however, the rather high complexity and duration of development point to the fact that copying the solution Distributed Credit Chain does not make sense for third-party developers.

Competition

Competitive environment

The project falls into a sphere with very strong competition, which is to be sustained both by BLOCHEJN projects and by traditional banks. Among the projects blockchain the main competitors of the network are: SALT, Nexo, Libra Credit, ETHLend.

Here we can note the significant fragmentation of the market, where there is no definite leader, and there is a group of projects that are in the initial stage of their existence and struggling for their market share.

Nevertheless, the platform is to be faced with long-running banks, microcredit organizations, credit brokers, which have a long-formed customer base, worked out schemes and standards of work, so if we consider The situation as a whole, competition to the project will be serious.

Quality of competitors products

It is early to judge about the quality of products in the blockchain sphere, as most of them are at the initial stage of development. Among offline credit providers the situation is ambiguous, in general banks are often accepted by consumers not on the best side, however there are a number of organizations in each country with acceptable quality of services for consumers.

Other factors

Tokenomics

Hard-cap project will make 40.0 million $, the price per 1 DCC token will be $0.0388.

To estimate prospects of future growth of capitalization of the project it will be logical to compare it with the competitors, namely with their capitalization, maximal and current:

SALT: current capitalization: 89.94 million $, maximum – 959.5 million $;

Nexo: current capitalization: 47.94 million $, maximum – 238.5 million $;

ETHLend: current capitalization: 34.7 million $, maximum – 442.47 million $;

In general it can be noted that the credit sphere is just beginning to reveal its potential in terms of capitalization of companies.

It is obvious that loans through blockchain will be overly popular in the near future, so the initial stage of development of this sector of economy gives investors a chance to earn quite serious profit if they have time to enter this sphere at the moment.

Road Map

Total

Distributed Credit Chain is a project that, in my opinion, has a huge growth potential in the next 2-3 years. The main catalysts will be, first, the growth of the lending sphere by means of blockchain, secondly, the simple, understandable for most technology of the system itself, which does not require a long study, and, finally, a strong, competent team, Having extensive experience in financial and blockchain spheres.

See the project for more details on links:

Coins mentioned in post: