PRELIMINARY

CURRENT PROBLEM

The market is cruel and has no emotion. Well, this may be true for the market but not for consumers, because all that consumers do involves a little emotion. Being an emotional entity in the market has its own advantages and disadvantages. What we need is always clear to us from the beginning, and we achieve it in any possible way. Bias, beliefs, and intentions determine the nature of the work we will do in our lives. Banks and financial institutions of the world have explained that they do not care about consumers, but only their growth.

Reaching out to everyone and offering services that other people get is not their priority. Developing countries are at the bottom of the food chain, where they have no access to the time and resources of developing countries. The time has come for redistribution of attention to the people who need it most, and not the people who have the most.

Government's oblique policy must be changed, alternative financial ecosystems must be created, and a new order of financial freedom must be achieved. What do you think? Do you think it's possible to create solutions for millions of people who still do not have bank accounts?

SOLUTION OFFER

L-Pesa Microfinance is a fintech startup that is ready to take advantage of the burgeoning financial services needs of the developing world. L-Pesa has a strong focus on automation. 95% user acquisition process and automatic loan underwriting and therefore highly scalable. The company has spent two years developing a system that deals with customers and back

office using a team of seven software developers. The user experience is based on the mobile and web interface, and marketing is mainly done through social media and SMS.

The L-Pesa technology stack builds on Amazon Web Services, a highly scalable on-demand cloud computing platform that has been or used by major brands like Netflix, Airbnb, Pinterest, and Spotify. L-Pesa has integrated a number of third-party applications to perform tasks such as SMS messaging, user verification, and marketing. Fund transfers are handled through integration with mobile money service providers such as M-Pesa, Airtel Money, Tigo Pesa, and MTN.

Network Effects:

L-Pesa is not a charity. L-Pesa purely business. Being a business gives us certain freedoms not owned by a charity. As a business, we must provide returns. In facilitating microfinance, we must be very efficient; costs for

making a $ 1000 loan equal to $ 100, and because operating costs, banks and financial institutions are limited to how low they can go. Blockchain brings transparency and efficiency, and drastically reduces operational costs, making small loans work. Tokens are transitionally more efficient than fiat, so tokens are more attractive to

target markets of L-Pesa, and they also help in building communities and creating network effects.

We have done it with fiat as an existing operation; blockchain will allow us to expand our reach and lower our costs. The cost of bank financing does not allow us to reach the people who need it most. Expanding operations by extending reach will enable us to make the facilities available to people who can not be served by banks or microcredit providers because they are considered "unprofitable"

L-Pesa was founded with a vision to improve people's lives through efficient access to credit and related financial services. Ron Ezra Tuval, founder of L-Pesa, has spent most of his career working in developing countries and admits about a decade ago that the most effective way to improve people's lives is through access to credit and related financial services. Since establishing L-Pesa, Ron has focused on achieving this vision. It's about making the world a better place for everyone. L-Pesa began offering microfinance services in Tanzania in 2016 and has expanded its service offerings and geographic footprint with increasing speed in pursuing this vision.

The L-Pesa Initiative

The idea for L-Pesa was incubated for a decade, and business

launched at a time when four important market forces gather to allow

fast scaling.

L-Pesa has built a credit ownership underwriting system which is one of the keys to its success. Consumer credit reporting as available in Western Europe and North America is absent in Africa, India, or other developing regions. A number of models have been tried for years, some with more success than others. The L-Pesa model is based partly on the trust ladder: the user starts with a very small loan (usually $ 1.00) and is allowed a larger loan after a smaller loan has been paid on schedule. Successful payments contribute to the credit score. Credit scores are also influenced by other factors, such as completion of identity verification. Furthermore, L-Pesa relies on other service providers to filter users; in the market today,

About Milestones Financial Rating Team White Book STOCK

About L-pesa

L-Pesa Microfinance is a fintech startup that is ready to take advantage of the burgeoning financial services needs of the developing world. The company has validated its operation model over the past 18 months and has built advanced technology, automating most of the operations. The main obstacle to growth at this point is its ability to fund user acquisitions and loans.

Ratio of losses on loans goes below 10% while repayment of loans

about 25%.

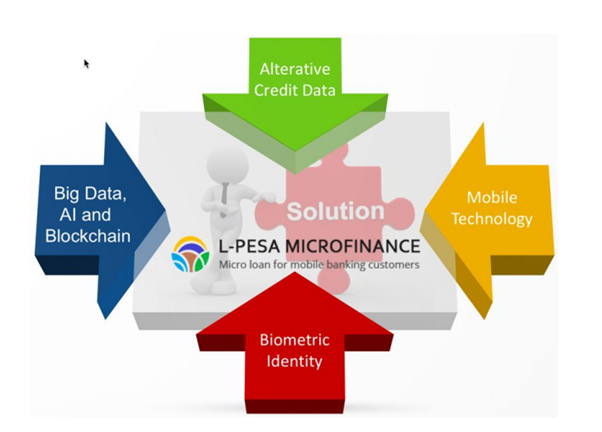

The idea for L-Pesa was incubated for a decade, and business was launched at a time when four important market forces converged to allow scaling:

Big Data, Artificial Intelligence & Blockchain

Alternative Credit Data

Mobile Technology

Biometric Identity

L-Pesa has harnessed the power of this built-in market and technology and an exclusive lending model that enables it to rapidly scale microlending in developing countries while maintaining a loss ratio below 10%. The solution is highly automated, allowing small back office teams to support high-volume loan origi- cations. All loans are serviced by L-Pesa.

Ron Ezra Tuval, founder and managing director of L-Pesa, has extensive experience in developing countries, particularly related to agricultural projects and technology-related tourism. Ron first found microfinance in Southeast Asia and spent a decade incubating the idea of L-Pesa while waiting for the technology needed to mature. Ron has built a strong and diverse team for L-Pesa with managers in countries operating in Tanzania, Kenya and Uganda, and development teams in India. There are also back office teams in Tanzania, Kenya and Uganda who handle background checks, credit approvals, and customer service. Technology, marketing, and accounting teams operate on a virtual model and consist of experienced staff based in Europe, the US, and India.

L-Pesa has a strong focus on automation. 95% user acquisition process and automatic loan underwriting and therefore highly scalable. The company has spent two years developing a system that deals with customers and back office using a team of seven software developers. User experience 832754982.1 4

based on mobile and web interfaces, and marketing is mainly handled through social media and SMS-based marketing.

The L-Pesa technology stack builds on Amazon Web Services, a highly scalable on-demand cloud computing platform that has been or used by major brands like Netflix, Airbnb, Pinterest, and Spotify.

L-Pesa has integrated a number of third-party applications to perform tasks such as SMS messaging, user verification, and marketing. Fund transfers are handled through integration with mobile money service providers such as M-Pesa, Tigo Pesa, and MTN.

L-Pesa has issued over 35,000 loans since it aired in March 2016. More than 160,000 users have signed up based on social marketing campaigns that run on a minimum budget. Marketing strategies have been refined over the last 18 months, and L-Pesa is now set up to launch marketing campaigns via SMS and social media at a projected cost of conservative customers

$ 1.00.

Founder of L-Pesa, has invested about $ 500,000 to date. The business was launched in Tanzania in 2016 and in Kenya in August 2017.

Gentle launches are underway in Uganda and India. Company technology is stable, scalable, proven, and will support the company's growth plan. At this point, L-Pesa has reached a growth barrier - there is not enough available capital to lend to all interested people, and the potential for user acquisition is virtually unlimited, but requires capital for marketing costs and support staff. The company is now raising funds to take advantage of

leading position, a strong platform, and an almost limitless opportunity to expand financial options to a large portion of the earth's inhabitants.

For more information visit;

Website: https://kriptonofafrica.com/

Telegram: https://t.me/LpesaICO

Twitter: https://twitter.com/lpesaico

Facebook: https://www.facebook.com/lpesaico

Author: Wawan Grab