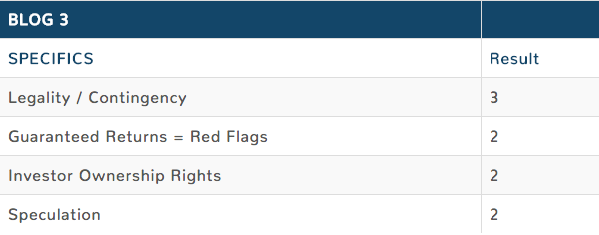

In parts one and two of this three-part blog series, we discussed 11 sources and what they considered to be the essential and deep dive factors when evaluating ICOs. For the third part below, we give consideration to the specifics.

These are the granular factors to consider, mentioned three or fewer times among the 11 sources. The factors we will analyze below are not less important; rather, keep them in mind as possible reasons why to participate in an ICO or not.

CATEGORY 3: DEEP DIVE

Legality / Contingency: 3/11 mentions

All projects following through with an ICO are subject to the laws in which the project exists; government institutions need not only to sign off on such a project, but regulations in any jurisdiction where the token will have ownership can make it illegal to use or trade that token. A new regulation can critically undermine the project and thus, as an ICO participant must determine if this is important to you. For ICOs looking to reach the USA in particular, knowing if the ICO is structured as a corporate or non-corporate entity and is SEC compliant are huge factors not to be overlooked when deciding if that ICO is a good idea.References used: 3, 4, 6

Guaranteed Returns = Red Flags: 2/11 mentions

As an additional tidbit to consider: be wary of any ICO offering guaranteed rates of return to investors. As scammers are pervasive in this new digital world, they understand the motivations of participating in an ICO by putting guaranteed returns in their marketing materials and white paper. Consider this as a red flag and look elsewhere. Projects solely driven by guaranteed rates of return are in the wrong business anyway!References used: 3-4

Investor Ownership Rights: 2/11 mentions

All need to understand from something very important the start: sometimes, the token represents ownership in the future profits of the network or ownership in another asset altogether. If this is the case, the ICO actually will look and feel like a traditional equity raise instead of an ICO. As a potential Token Sale participant, you must determine whether the token affords a sort of ownership, whether real or a proxy to a value in the future.References used: 2, 8

Speculation: 2/11 mentions

As a potential participant in a token sale, one must ask if the project is conducting an ICO for means other than speculation. This notion is tied into investor ownership rights above and the business model in part one. Hype and speculation must be put aside in determining if the value created by the project will be linked to its inherent value. Once it has been determined whether the token is entirely speculative and has no current real value, you must weigh if the idea is good enough to wait for future gains while present gains can be made today.References used: 3, 6

CONCLUSION

This time, we looked at the specific factors required to evaluate ICOs. As mentioned in the parts one and two, if you read any one of these sources, you’d be have a piece of the puzzle, but never enough to construct the entire puzzle and hang it up on the wall. Hence, by receiving a collective statement, we can obtain collective advice and make better financial decisions on tokenized assets. Get out the frame, because you’ll be hanging that puzzle on the wall in no time!By understanding the essentials, taking a deep dive, and taking out the microscope to look at the specifics, effectively evaluating ICOs becomes easier. We look forward to hearing your comments on this three-part series, and do not hesitate to contact us with your thoughts on anything Finnoq related.

DISCLAIMER

Although we believe there are 18 factors worth mentioning, it is not for us to decide on the protocol. This is just an example. Our proposed protocol seeks to decentralize power. Thus, it is you the global community who decides what is important knowledge, and not us. Additionally, results in an actualized protocol would be anonymous; thus, attributing answers to particular members of the community would never happen. What we found does not indicate that the source is somehow uninterested in other parts. The authors wrote articles focused on elements pertaining to ICO evaluations; if we were to ask the question on the actual protocol, their responses would probably be different. That being said, we would still collect the responses and be able to give better advice than any one single contributor (as no one contributor made mention of all 18 factors). Finally, rewards and incentives for answering questions will be discussed in greater detail in a later blog series, so stay tuned. The point of this exercise was to show that many minds are better than one.

SOURCES USED

https://blog.icofunding.com/how-icos-are-being-rated-and-how-to-evaluate-a-token-yourself-948cbef6a921

https://medium.com/@wmougayar/tokenomics-a-business-guide-to-token-usage-utility-and-value-b19242053416

https://medium.crypto20.com/ico-evaluation-deep-dive-13-questions-to-ask-77ee444c0b99

https://medium.com/@petehumiston/50-questions-to-ask-when-evaluating-an-initial-coin-offering-ico-82d130501ee0

https://thenextweb.com/contributors/2017/12/18/4-step-guide-evaluating-mad-world-icos/

https://www.coindesk.com/moon-bust-questions-ask-evaluating-icos/

https://www.coinannouncer.com/4-keys-evaluating-ico-investments/

https://medium.com/@ntmoney/discussing-cryptotoken-best-practices-5ff4b9184933

https://www.bitcoinmarketjournal.com/ico-due-diligence/

https://cryptopotato.com/10-keys-evaluating-initial-coin-offering-ico-investments/?fb_comment_id=1431590406935042_1468304953263587#f2a3f6fa9af888

https://hackernoon.com/evaluating-tokens-and-icos-e6c22c1885bb