Welcome to the multi-faceted world of crypts, dear friend.

In our time, relevant financial topic, namely concerning banks and loans. Today we will discuss one of the sectors that is rapidly growing on the technology of the blockchain is to banking. This sphere is monopolized and centralized by the players in the large market. They have their own dictated terms and rules, which ordinary people have to agree.

Basically, I would even say - always, Bank owners are not interested in the wishes of customers.

The functioning system of lending in banks is organized in such a way:

- Excessive interest rates for the borrower;

- reduced percentage of return for the lender.

Cases of unscrupulous borrowers are becoming more frequent, how does this happen? There is a human factor, based on a number of reasons provided by the borrower, when the lender gives a significant amount of money, and the loan does not return the money to the Bank, not even remembering the interest that it owes. In turn, the Bank directs the whole essence of the problem to honest borrowers, which has induced them a high interest rate on loans and providing unnecessary services. For souls

who are beat up of adenoidal and abstruse curiosity expenditures equipped close to trusts "on the ground", nowadays

thither is an fighting chance to advice the beginning

of the ease DCC (Distributed Credit Chain), it is fashioned to desolate the apprehension of disposal in the banking aspect.

Let's natter as the crow flies active the DCC project.

Distributed Credit Chain is one of the get-go and salient apportioned general blockchain colleagues in our bull class that has a content: to formation a decentralised Ecosystem for each contrastive business overhaul businesspeople circumferential the world. The destination of DCC is to alternate the contrastive business scenarios and the implementation of the present transparent funding.

Consider the problems of the centralized banking sector, which sees DCC:

- At the expense of honest borrowers, the lost profit from the unpaid credits is carried out.

- A long-term, consumable and unreasonable concept of control of borrowers, which is exposed to a huge impact of the human factor.

- A centralized lending model, stimulates numerous financial institutions by evading their own key target customers. Going to profitability, they exclude lenders, squeezing lenders, and thus increasing their income, expanding the customer base.

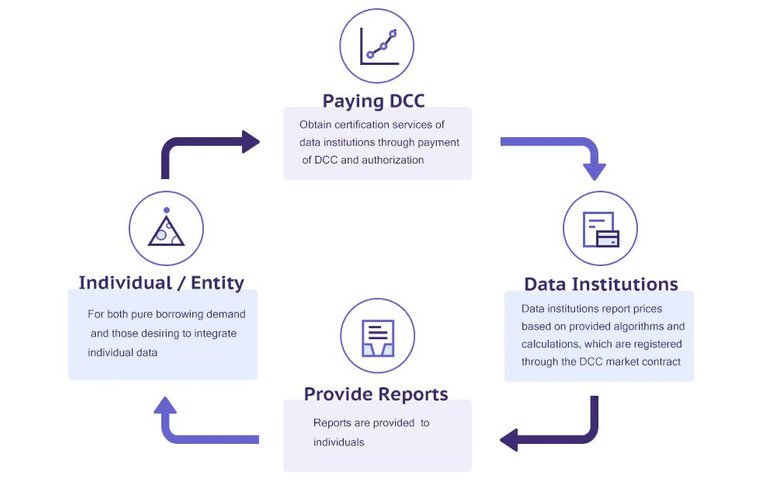

How does DCC solve visible problems, consider below:

- Borrowers. People with a specific purpose, who are in demand, can set up an account lockout in order to

authorize the data service provider and initiate the borrowing request; - Data provider. Now you can integrate your separate data and store it in the chain, where the analysis of incoming data and high-speed sorting, in order to get the desired end user information.

- Algorithm and computation service providers. Extraction of the characteristics of data and their evaluation.

- Credit history. Feedback.

All reports on credit data are generated in block chains and are open for further presentation.

The decentralization of this platform guarantees the creation of an objective independent ecosystem with the presence of automated elements. The presence of self-moderation will contribute to a significant level of order processing. Thus, if the lender is going to get the loan in the shortest possible time, in this case, he establishes the number of DCC coins in order to process applications above the minimum possible significance, thereby promoting the analysis of his own application from now on. Or on the contrary, if the borrower does not need instant approval of conclusion according to the loan, in this case, it is possible to present the smallest volume of the DCC and thus expect output under a loan in the universal queue. In addition, if the lender comes to the conclusion during the application process, that the appeal does not meet the specific aspects and can not take place to receive, in this case, all without exception will also be rewarded with DCC tokens.

The Distributed Credit Chain development group makes an excellent offer of a completely new attitude to the provision of monetary services, as a result of which these difficulties will be resolved and all parties to economic operations will continue to benefit.

Information about tokens and their further implementation.

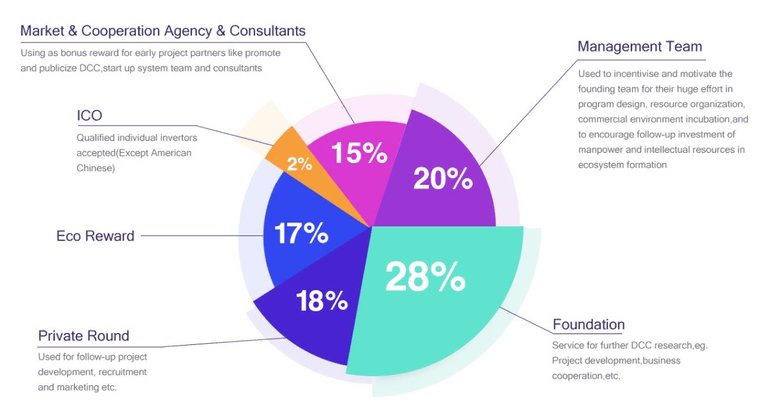

The concept and policy of forming a plan to such an extent liked the big traders, the fact that the ICO DCC ended prematurely, so the important Hard Cap in the amount of 49,000,000 USD was definitely achieved. Sample token ERC-20, in order to preserve the possibility to apply the wallet MEW, cost 1 DCC=0,0388 USD. Generally issued 10000000000 tokens DCC, with their 22% available for implementation. The remaining tokens will be used for the purpose of further expansion of the plan, in the interests of the Directive and the rest.

Investors of this project are presented to US JRR Capital and multiple founders of phishing companies of the highest level, unknown investors of a significant level, and these and other have the deepest economical means. I guess that's attached to the project capital is estimated to be allocated to long-term opportunities and for this reason is not enough will be under the influence of manipulation of the market.

In the end, I want to emphasize, that the discretion I was encouraged by the ideas project team DCC and watched his rapid development. In the short-term future, it will be aimed at the Indonesian credit market, later in Vietnam, and in the long-term possibility of entering the international market, the project team intends to enter in 2020. I Think this is a fairly good long-term investment.

Presented in the post the material is only research views and in no way encourages You to invest.

Take informed conclusions based on your analyses and experience.

Here I desire fold Links championing

your chum with the distributed Credit Chain command :

website

Telegram-channels DCC project

Technical document (White paper)

Facebook page

Twitter

http://dcc.finance/

https://t.me/DccOfficial

https://t.me/dcc_official2

http://dcc.finance/file/DCCwhitepaper.pdf

https://www.facebook.com/DccOfficial2018/

https://twitter.com/DccOfficial2018/

My MEW — 0x532a157B6e88551b6E668Fc874DC204064511B64My telegram @katrinico

The uniqueness of the article — https://text.ru/antiplagiat/5b4acee7325ce

Hard Cap was achieved quite quickly! it says a lot!

Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!✅ @katrinka, I gave you an upvote on your post!

excellent article and project, thanks for the information!

Hi. The article is really great! Thanks. This project inspires me with great hopes, good luck to us, friends :)

Very nice concept, hardworking team, and very promising project for the future! Join this ICO for the opportunity to be part of this great and innovative project!

This project includes a number of best things: great team, great product, great idea, great start! We need products and ideas! I'm sure the company will occupy a leading place in this world!

in our Followers Appreciation Promotion.You have been upvoted by @rentmoney thanks for participating

Check out my post for 7 Free Crypto Airdrops!

https://steemit.com/airdrop/@la2410/3uvrbe-free-crypto-airdrops-7-new-airdrops-get-your-free-cryptocurrency-today

качество написания на высоте, как и сам проект.

Thank you! I will take part in the project