From purchase, to sale or send, Rubius offers the complete crypto-payment ecosystem.

The end-to-end solution begins with the Rubiex exchange. There, users can purchase and trade cryptocurrency within an intuitive environment. The exchange leverages extremely low fees to offer greater value than its competitors.

Rubius’ next link in the chain offers users a secure tool to send and receive cryptocurrency. The versatile Aryl wallet serves as both decentralized bank and exchange facilitator. The wallet’s user-friendliness allows for confusion free payments between users, and Aryl’s Volatility Shield protects wallet value by converting unstable cryptos into a preferred, steady currency. The Shield’s streamlined conversions allow users to quickly liquidate their holdings from an exchange without excessive fees or long queues typical of other “cashing-out” methods.

RUBY tokens power this innovative ecosystem. Users who transact with the native Rubius currency receive 50% off fees across all platforms.

Proceeds from the ICO will be used to develop the first crypto network to solve the issues of over complexity, exploitative fees, and volatility. Early investors will benefit from adoption at the premier stage of development, when the coin is at its cheapest value. Eventually Rubius will expand to explore further blockchain solutions outside the financial sector, and RUBY tokens will always be at the heart of these ventures, increasing in utility and demand.

Market Problem

The fact remains that roughly 1.7 billion adults in the world remain unbanked. That’s 1.7 BILLION adults who don’t have access to any electronic financial services and are forced to operate in either a cash or barter system which promotes crime and corruption.

Although smartphone ownership is increasing at an exponential rate, not everyone will have access to the needed solutions due to the limited software and cross-border restrictions. The existing solutions utilize third-party service providers that increase costs and limit services based on trust. These service providers also restrict access to their products depending on where you live. Unfortunately, the people living in war-torn countries, who arguably need to protect their money the most, are the ones who are affected most.

The most unbanked region is the Middle East, where a staggering 86% of adults are unbanked

The world’s largest banks refuse to operate in the region because they cannot comply with the Islamic banking laws. The business model of the world’s major banks revolves around loaning money and charging interest, which violates Sharia law. And, in order to operate there or in any other location, the financial service providers have to fully vet and trust every single individual.

The traditional financial system’s dependency on trust is leaving millions unbanked and is limiting the economic development of the world. We all saw the failure of the big banks in 2008 when their fraudulent practices caused a domestic crisis in the U.S., which then propagated into a full-blown international crisis due to the interconnectedness of the banking sector with non-banking sectors. This linkage was due to the fact that eCommerce had grown into a multi- trillion-dollar industry and, at the time, there were no means of sending peer- to-peer payments on the internet. Thus, the actions of the big banks caused the Great Recession, the worst economic downturn since the Great Depression. One smart individual, referred to as Satoshi Nakamoto, saw the failures of the banks and the faults in the system and decided to make a change. Bitcoin didn’t emerge in 2009 out of coincidence. It was born out of necessity.

Cryptocurrency solves almost all of the problems necessary to bank the world. There is no trust involved, no interest or loans needed, and it enables peer-topeer payments. Well, if that’s the case, then why isn’t the entire world using cryptocurrency? Why aren’t those 1.7 billion adults accessing bank accounts and financial services? What is hindering mass adoption? The answer: the software is terrible. None of the wallets made for cryptocurrency are user-friendly or intuitive. None of them are designed for the consumer. Instead, they’re all designed in a hurry to produce a minimum viable product, which the ICO/project will never improve upon because they were only in it for the money.

The Solution: Rubius Software

Rubius software will be designed for the consumer and will be continually upgraded and improved indefinitely. This may include rebranding our products in specific regions to help promote mass adoption. Our goal is to provide the entire world with access to banking and financial services through our software products. All of our products will be open-source, free- to-use, and will have zero-trust involved. Our products will utilize decentralized applications and operate on existing blockchain platforms like Ethereum.

The World Needs Rubius: Here’s Why

Our company will begin as a software startup but will transition into a new world bank, offering trustless financial services to the masses through our consumer-facing software. The world needs Rubius because the traditional banking model is dying. The old-world model depends entirely on trust, which will at some point no longer be sufficient as it is difficult to fully vet and trust billions of people; and the world population is growing exponentially. This traditional model is leaving 1.7 billion adults unbanked, limiting economic development and innovation worldwide.

Through Rubius, we will harness the power of the blockchain and provide every person in the world with essential financial services. Rubius was born because nearly every “wallet” or “exchange” solution so far is extremely haphazard and not user-friendly. Thus, our focus will be 100% on quality. We will make simple, easy-to-use intuitive software that will enable mass adoption of cryptocurrency and blockchain technology.

Rubius Smart Loans (RSL)

The RSL will be very similar to the smart escrow application because they will utilize Ethereum smart contracts to conduct simple loan operations. The smart loans will be designed for small agreements between friends and the users will be able to deploy loan contracts directly from their Aryl app. Similar to the RSE process, the participants will agree upon a set of conditions before the contract is deployed. In the Aryl app, users will be able to select another friend to act as an arbitrator for the agreement to mediate in the case of a dispute.

Decentralized Social Media

We plan to explore the potential of using the blockchain as a host for a decentralized social media platform. This may include expanding Aryl’s social media features to include more detailed user profiles and a secure messenger feature. Or, this may include developing our own novel social media platform. At Rubius, we envision a world where your data is owned by you and can only be sold or distributed with your permission. After implementing our financial software, we will experiment with different ideas to try and bring our vision to life.

Security

For all of our applications, security will be our highest priority. Our products will already have a security advantage over traditional financial solutions because the traditional service providers operate using centralized ledgers, whereas we will be utilizing decentralized ledgers. Centralized storage means that your important data is stored in one (or a few) locations which leaves the sensitive data vulnerable to attackers. With decentralized storage, your data will be distributed amongst tens of thousands of computers, making it impossible to hack because the attackers would need to gain majority control of the fault-tolerant blockchain network.

To improve security, we will be publishing all of our products as open-source so that they can be publicly audited. We will also hire IT security professionals to do their own evaluations of our software and systems. We will strive to maintain the highest levels of IT security to protect the assets of our users. After our ICO is complete, our first move will be to hire full-time security personnel to oversee our operations.

Customer Service

Unlike some of our competitors in the market, we will be extremely focused on providing excellent customer service. All of our software applications will be manned by a support team that will be accessible at all times via email or phone.

You will never have to worry about unanswered tickets. We will respond within minutes to address every issue that you have.

ICO Details

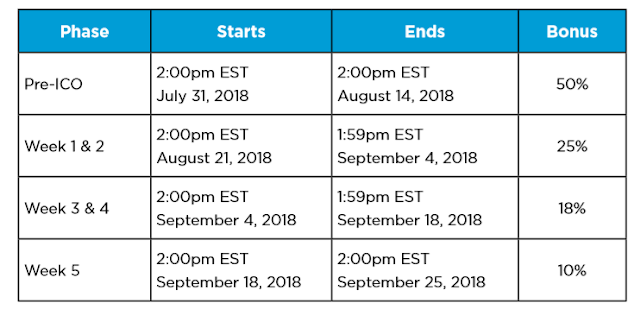

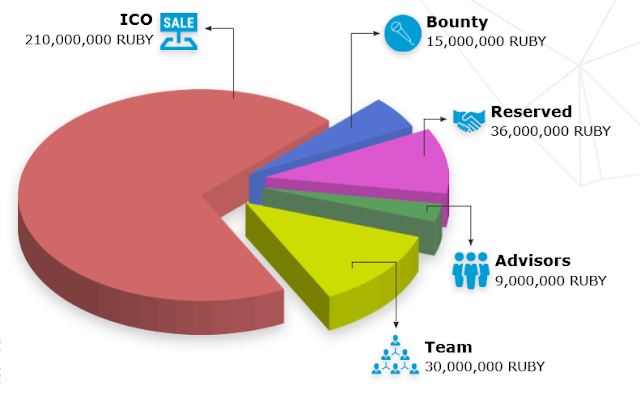

We have dedicated 70% of all Rubius coins to our initial coin offering. Our Pre-ICO will begin on July 31st and last for two weeks. The main sale for our ICO will start at 2:00pm EST on August 21st, 2018. The ICO will consist of three phases, spanning across five weeks (or until all tokens have sold). After the end of each phase, the price will increase, so we recommend participants get their RUBYs early.

Whitepaper : https://rubius.io/rubius-whitepaper.pdf

Ann Thread : https://bitcointalk.org/index.php?topic=3254617.0

Twitter : https://twitter.com/Rubius_Inc

Telegram : https://t.me/rubiuschat

Medium : https://medium.com/rubius-inc

Facebook : https://www.facebook.com/RubiusInc

Youtube : https://www.youtube.com/channel/UCtNH8Px0_rU9-T52XrHxW1Q?&ab_channel=Rubius

My Profil : https://bitcointalk.org/index.php?action=profile;u=1687366;sa=summary

UP