At 9:41am ET, 15 September 2017> Bitcoin ~ $3,322 Ethereum ~ $231.72 Litecoin ~ $44.72 Bitconnect ~ $101.77

Are North Korean President Kim Jon Un Statement to challenge US for World War III and N. Korean Hackers, China Banned for ICO and Stopping BTC Bitcoin Exchange to trade on 30 September 2017 & JPMorgan's CEO Jamie Dimon (EEA Member) To Be Blamed?

Today brings several major cryptocurrencies into a downtrend at the market place. After such a strong showing these last few months, the easiest go-to explanation.......were the players in this market driving stock prices above the real value (Bubble)? I believe that would be just an excused. Cryptocurrency has definitely matured over the last few years and the markets are well regulated. I think we can rule out this market being in an bubble. That's actually great news for investors. Buy low sell high, this is just what markets do.

Next, we have the China ban. This ban initiated by China's central banks in response to the rise in initial coin offerings (ICO) to the tune of some $200 million - $700+ Million in less than one year's time. Surely has some Chinese regulators a bit uneasy.

China, even though fairly new the world markets. Does have a most robust financial sector. The reforms of the 1990s giving the go ahead to the Shanghai stock exchange provided China with a growing middle class society. Not wanting a repeat of the Black Monday/Tuesday of 2015. Best believe China's looking after it's own best interest in the wake of this new era of currency. According to ICO Chinese analyst Lola with interviewed by Boxmining

there is a meeting will be taking place by Communist Party on 15 Oct. 2017 and they temporary stopped the BTC Bitcoin Exchange and ICO due to get back the public confident which reported many Chinese people were scammed before. But the perceptions is Government will get back the business of crypto-currencies they believed that a lot of Billionaires who are members of Communist Party are already engaged in Cryptocurrency and to raise additional government and private fund to finance additional projects with joined venture.

China's recent ban on so-called initial coin offerings (ICO) doesn't mean regulators are slamming the door on the country's fintech techies, including the crypto-currency players who operate in the mainland and in Hong Kong. China's mainland ICO market is rife with scams and and not at all regulated, so the shut down of new ICOs was no surprise, industry experts agreed. The ban mostly hurts local developers, who may just look elsewhere to raise virtual funds for their new digital world start-up projects. Others, such as bitcoin miners, may have to watch out for Beijing's crypto-currency watchdogs, as hiding a warehouse full of computers trading virtual currencies is not easy, should China's government seek further crack downs beyond the ICO marketplace.

"We expected toughening in ICO and crypto-currencies regulations in China for some time already. The Chinese government might consider the idea of a decentralized economy as one of the major threats to the existing regime," says Stanislav Glukhoedov, CEO of Prosense, a virtual reality broadcasting service based in Moscow. "On the other hand, maybe increased attention from governments can help clean up the ICO market from scammers and we suppose that in the near future the number of teams planning new projects through ICO mechanisms will be reduced, and those who will stay will be strong, serious companies." Prosense is considering launching an ICO this year.

There were 43 ICO platforms in China as of July 18, according to a report by the National Committee of Experts on the Internet Financial Security Technology. Sixty-five ICO projects had been completed, the committee said, raising 2.6 billion yuan ($398 million), Bloomberg reported. Then in July and August alone, the market went boom as China has a habit of doing sometimes. Chinese tech firms raised $766 million worth of crypto-currencies in local ICOs in just 8 weeks, according to Shanghai Security News.

ICOs are sort of a hybrid between the initial public offerings of the equity markets, crowd-funding and venture capital, allowing start-ups to raise funds for new technology projects, funded entirely in virtual money.

Some $1.78 billion has been raised through ICOs worldwide since 2014, according to data from the CoinDesk ICO tracker. China's central bank called for the ICO ban on Sept. 4, saying it was an "illegal public finance" mechanism used for securities issuance and money laundering. Bitcoin prices fell because of China's ruling, but quickly bounced back to life as of Wednesday. Bitcoin is up 56.3% against the dollar in the past four weeks, and up thousands of percentage points in the last five years. But Ethereum, one of the most popular currencies for ICOs, is still in a holding pattern.

Another threat is the North Korean President which is challenging the US Government for World War III. There is article that North Korean President is prepared to push the bottom of their nuclear/ chemical missiles to pulverize Guam, one of the US Territory and follows other states one by one. The question is How can US and his other allied countries to anticipate these threats which resulting to world war III.

And yet, another reason........

N. Korea hackers seem to be targeting crypto exchanges and have beefed up their own mining efforts. In an attempt to offset newly implemented UN sanctions. Securities expert expect that the North Koreans will intensify their hacks of digital currency in order to launder them into hard cash. It's kind of scary when you hear the types of threat coming out of N. Korea. Recent saying "It will cause great pain". Could this "great pain" include financial pain?

One last ingredient into today's crypto downtrend. Involves JPMorgan's boss Jamie Dimon erroneous words on Bitcoin. Speaking out against bitcoin & other altcoin as "a fraud and would eventually blow-up."

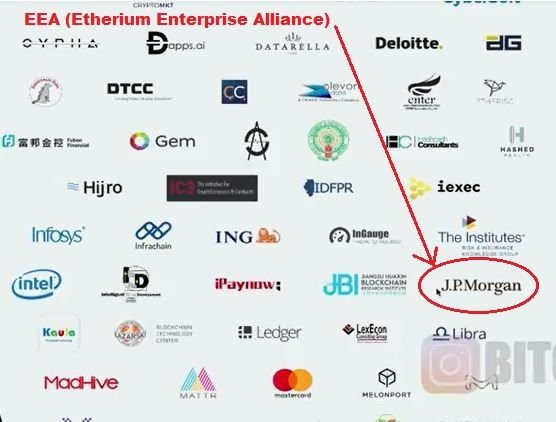

Experts, traders, former partners & analysts have criticized Dimon for such harsh statements. Sighting that he could very well be attempting to protect his own interest.......an on going blockchain development venture. While Dimon spoken to Media that Bitcoin is fraud his team is doing meeting with EEA (Etherium Enterprise Allaince) so there is crypto-politics (See below from tweeter) and JPMorgan Membership in EEA.

Both financial and government aspects there is always politically turmoil. But today we experience financial turmoil but according to experts financial problems and even political problems always take rest and make ready and prepare for a new take off. If someone will say like JPMorgan's CEO Jamie Dimon that Crytocurrency is fraud for the purpose of protecting himself and from kicking out from JPMorgan. I would says that he is not doing his research well before speaking up against cryptocurrency which in real world there are a lot of banks participating in these industries. Example Yugoslavia's Bank built 147 crypto-currencies ATM and Banks of India moved to acquire more holding stakes at Ripple Tokens and there are so many banks including central banks of Singapore, Japan, Hongkong, Malaysia and Vietnam supporting crypto currencies and recently Banko Sentral ng Pilipinas accepts Bitcoin as a form of payments.

Recently CEO John McAppe is challenging CEO Jamie Dimon and even US Government and other government in other countries that they are too late to stop and track down bitcoin and other crypto-currencies like ripple token. Monero token you can't detect during transfer operations. He said to CEO Jamie Dimon which is fraud to mining bitcoin which you put more than $1,000 capital than a printing fiat money like dollar which is used of papers and machines? it takes massive resource of government to regulate or track down bitcoin according to John McAppe but instead to prohibiting bitcoin or other crypto-currencies he said that it is government advantage to capitalize the crypto-currencies to raise funds for more joined projects with the private sectors.

Still this is why those who are investors, curious buyers & sellers. Stay informed, markets will fluctuate particularly in political turmoil. This will not be the last dip in the market. Patience & information gathering are key.

Here's what other experts in trading says when the market is crushing/downtrending;

Instead of selling during a downturn, it’s better to buck the trend. Follow the advice of billionaire Warren Buffett, the world’s greatest investor: “Be fearful when others are greedy, and be greedy when others are fearful.”

In his 1997 letter to Berkshire Hathaway shareholders, Buffett made a brilliant analogy: “If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef?” You want lower prices, of course: If you’re going to eat lots of burgers over the next 30 years, you want to buy them cheap.

Buffett completes his analogy by asking, “If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period?”

Even though they’re decades away from retirement, most investors get excited when stock prices rise (and panic when they fall). Buffett points out that this is the equivalent of rejoicing because they’re paying more for hamburgers, which doesn’t make any sense: “Only those who will [sell] in the near future should be happy at seeing stocks rise.” He’s driving home the age-old wisdom to buy low and sell high.

Doing this can be tough. For one thing, it goes against your gut. When stocks have fallen, the last thing you want to do is buy more. Besides, how do you know the market is near its peak or its bottom? The truth is you don’t. The best solution is to make regular, planned investments — no matter whether the market is high or low.

Meanwhile, ignore the financial news.

No News is Good News

The mass media is in the business of selling news, and to do that, they sensationalize it. Fueled by the over-eager reporting, irrational exuberance can quickly turn to pervasive gloom. Neither state of mind makes sense. They’re both extremes that lead investors to make poor choices.

For example, I know a couple of people who “invested” in Bitcoin when it was all over the news. Now they wish they hadn’t but they bought into the hype. My brother lost two homes to foreclosure and declared bankruptcy because he bought into the U.S. housing bubble during the mid 2000s.

Meanwhile, the people I know who ignore financial tend to prosper.

The May 2008 issue of the AAII Journal featured an article entitled “The Stock Market and the Media: Turn It On, But Tune It Out” in which author Dick Davis argued that daily market movement is often illogical and/or arbitrary. Except for obvious catalysts — military coups, natural disasters — nobody knows what makes the market move on any given day. Short-term changes appear random. Besides, as we just learned from Warren Buffett, they aren’t really relevant if you have a long-term investment horizon (which is probably the case for most of you).

To the long-term investor, daily market movements are mostly noise and filler. “What’s important is repetition or the lack of it,” Davis writes. A trend line is more useful than a data point.

“I believe one of the worst things that can happen to a long-term investor is to be instantly and totally informed about his stock. In most cases, spot news fades into irrelevance over time…Big market moves may be inexplicable, but a long-term or dollar-cost averaging approach precludes the need for explanations.”

You can watch the daily investment news, but don’t let it sway your decisions. “Focus on the long term,” Davis writes, “and you can ignore the media’s distortions.”

Davis isn’t the only one to believe that no news is good news. Research backs him up. In Why Smart People Make Big Money Mistakes (and How to Correct Them), the authors cite a Harvard study of investment habits. The results?

“Investors who received no news performed better than those who received a constant stream of information, good or bad. In fact, among investors who were trading [a volatile stock], those who remained in the dark earned more than twice as much money as those whose trades were influenced by the media.”

Though it may seem reckless to ignore financial news, the book argues that it’s not: “Long-term investors need not concern themselves with yesterday’s closing price or tomorrow’s quarterly earnings reports.” Make your decisions based on your personal financial goals and a pre-determined investment strategy, not on whether the market jumped or dropped yesterday.

The Bottom Line

I know market downturns can be scary. But here’s the thing: If this volatility makes you nervous, if it causes you to make bad decisions, then maybe you’ve put too much money into the stock market. Volatility is one of the fundamental features of stocks.

On average, the stock market returns 10% per year (around 7% when adjusted for inflation). But average is not normal.

Recent history is typical. The following table shows the annual return for the S&P 500 over the past fifteen years (not including dividends):

The S&P 500 earned an average annualized return of 4.24% for the fifteen-year period ending in 2014. But only two years — 2005 and 2007 — generated stock market returns close to the average for that time span. (Note: This fifteen-year period has one of the lowest rates of return on record.)

Short-term market movements aren’t an accurate indicator of long-term performance. What a stock or fund did last year doesn’t tell you much about what it’ll do during the next decade.

In Benjamin Graham’s classic The Intelligent Investor, he writes:

“The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored. He should never buy a stock because it has gone up or sell one because it has gone down. He would not be far wrong if this motto read more simply: “Never buy a stock immediately after a substantial rise or sell one immediately after a substantial drop.

“If you believe stock prices are still high, then steer clear of the market. If you think they’re low, then buy. And remember: Unless you sell your stocks, you haven’t lost anything at this point — it’s all on paper.

During the tech bubble of the late 1990s, JD Ruth was part of an investment club. His friends and him chortled with glee as we bought tech stocks (Celera Genomics, Home Grocer, Triquint Semiconductor) near the top of the market. They thought they were going to be rich. They weren’t laughing so hard when the bubble popped; they closed the club and sold the stocks at huge losses. What lesson did he learn? The time to buy is when prices are low, not when they’re high.

I believe that for the average long-term investor, the best course of action right now is to make regular scheduled purchases of low-cost diversified index funds.

That’s what I’ve done in the past. If I had money to invest, that’s what I’d be doing today.

Further reading: Four years ago, Jim Collins wrote a great article about market crashes and how to handle them. Jeremy from Go Curry Cracker has written about exposure therapy, about how repeatedly “losing” $100,000 (or more) in the stock market has desensitized him to the experience. And just yesterday, Mrs. Frugalwoods wrote about the zen art of losing money.

References;

• https://steemit.com/cryptocurrency/@wecrypto/market-fears-surrounding-cryptocurrency-are-n-korea-hackers-china-ban-and-jpmorgan-to-blame.

• https://www.forbes.com/sites/kenrapoza/2017/09/06/chinas-ico-ban-doesnt-mean-its-giving-up-on-crypto-currencies/#63ed3faf7aeb

• http://edition.cnn.com/2017/08/08/politics/north-korea-considering-guam-strike-trump/index.html:

• http://moneyboss.com/what-to-do-when-the-stock-market-crashes/

To look for legit and stable investment programs;

• Top #1: (0.25%-2% daily) Bitconnect Trading: http://bit.ly/btcprincess or http://bit.ly/bitcoinprince (Min.cap=$100-$100K)

• Top #2 (0.20%-10% daily) Chain.group Trading: http://bit.ly/cgbitcoinprince (Min. Cap: $5- $1M)

• Top#3: (1.00%- 3.50% daily) Bitpetite BTC Tumbler: http://bit.ly/bbitcoinprince (Min. Cap. 0.005BTC/$20)

• Top #4: (0.35%-1.5% daily) Trading: http://office.tradecoinclub.com/register/fromrags2riches (Min.cap=0.01 BTC $35)

• Top #5: (6%- 12% monthly) Mining: http://www.eobot.com/user/844616 (Min.cap=$10)

• Top #6: (6%-12% monthly) Mining: http://hashing24.com/?ref=bitcoinprince (Min.cap=$30)

• Top #7: (6%-12% monthly):Mining: http://www.genesis-mining.com/a/1439876 Get 3% discount code: Ll0YGI (Min.cap:$50)

• Top #8: (6%-12% monthly): Mining: https://hashflare.io/r/1E2B703F (Min.cap=$12 )

The requirement above before you deposit you must have bitcoin/ btc wallet address:

Coins.ph links: https://coins.ph/m/join/j0dzos (Philippines Exchange)

The Cheapest Exchange that only charge flat rate of 0.50% or 0.0002BTC

Coinpayments links: https://gocps.net/sfg8gao80dn61eqbasrwe8q0vloa/ (International Exchange)

The advice of billionaire Warren Buffett, the world’s greatest investor is right: “Be fearful when others are greedy, and be greedy when others are fearful.” Now today 16 Sept. 2017 Bitcoin, Bitconnect and other crypto-currencies price are slowly getting back. Now bitcoin BTC is $3,753 from $3,070 yesterday and Bitconnect now is $111 and yesterday was $92.53. I believed Bitcoin BTC will return back to $,4000 and skyrocket to $5,000. #steempilipinas

How far with your financial predictions?