MoneyToken project is focused on crediting process optimization.

If you have ever faced such need, you must be familiar with a wide range of problems existing in this field. With the appearance of digital assets, it became much easier to obtain credit. Why so? I will tell you further in the article.

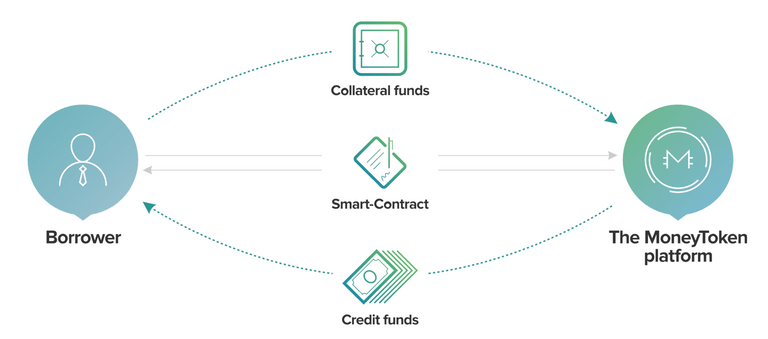

Operation principles of MoneyToken network

Within the project, any interested user will be able to receive a loan of a certain amount secured by digital currency. For this purpose, you can use Bitcoin, Ether and other crypto assets.

The ecosystem is of a decentralized type, there are no intermediaries. The deal will be guaranteed by a smart contract between the user and MoneyToken system.

Thus, if you need a certain amount of money, you don’t have to sell your digital assets, you can use them as a security and obtain a credit in a fast and reliable way.

A solution of the investors’ problems

Investors, who use digital assets in their activity, are interested in finding a way to apply them with maximum profit. For them, to lose digital currency for a while means to miss a significant share of investments. But in case if all other possibilities of obtaining a credit in usual financial institutions happen to be unprofitable, then the investor has no choice but to sell cryptocurrency.

Thereby, until the investor earns enough money to buy new digital assets, he will be losing the potential profit. And as you know, the cryptocurrency exchange rate is quite unpredictable. Even when you think that you won’t lose anything if you sell your cryptocurrency, the rate can rise in dozens of times.

By using MoneyToken project’s functions, the investor won’t need to sell his assets in order to obtain a loan. He can use them as a security and receive them back afterward. The project’ ecosystem is built on the Ethereum smart contracts, thus ensuring transparency and security of its operation. You will be guaranteed that your money won’t disappear and that the loan amount will be provided to you instantly.

How does it work?

In order to obtain a credit with MoneyToken you don’t have to mess with all that paperwork.

All you need is to:

● Determine the time when you will be able to repay the loan. It can be both 3 days and 3 months.

● Indicate the required amount of the loan. The minimum amount is $500, the maximum - $1 000 000.

● Provide security in any digital currency

● Receive confirmation from the system

● Specify a wallet to which the loan amount should be transferred.

Ensuring safety of cryptocurrency storage

When providing your digital assets as a loan security, you shouldn't worry about its safety. As a unique multi-subscription wallet will be used to store each user’s assets.

Thereby, a certain amount can be transferred to the wallet only after obtaining consent from the borrower, the lender and in some cases MoneyToken platform itself. Consent of the latter can be required in case of disputes arising between the parties.

Your request can be confirmed within a few seconds. The borrower's reputation is verified by artificial intelligence so it is impossible to fake the information in request.

It should be noted that besides the popular cryptocurrencies there will be an internal token. Its rate will depend on the US dollars rate. Thus, the loan amount will not depend on the frequent changes in the digital currency exchange rate. The amount of your loan will be fixed, it means that you will be able to repay it even if the rate drops.

About the system tokens

During the crowdfunding campaign, users will be able to purchase not the above-mentioned token but the IMT token. In contrast to the previously mentioned token, this one won't act as a mean of payment. It will be used to provide a discount for the amount of commissions paid to MoneyToken ecosystem. It means that when a user buys this token, he obtains a VIP status. After that, he can act as a creditor.

Ethereum-based exchange

At initial stages, the loan will be transferred to the project’s cards and in prospect - to Visa and MasterCard. It will allow to bypass the processes of converting digital currencies. The borrower will be able to use the loan in fiat currency. Thus, saving money on extra commissions for currency converting. More information about the operation of this decentralized exchange you can find in the project’s White paper.

ICO details

At this stage, all interested investors can participate in the ICO. It launched on May 2 and will last till June 6. We have already told you about the tokens which you can by during the ICO and about the opportunities provided by them. That’s why, if you want to become a creditor and to start gaining profit by providing loans in digital currency, you should buy the IMT tokens.

According to terms of the crowdfunding campaign, investors are offered discounts and special offers. These offers depend on the amount of the purchased tokens. For more information, subscribe to the project’s newsletter and follow the updates on the official website.

More information:

Website: https://moneytoken.com/

White Paper: https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

Twitter: https://twitter.com/MoneyToken

Facebook: https://www.facebook.com/MoneyTokenOfficial/

Telegram: https://t.me/moneytoken

Author:

Bitcointalk Username: saycryptohello

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1336255

great article

Достойный обзор! спасибо!

Проект достаточно интересный, думаю стоит присмотреться к нему внимательнее. Спасибо за обзор!