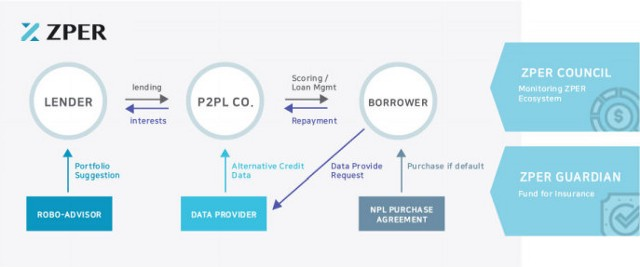

ZPER is a financial ecosystem supported by Ethereum that can immediately use smart contract technology to distribute P2P transactions. Venture is a combination of the efforts of Robot Advisor and leading P2P providers to provide a solution to secure transactions between borrowers and lenders around the world. The ZPER platform will incorporate the latest P2P funding value with property data around the world to establish a financial model. As a result, this platform will be able to surpass all countries and currencies to bring existing structures to global use and capital flows.

Financial Benefits of Zer P2P (Peer-to-Peer)

Financial

Network The P2P Verification Network creates a financial environment for all participants by allowing participants to interact and exchange values.

Unlimited Trading

Because blockbuster technology is superior to the rest of the world, ZPER connects borrowers and lenders of multiple nationalities regardless of their currency. With a standard token, lenders receive high returns on loans and borrowers get low interest loans.

Proper Risk Management

Your portfolio will be under the supervision of a robot expert with algorithms that help reduce investment risk and diversify your wallet.

Security

Community and loans borrowed in the community will have little fear of the trust due to the application of intelligent engineering contract. Self-enforcing agreements guarantee both credibility and eligibility.

THE PROJECT ADVANTAGES, BENEFITS

P2P Finance Alliance:

Confirmed worldwide P2P loaning organizations, data suppliers, and robo-consultants are a piece of the ZPER Alliance. The Alliance, which enables an assortment of members to unreservedly interface and trade esteems, gives a sensible money related condition to borrowers and banks. All members will be remunerated reasonably for their commitments.

Cross- outskirt exchanges:

ZPER interfaces borrowers and loan specialists paying little respect to their nations’ cash. Banks harvest higher returns, while borrowers get advances at bring down loan costs.

Hazard Management by Robo — consultants:

Universally perceived robo-guide calculations constitute the worldwide venture portfolios. The calculation is then used to bring down venture chance and give security by means of speculation enhancement.

PARTNERS

XnTree: XnTree is a deep tech venture curation and project management company focused on Fintech, Blockchain, AI, SmartCities and Robotics. Bespoke programmes are designed to facilitate a soft landing pad for tech ventures who wish to participate in projects in conjunction with corporate bodies and governments.

Chain Partners: Chain Partners is a blockchain company builder, the one and only Korean enterprise that InBlockchain has invested to. InBlockchain is the largest blockchain investment firm in China, which has supported global blockchain projects such as Steem, Zcash, Qtum, EOS and Yunbi. Chain Partners is a union of top professionals from Google, Fast Track Asia, Yellow Mobile, Shinhan Investment Corporation and DS Asset Management.

FINDA: FINDA provides comprehensive financial information as a platform, recommending individual financial products to users. Borrowers can compare and analyze a wide variety of products at once, including mortgage loans, credit loans, P2P loans and car loans, and, at the same time, investors can also receive a broad spectrum of information from deposits to saving products as well as P2P investments. With more than 7,600 comparable financial instruments, FINDA will play a key role as the council and robust information provider in the ZPER ecosystem.

MOIN: MOIN is a company that offers efficient and rational money transfer system. They have matched the level of security the banks can offer but with faster transfer and lower fees. Founded in March of 2016 and upon receiving the top award in the Financial Job Fair Contest the same year, to being officially licensed as a business for foreign transferring system, MOIN has rapidly expanded to allow transfer to Japan and China. They are looking forward to advancing into the Southeast Asia and Europe as well.

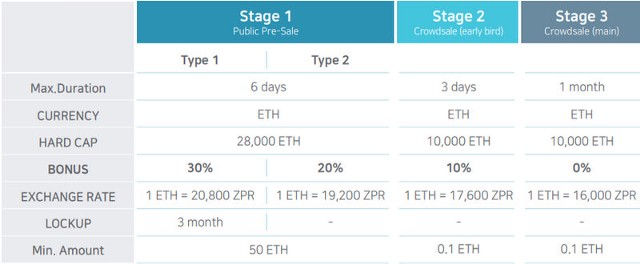

Details ZPER ICO

Distributed ecosystems are open to private borrowers, P2P finance companies, robot consultants, investors, and financial information providers. The ZPR cards allow a global payday loan model to exchange loan information for participants around the world, so the platform is a great choice. ZPR cards can be purchased in the original coin programs that the company has not yet announced.

The ecosystem open to global businesses is planning to have P2P financial services, data providers, and buyers of all types of loans. All of these characters can benefit from inside the platform, including bonding investors with loans, information, portfolio preparation, loan management, risk analysis, and exposure. Exchange of fund transactions.

About Token Tokens

- Token: ZPR

- Price: 1 ZPR = 0.0000625 ETH

- Token open for sale: 2,200,000,000 ZPR

- Total Token: 4,400,000,000 ZPR

- Bonus: Yes

- Platform: Ethereum

- Accepted: ETH

- Soft cap: 5 000 ETH

- Hard cap: 48 000 ETH

- Country: Singapore

- Whitelist / KYC: Yes

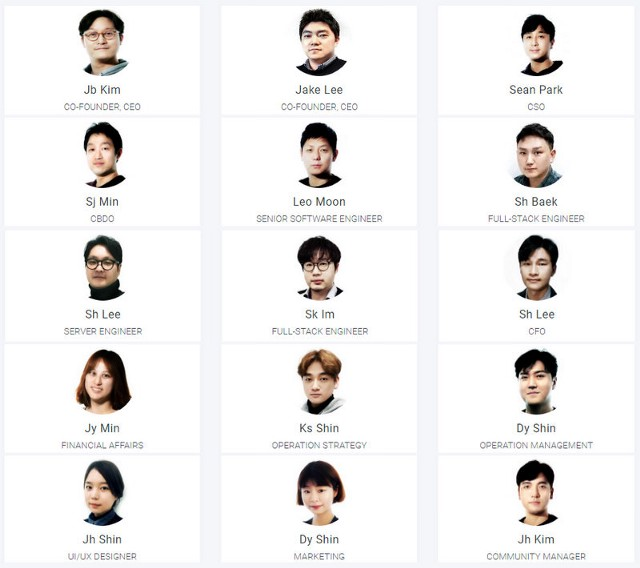

Project team

ZPER ROADMAP

2015–2017

§ Established P2P financial platform Funda/Midrate/Olley.

§ Established financial product recommendation platform Finda.

§ Initiate ZPER.

2018

§ Partnership with leading domestic P2P financial companies & RoboAdvisor.

§ Presale & Crowdsale.

§ Launch of basic ZPER Wallet service.

§ Listing on exchange.

§ ZPEROBO Service Beta Test.

§ Expand parnerships.

§ Full ZPEROBO Service Launched.

§ ZPER Open Market Service Beta Test.

2019

§ Full ZPER Open Market Service Opened.

§ Expanded partnership.

Infomation :

Website: https://zper.io

Whitepaper: https://zper.io/paper/Whitepaper_Eng.pdf

Telegram: http://t.me/zper_kr_official

ANN: https://bitcointalk.org/index.php?topic=3218843

Author: terry17

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1450768