ICO's: The Wild West of Investing

An ICO is typically used by blossoming cryptocurrency organizations to raise capital through crowdfunding, and can be a major source of profit from investors. However, there are many ICO's that are shady and unwise to invest in. Being able to identify both good and bad ICO projects is extremely important, and below are a few guidelines to keep in mind when investigating whether or not participating in a particular ICO is wise.

Whitepaper

One of the best things to do when initially looking into an ICO is to read the project's whitepaper. The whitepaper contains large amounts of relevant information regarding the project's technology and utilization of the token that is created. Within the whitepaper, you want to find concrete and detailed explanations of the project's goals and how they will be achieved. Many whitepapers that are considered to be well written include the introduction of the technological problem they are attempting to solve, followed by a comprehensive breakdown of how the project solves the given problem. On the other hand, whitepapers that are generally considered to be poorly written include vague wording and goals, along with unclear information regarding the team's plan to achieve the project's mission.

Token Use

Another important guideline to keep in mind when investigating an ICO includes the token's overall use. One red flag includes tokens that do not have a specified use and seem to be created to just raise capital during the ICO. This is a bad sign for the investor, as this means there will not be opportunities in the future that can drive the demand and price of the token you possess. You are likely to not be entitled to ANYTHING when you buy tokens for a project's ICO as far as monetary value, so having something that will provide that value and use for the token in the future is essential.

Core Team Members

Projects with well known developers are the most ideal situations to invest in, however this is rarely the case in reality. In most cases, the best thing you can do is look at the backgrounds of the developers and core team members. Many developers have LinkedIn accounts you can check out, and this is a good start. Also, some developers have their code on GitHub, giving you the chance to review it if you have the skills to do so. Having their code available for review is a good sign, as project with poorly written code that doesn't work as described likely would not have the code available for open review.

GitHub

.png)

Communication From Project Team

As project's gain investors and develop a community, it is extremely important that the project maintains solid and consistent communication along with updates to their community regarding the projects goals and overall status. Along with these updates, it is also important to make sure that the project delivers on promises and dates that are given.

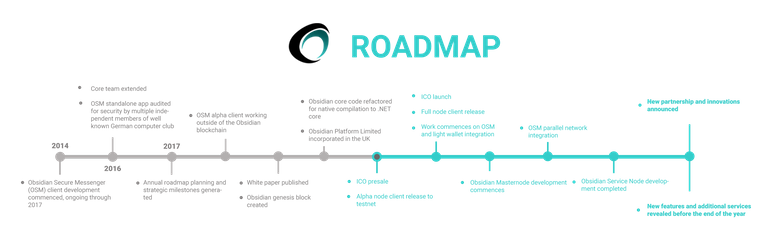

Project Roadmap

The vast majority of ICO's have roadmaps written out within their whitepapers, and it is important to ensure that the ICO has met previous goals that have been laid out. If you feel that the roadmap is a bit vague or doesn't have meaningful milestones, it may be a red flag that the project's overall vision is unclear.

Here is an example of a Roadmap from the Obsidian ICO:

Trust Your Gut

These guidelines just scratch the surface in terms of what to keep in mind when checking out an ICO, and one of the best pieces of advise that can be given is to just trust your gut. If you are looking into a cryptocurrency and something just doesn't "feel" right, do not ignore that feeling and let FOMO push you to make an emotional decision against your better judgement. Ensure that you look into ICO projects as much as you can before you decide to invest, good projects will withstand whatever scrutiny you give it.

Thank you for reading and invest safely, Steemians!

You got a 53.00% Upvote and Resteem from @estream.studios, as well as upvotes from our curation trail followers!

50SP | 100SP | 250SP | 500SP | 1000SP | 5000SP | Custom AmountIf you are looking to earn a passive no hassle return on your Steem Power, delegate your SP to @estream.studios by clicking on one of the ready to delegate links:

You will earn 80% of the voting service's earnings based on your delegated SP's prorated share of the service's SP pool daily! That is up to 38.5% APR! You can also undelegate at anytime.

We are also a very profitable curation trail leader on https://steemauto.com/. Follow @estream.studios today and earn more on curation rewards!

Oh... so that's how it is. Thanks for sharing! :D

I mostly look for the quality of the logo.

50% of the time, it works every time.

Single lower case letter, always!

This post has received a 5.77 % upvote from @booster thanks to: @thatconeshape.