I am both a crypto holder and a trader. When I trade, I prefer to trade on high-volume exchanges which have a good reputation for being secure. To name them, Binance, Kucoin, Huobi, and Gate. I have never traded on any low volume exchanges unless it is a decentralized exchange, like Switcheo.

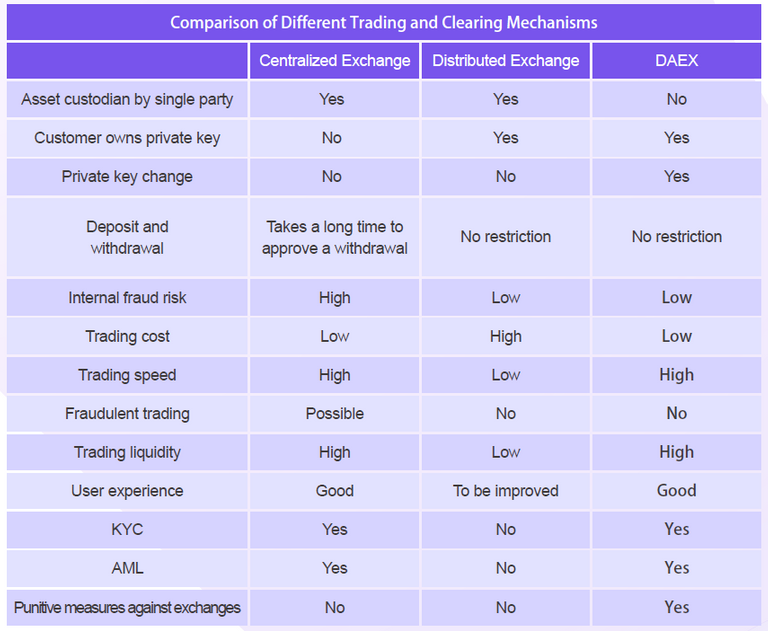

I find that centralized exchanges have higher liquidity due to the high trade volume. Order matching is a lot faster than decentralized exchanges. On the other hand, decentralized exchanges are more secure as we are trading from our own wallet.

However, trading of CEX will expose us to the risk of being hacked. This has happened in many centralized exchanges. Mt. Gox, Bithumb, Coincheck and Coinrail are some of the famous crypto exchange hacks in the history. In the year 2018 alone, it is reported that about $731 million has been stolen from crypto exchanges due to the security breach. Security is a critical issue and with funds getting stolen, the crypto space has become very volatile and this has prevented many of the public from investing in cryptocurrencies.

I recently came across a project called DAEX. DAEX is a clearing solution for centralized exchanges using the distributed ledger technology. DAEX is purely decentralized, with its own blockchain and it is a fully open source project. The codes are available to the public for supervision and audit.

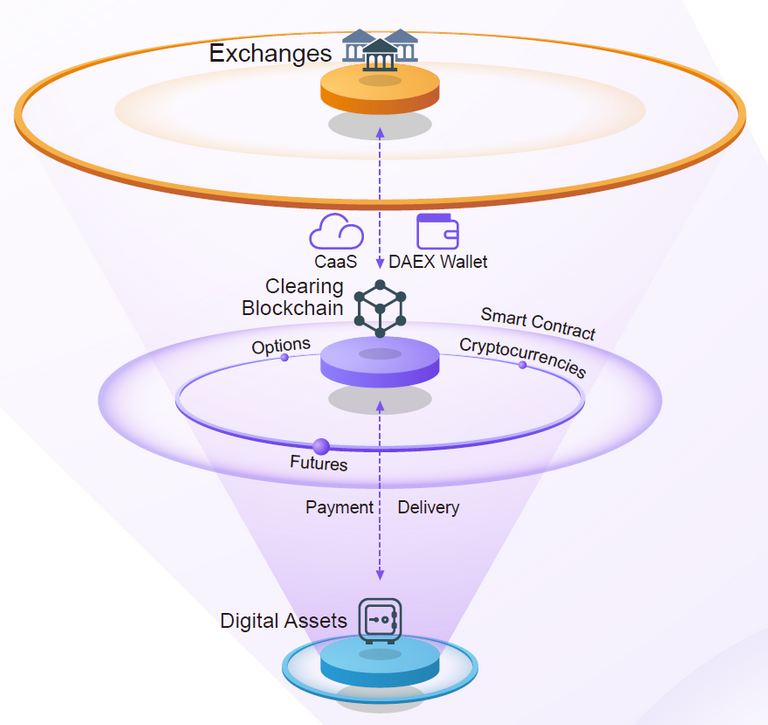

What DAEX is aiming to achieve is to provide the decentralized like security to the existing centralized crypto exchanges. It is an ecosystem that connects users’ wallets to the centralized exchanges. Once the orders are matched, a clearing smart contract is triggered to make sure that the trade meets all the requirements. When this is done, the funds will be sent to the users’ wallets. Funds are no longer stored in exchanges. This sounds very similar to the working principle of decentralized exchanges but with the perks of high trade volume and fast order matching. Bear in mind that on the decentralized exchanges, order matching can take days.

The clearing chain is the core of DAEX ecosystem. It works based on the clearing value factor proof of stake (CVF-POS) mechanism. Every user’s wallet that contains funds and is connected to the DAEX ecosystem can participate in the clearing services. All participants will be eligible to earn financial rewards. This POS mechanism is designed in such a way that every wallet has equal accounting power, but different accounting scores. Wallets that have enough accounting scores can participate to be the validators. If a validator fails, or is hacked and violates any agreement, all the staked DAEX tokens will be penalized.

Each DAEX user will have to go through a KYC. After clearing the KYC process, each user will be assigned a private key to the DAEX wallet. Users will have full control of their wallets. There will be a 3-part private key and 2 parts will be needed to access the wallet. Each user will also have their own clearing account on the distributed ledger. This clearing account records all the funds' balances and clearing history.

As of now, the DAEX token is an ERC-20 type token. When the mainnet is live, the ERC-20 type DAEX will be destroyed and a new native token will be issued to the existing holders. Testnet is expected to be released by end of 2018. DAEX has formed partnerships with a number of cryptocurrency exchanges e.g. Indodax, Tokenomy, and Hyperquant. More news to come about the implementation of the platform after the testnet release.

DAEX's public token sale is now live until the 14th September 2018. For more details about the token sale, please visit these channels:

Website: https://www.daex.io/

Telegram: https://t.me/DAEXOfficial_en

Twitter: https://twitter.com/DaexBlockchain

Reddit: https://www.reddit.com/r/DAEX_Blockchain/

Medium: https://medium.com/daex

Whitepaper: https://www.daex.io/daexPaper.do

Author: https://bitcointalk.org/index.php?action=profile;u=1774179