Introduction

The first dApp based on ET Protocol that other trustees can use as is, or fork, customize, and white label in collaboration with the ET development team, is currently in development.

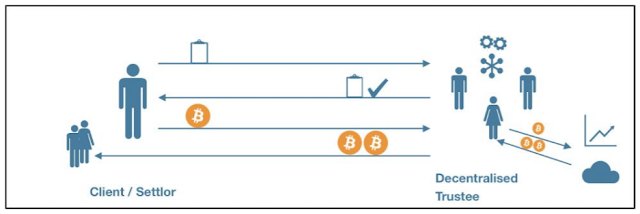

The original ET dApp will be the world’s first dApp providing trustee services for the crypto world, by fulfilling simple “Dynasty Trust” scenarios for clients and replicating the traditional fiduciary inheritance and asset redistribution schemes. This application will serve as an example of how the ET Protocol can be used by trustees to establish more convenient and faster channels of direct communication with clients and experts.

The Market for the original dApp

The team of ET believes that financial planning is crucial for every person, no matter whether they belong to the world of high finance, or the crypto community. We also believe in the extended long term growth of the crypto markets and the further tokenization of assets, which is particularly expected to become most prominent in the financial industry. Hence, before dividing the potential clients of our dApp into groups in terms of their consumer behavior, we attempt to evaluate the market by the top-down approach, analyzing the data that can be found in open sources to approximate the headcount of beneficiaries of value created by our ET dApp.

According to the Cambridge University research, there were more than 30 million crypto-wallets registered around the world by 20172. This figure quadrupled since 2013. We use this estimate as an underlying basis for our calculations, also mentioning here that the number of wallets has obviously soared since 2016 and with a given pace of growth it may reach 1 billion by the latter period of our planning time-frame.

We know that a trust settlement and maintenance is an expensive service to purchase. IBISWorld Trusts & Estates in the US Industry Report states that there are only 3.2 million trusts and similar entities settled in the US and also that this figure is strongly correlated with the number of households with 100,000 USD or higher yearly income. We may reasonably suppose that there are at least 5 million such structures existing in the world. There is an indirect confirmation of this logic in the estimates given by the Global Rich List project3: there are only 5 million people in the world with a yearly income of 100,000 USD. Hence, traditional trusts settlement and management industry is currently most likely limited by the number of 5 million wealthy individual clients due to its costs. However, we also know that there is huge capital to be transferred between generations in the coming years, and the industry of trusts may face significant market expansion.

The first dApp built on ET Protocol offers dramatically friendlier pricing as well as more convenient client service and thus may reasonably expect a larger available market. We use the same Global Rich List functionality to evaluate the number of individuals that are worth 100,000 USD (not yearly income) and might spend 10% of their wealth to switch onto the crypto world. Our calculations returned an estimate of 367 million people globally

The business model for the original ET dApp

In the first ET-dApp, in accordance with the so-called Purpose Execution Flow implemented by the protocol, all clients are supposed to purchase ET Tokens and go through onboarding services with Oracles to get everything customized – this part of the business process is paid with the initial fee, to be adjusted by the dApp founders if needed. Within the lifecycle of a product or service, the client pays transactional fees that may be of a different nature. It is recommended to purchase one specific service regularly, at least once a year – that is a revision of an investment strategy for the client’s assets. There are no more compulsory fees included in our financial model in order to keep it reasonably pessimistic and simple to verify. To sum up, there are three main sources of revenue for the original dApp. They can be 100% tokenized, i.e. paid by ET tokens, or can be paid as a part of the traditional management fee as a portion of Assets Under Management (AUM) in case of long term purposes:

ET dApp Long-term Purposes

ET dApp Dynasty Support Algorithm

Objective – replicating the model of a Dynasty Trust, which provides all kinds of support for the family members of the client for an unlimited amount of time.

Solution – Finding asset managers that would secure returns of traditional developed liquid markets and sending generated income via smart contracts to the wallets of the given beneficiaries after the dApp receives external triggers (age of the beneficiary, educational degree, marital status, loss of legal capacity of the settlor, etc)

Tasks for Oracles – to properly identify preset triggers, to properly identify beneficiaries, to ensure the safe and reliable transfer of assets, and to check that payment was received

Initial assets to be input – cryptocurrency, not less than 10 ETH

Partners

RATING

The benefits for the Trustees powered by the ET Protocol:

1. Safety of assets

Assets are protected from all legal claims and are impossible to withdraw without the whole dApp network agreeing to the solution.

2. Earning more on managing assets through tokenization

Crypto assets can be distributed among a variety of asset classes via tokenized ETFs, equities, FI, REIT, etc. to provide reasonable risk/returns ratio.

3. Smarter decision making

The ET-powered trustees can Integrate expert networks and AI to solve any fiduciary purpose of the client.

4. Faster operations

Decisions can be made remotely and are only limited by the speed of the blockchains used.

5. Perspective for new markets & services

Trustees can scale their services onto new markets of crypto enthusiasts, the low/mid income and developing markets, or solve a wider range of purposes for their current target audience.

6. The protocol is flexible & Modular

If needed, trustees may integrate only what their company needs, be it cryptocurrency payment gates or the full decision making process. The protocol provides varying levels of trust structure, privacy, and voting rights highly configurable by the dApp founders.

The Team

The journey to attaining the vision of ET is spearheaded by a team of experts in many traditional and innovative fields that have come together to disrupt multiple industries at once: trust fund establishment, asset management, and hybrid intelligence technology. Eternal Trusts was conceived by Kirill Silvestrov, MBA, an investment banker with more than 15 years of experience in C-level positions and a portfolio investor in biotech companies. The executive team is also comprised of Mark Lea, a legal adviser to the governments of Singapore, Hong Kong, Malaysia, and Samoa on the establishment of trust legislation, and Benoit Vulic, with more than 10 years of asset management experience in leading global investment companies, in managing "funds of funds", and active portfolio management.

In total, the team of Eternal Trusts boasts decades of top-level experience in their respective fields.

For more information about Eternal Trusts, you can visit the link below:

Website : https://eternaltrusts.io/

Whitpaper : https://eternaltrusts.com/docs/wpen.pdf

Facebook : https://www.facebook.com/EternalTrusts/

Twitter : https://twitter.com/Eternal_Trusts

Medium : https://medium.com/@EternalTrusts

Linkedin : https://www.linkedin.com/company/eternal-trusts/

Telegram : https://t.me/eternaltrusts

ANN Thread : https://bitcointalk.org/index.php?topic=3130908.0

Author:

My Profil : https://bitcointalk.org/index.php?action=profile;u=2269084;sa=summary