CoinDCX seems to be an innovation spree to become the first Indian cryptocurrency exchange to provide a lending option and earn interest on your cryptocurrencies. This is close on the heels of the exchange bagging VC funding.

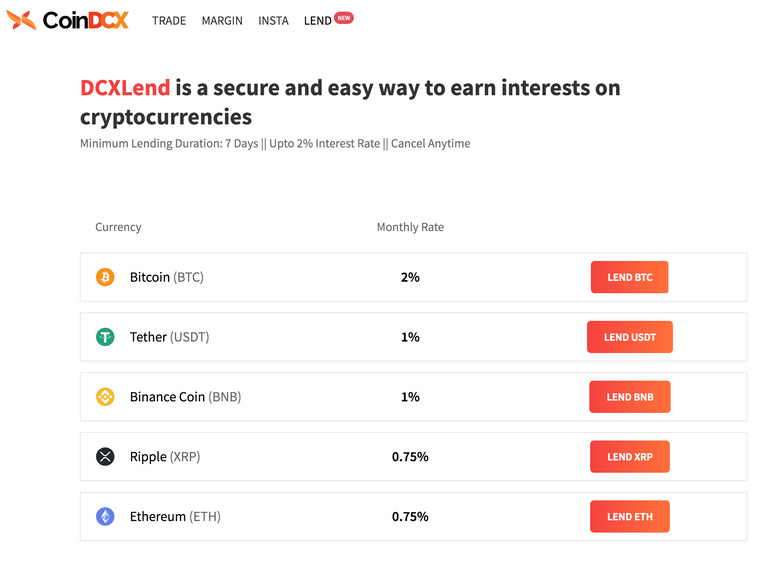

You have an option to lend your cryptocurrencies that you are holding on CoinDCX. They have opened up the service to users who hold BTC, BNB, XRP, ETH and USDT.

The exchange’s website currently displays monthly interest rates of 2 percent for BTC, 1 percent for USDT, 1 percent for BNB, 0.75 percent for XRP, and 0.75 percent for ETH. CEO Sumit Gupta told Bitcoin.com that BTC has the highest interest rate “because our traders mostly do margin trading in BTC markets (hence high demand for BTC lenders).”

At press time total BTC lent was 170.90 and total borrowed is 167.25 with the Margin Open Orders at 1381.00 BTC.

The exchange currently provides three lending term lengths of 7, 15 and 30 days respectively. The rate of interest change dynamically based on demand and supply dynamics and goes upto a maximum of 2%.

Funds are then lent to the users only when the margin trade is open, with no withdrawal access and hard liquidation with 7.5% maintenance margin.

A few FAQs from their website that's a must read are:

Are my funds secure with CoinDCX?

Your funds are absolutely secure with us. We rely on MultiSig Cold wallets for safety of the funds. No single person has the access to the crypto assets that we hold.

Why are interest rates better on CoinDCX?

We use the borrowed funds to provide margin to our DCXmargin users on interest enabling us to give a high interest rate to you.

Do I need to do KYC for lending?

You do not need to do KYC for lending cryptocurrencies. If you are dealing with fiat or if you want to withdraw more than 2 BTC worth of Cryptocurrencies per day, you will need to do KYC

What if I wish to withdraw my funds before the end of the lock-in period?

If you wish to withdraw your funds before the end of the lock-in period, you will receive no interest on your cryptocurrency. However, understanding market sentiments, we have kept the minimum lock-in period as 7 days only.

It is worth reading the fine print disclaimer which states the following:

Interest rates are calculated dynamically based on market demand and supply. This system is set in place to ensure that all lenders receive an interest rate that is both fair and aligned with the latest market conditions. Note that the cryptocurrencies lent through DCXlend will be used to provide leverage to users on DCXmargin.

If you like my work kindly resteem it to your friends. You may also continue reading my recent posts which might interest you:

- Why You Should Vote For Firepower As Witness—Witness Campaign Post From India!

- Steem.Chat Contest #70

Hello sir am also from India

Posted using Partiko Android

After Zebpay got closed, I took an exit from all the exchanges. Let's see how far this exchange will go. And can we withdraw to bank accounts from this exchange? Thanks!

Yeah. with dcxinsta. But there are many other exchanges in p2p model.

Good news. A good start for crypto lending in India

Posted using Partiko Android

2% per month is pretty good actually. That's 0.02 BTC interest, which could be 20k USD if BTC hits 1M USD :P