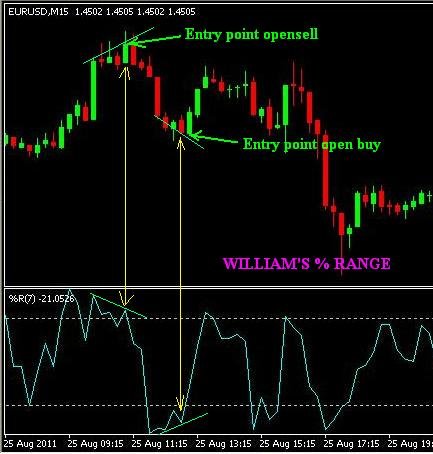

Williams Percent Range is an oscillator type indicator (move back and forth) whose function is to signal that the market is saturated.

The scale used in this indicator is from - 100 s.d. 0, where the condition is overbought if williams% range is worth -20 to 0. And the condition is said oversold when williams% range is worth -100 to - 80.

In practice, the use of the range% williams indicator is not stand-alone but is used together with other indicators that can provide signal entry points.

However, we can also use the range% williams on a stand-alone basis if we use a convergent strategy.

The rules of the game are:

Buy when there is close the lower, while williams% range shows increasingly higher and is in oversold condition.

Sell when there is close that semain rises, while the williams is getting lower and occurs in the overbought area.

To note is that when using this convergent strategy, our profit target is not too long