Last week, ShapeShift, the currency exchange, announced the launch of Prism: "The world's first platform for managing crypto-currency assets based on Efirium smart contracts." The new product is aimed at investors in the crypto currency market.

With the help of Prism, users create their own "fund" from various crypto assets, and receive a profit proportional to the growth of the value of these assets. The funds are stored on a smart contract, and the air is used as collateral.

How it works

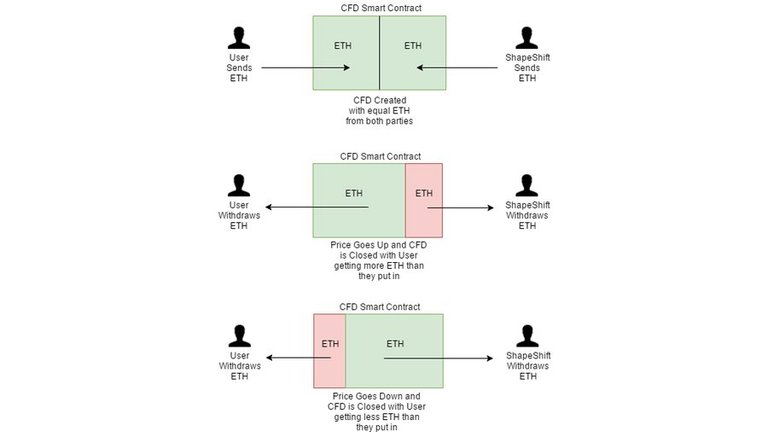

The basis of Prism is a contract widely spread in the financial market for a difference in prices, or CFD, issued in the form of an Ethereum smart contract: two participants stake on the future price of the asset. They send an equal amount of airtime to the smart contract, and when Prism closes, each participant can take back some amount of air, the amount of which depends on the value of the pledge assets at the time of closing.

The bid price at the moment of closing Prism is determined by the value of the assets listed in the contract. If the value of the asset has grown, then the user who created Prism receives a profit proportional to the growth of assets. If the value of assets has fallen, then ShapeShift is the winner.

In the Prism contract, the value of assets is determined by the oracle, which translates prices into the blockbuster of the Etherium. From the available information it follows that asset prices are updated every 30 minutes.

Currently, ShapeShift is the second participant in each bet that users make and charges fees as compensation for frozen assets. The company claims that all of the underlying assets are hedged outside the Prism contract, so, theoretically, it can not lose money, even with strong price fluctuations.

Positive sides

The new technology opens access to crypto-currency assets to a whole class of investors, without requiring them to purchase assets and eliminating the difficulties associated with reliable storage. After all, if a user wants to assemble a portfolio on his own, he will have to buy assets on exchanges, and either keep them there, at the risk of a third party, or take care of the contents of a variety of purses, risking losing private keys or being robbed.

One more advantage: in spite of the fact that the platform is working on the Ethereum blockbuster, the type of security tokens is not limited to ether and derivatives of the Etherium tokens. Users get access to the assets of other blockers, such as bitcoins or lightcakes.

Finally, Prism conducts all transactions on a single smart contract, so that there is no risk of theft of assets by a third party, of course, provided that the smart contract itself has no errors.

Negative sides

The main disadvantage of the platform is its commissions. For each Prism, the company charges a technical commission of 1% of the value of the asset per month, which is equivalent to an annual interest income of 11% (commission is charged monthly). This is very much - even on a credit card the cost of a loan is less, not to mention the fact that the portfolio can be collected independently. In addition to the technical commission, the platform takes 2.4% for withdrawal, and 0.5% for changes in the balance of security tokens.

If a user creates a Prism of $ 1,000, changes the balance monthly, and withdraws exactly one year from now, it will be missed about $ 160 (assuming there are no profits or losses).

The next negative point is centralization, or the need to trust the price oracle from ShapeShift. If they want to cash in on their users, they just need to give the wrong prices to the oracle. Of course, Shapeshift is a respected company with an excellent reputation, but, nevertheless, the risk is not equal to zero.

And the last is a limit on the maximum amount that you can earn on CFD. If ShapeShift becomes the second bet participant, it limits the possible win of the first participant by double the size of the deposit (including commissions). In other words, if the participant has placed 10 ETH, then the maximum amount of the win is 20 ETH, but the possibility of increasing the cost of a crypto asset by 10 or more times is what attracts investors and players. True, this can be a temporary limitation, since the platform is still being tested.

Conclusion

ShapeShift Prism is a very interesting project. Now it is at the stage of closed beta testing, with access only by invitation, and the Prism size is limited to 10 ETH. The interface looks more than friendly, and the learning materials easily conduct new users through the process of creating Prism. This is a significant step in the creation of investment products of the crypto-currency sector, although if we do not take into account such shortcomings as high commissions and a centralized price oracle.

Of course, Prism looks a bit primitive compared to the MelonPort project, but before the beta testing MelonPort remains even more than a year, while Prism will be ready this year. ICONOMI, another crypto-currency investment fund, is difficult to compare with Prism and MelonPort because of its high centralization and the inability for users to independently form portfolios.

This is so cool, can't wait to check it out.

Fees too high

How do I get an Invite

Very impressive: detailed and very well written. have read to the last period and wanted more