Financial Markets Imploding this Fall, Biggest Wealth Transfer in History upon us…

Everything is almost all but complete; risk has been almost been fully transferred from the banks on to the suckers.

Banks are giving us a clear signal that they are just about ready to trigger the next financial collapse and along with it, the biggest transfer (from the 99% to the 1%) of wealth the world has ever seen.

There will not be very much left of the middle class after this (note: I highly recommend reading the linked article How Much Longer Will The Middle-Class Politely Tolerate Its Own Destruction? from earlier this year). And it will not be solely with one country, it will be world-wide.

This has been in the works for a very long time – not merely decades, but over a century in the making.

Already in the United States the private corporation known as the Federal Reserve has robbed citizens blind (through inflation – also known as money printing) of their wealth since its creation in 1913.

Every single dollar that has ever been issued by the Fed is a debt note – a debt that is owed to the banksters.

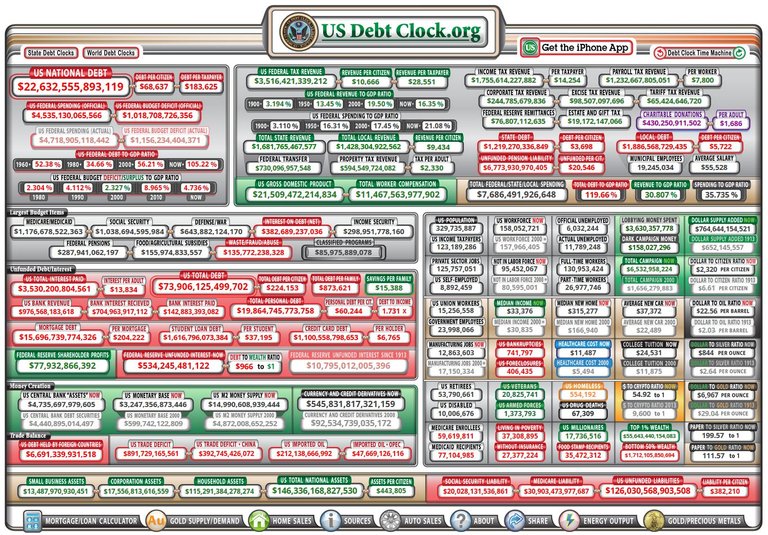

The amounts are staggering, numbering in the hundreds of trillions of dollars.

United States Debt situation as of September 29, 2019, Source: Usdebtclog.org. See also Canada’s debt clock

When this is all said and done, the citizens will be the ones holding the bag of worthless (or at least extremely devalued) fiat currency we call dollars. US Treasurys (bonds) are no better, as they are also debt even though the corrupt financial system views them as 100% safe; that is why they have a prominent position in many of the nation’s pension investments. In short, there are an integral part of the biggest bubble in history – the bond bubble.

Practically speaking, the same kind of theft has been occurring by the likes of the Bank of England, France, Germany, Canada, Australia, etc.

The ECB (European Central Bank) itself has been a monster in this regard. Over the past two decades, the ECB through its member banks (the private central banks of its member nations) has looted – through bond and other asset purchases as well as “Quantitative Easing” (which really means conjuring money out of thin air, at the expense of dumbed-downed European citizens) in the order of tens of trillions of euros to buy these assets. Most of these assets (with the exception of some corporate bonds) will eventually become worthless and hence will have to be written off – at the expense of the European taxpayer, of course (even those in Britain will be [partially] on the hook).

For all of these markets, we should not forget to lay as much of the blame on careless governments, regulatory agencies, et al. that have done nothing to stop this criminality over the decades, but instead have chosen to be the spineless puppets they truly are while enriching themselves greatly in the process. Year after year, they have run budget deficits that have ballooned to extremes, accumulating into debt levels that are beyond annual GDP. Yet they expect us, their citizens, to not spend a penny more than we earn, pay all our taxes on time, and punish and imprison us if we don’t (while they are actually doing it themselves).

3 Bubbles Popping at Once!

What is going to make this particular meltdown worse than the Financial Crisis 2007-8 or even The Great Depression for that matter, is that we will have three bubbles popping at once: the STOCK market, the REAL ESTATE market, and the biggest of all – the BONDmarket.

All these markets are grossly inflated. The stock & real estate markets have been ballooning since 2008 and the bond market since the 1990s. They have purposely (and criminally) been inflated through all the money printing and market manipulation. They are simply not sustainable.

The bond market is the biggest of them all – especially with the staggering amount of sovereign bonds that have been issued from the US, Japan, and Europe (through their Treasury offices and central banks) over the past several decades. These IOUs, or promises to repay, are mistakenly seen as assets, but are in fact liabilities. In other words, they are debt owed to creditors.

Governments and citizenry are the ones who owe this debt and the banksters are the creditors.

We’ve been paying them a shitload of our hard-earned money along with interest payments for many decades even though they have conjured this money out of thin air. It’s a genius of a Ponzi system that has been propelled on us gullible and ignorant souls for as long as anyone can remember.

Once these all pop simultaneously (of course, I mean over the matter of several months) the current financial system as we know it will be broke and become dysfunctional.

Everything runs on credit and without properly functioning debt and credit markets, there will be no credit available for businesses, individuals, nor governments. Exacerbating the problem will be a lack of savings on the part of each of these three groups.

What system will replace it remains to be seen. It could possibly be in the form of a return to a gold standard or a digital currency-based model. The Elite would certainly prefer a globally centralized currency (and government), but I doubt the enraged masses will oblige. Even their machinations won’t be enough to help them get what they want.

The only silver lining, is that this time I think the masses will be very quick to catch on when their financial lives fall apart and they go hungry. They will need someone to blame and seek revenge upon and I don’t think banksters are going to get off scot-free, let alone be bailed out.

Time will indeed tell. Same may go for the corrupt governments and institutions that have aided and enabled them to do so. There’s a potential for things to get really really ugly, fast.

The Repo Market: The crack in the damn that will be the Catalyst for the next Financial Crisis/Meltdown

Okay, here is what is presently occurring and what I believe is going to happen in the next few months.

But before I get into these, I first need to give you a quick explanation about something that is vital to the proper functioning of the financial markets, namely the repo market.

Brief overview of the repo market: In a nutshell, this is a market whereby participants – mostly banks – seek liquidity (cash) on a very short-term basis (usually overnight, or less than 24 hours) in order to make sure that their financial books are on the up and up (i.e., stating that they have enough reserves on hand to cover what they are legally required to or need for operations). They borrow the cash from another financial institution (a bank or the Federal Reserve) and offer them something like a bond (or other asset) as collateral along with a small interest payment. The next day, they “repurchase” that same bond back giving back the cash to the other party from whom they had borrowed. Repo is short for Repurchase Agreement.

For another oversimplified explanation you can first have a look at the definition of a repo and then a nice explanatory video. Same goes for another related concept called a reverse-repo.

Think of these short-term financial agreements as the grease that helps turns the gears of the financial markets. Without them, the markets would freeze up since in such a system everything runs on credit (and trust).

What triggered the Financial Crisis of 2007-08 was that this repo market (which by the way is not limited to New York financial institutions but also includes large foreign banks and participants as well) froze up. In other words, these financial institutions did not want to lend to each other because of a lack of trust (i.e., they didn’t believe that the other parties were liquid or solvent enough to pay them back, even in the short term). Some were still willing to lend the cash, but only at much higher interest rates.

When a situation as described above happens and nobody wants to lend, the Federal Reserve (or respective central bank) comes in as the “lender of last resort” and helps them out by providing liquidity (cash) in exchange for certain assets as collateral.

Last week (mid-September) this situation happened for the first time in about a decade.

We are now seeing signs that large investment banks, in particular, are all getting low on cash (mostly because of bad loans, bad investments, due debt, taxes, and the like) and thus are very distrustful of the other parties’ ability to pay them back their cash should they choose to lend to them.

So, early last week instead of charging the usual rate of interest (called the Fed funds rate) which was around 2% or so, they said: no no, we need to charge a much higher rate because of the increased risk. Hence the average rate spiked up to near 10% for mere overnight loans which is a huge pop from the usual typical rate. As there were no willing participants, the Federal Reserve had to step in with what they call reverse-repos – a similar arrangement to repos to save the day.

The Fed actually needed to do this for several days in a row to the tune of around (and sometimes over) $65 billion per day (or night, I should say).

The Fed has now announced that it would provide liquidity in the market (i.e., these reverse-repos) to the same order of magnitude (around $65’ish billion per day) at least until October 10th.

Come the 10th of next month, we will likely see the Fed install some kind of permanent reverse-repo operation or simple re-start a program of QE (Quantitative Easing), or money printing whereby, in essence, they will conjure up billions of dollars per month to inject into the system so that the big banks don’t get burned with their risky bets.

They did two QE programs in 2008 and 2009 basically forking over the cash to banks in exchange for a lot of their assets (better ones such as Treasury bonds and other not-so-good ones such as mortgage-backed securities – which are often referred to as ‘toxic assets’). This increased the Fed’s own balance from around $800 billion to over $2 trillion. In essence, they took a lot of the bad investments off the backs of the banks in exchange for cash.

While many proponents thought this was a necessary step to help re-liquidate the banks so that they can lend and get the grease of the economic machine moving once more, for the most part the banks didn’t lend out this fresh cash to businesses and individuals but rather used them to buy more investments (e.g., stocks) as well as simply “park” their funds at the Fed itself where they could safely get a few percentage points of interest income. Banks helping banks, nothing more, nothing less.

So what will happen?

So folks, here we are now in the fall of 2019 and this game will get played over like an old record. The Fed is very likely to sponge-up many of the “bad assets” (things such as CLOs – Collateralized Loan Obligations, or risky loans if you will, as well as bonds that will soon be fairly worthless upon the popping of the bond bubble) off the balance sheets of the banks and onto their own.

It is important to note, too, that the owners of the Federal Reserve itself are these very same investment banks (JP Morgan, Goldman Sachs, Citi Group, etc.), as the Fed is a private corporation and its ownership has been documented over the years; this is no big secret.

You see the banks got bailed out by the very corrupt Congress during the last financial crisis to the, somewhat muted, outrage of the populous. And I think they know that this time, the masses won’t stand for such repeated criminality. Accordingly, what they are doing this time is to unload these toxic assets (currently estimated at about $5.4 trillion according to expert portfolio manager Michael Pento) off their books now and getting fresh cash in lieu.

As such, when these bubbles pop, it won’t be them holding these bags of dung but rather the Fed itself. As a separate corporate entity, the Fed – the United States Central Bank – will be liable holding these rubbish assets and, in the end, it will still be the citizens who will pay the price.

At this point, so much anger will be placed on the Fed that I strongly doubt it will be able to retain its current status as the central bank of the United States. We’ve seen Trump taunt and criticize them a lot in the past couple of years and it wouldn’t be too difficult for him and others to lay the blame about all the economic and financial ills on the Fed itself (rather than its member banks who are the real culprits) and perhaps even nationalize it or give back the money issuance function to the only entity that is legally authorized to do so according to the Constitution – namely, the Congress (via the US Treasury Department).

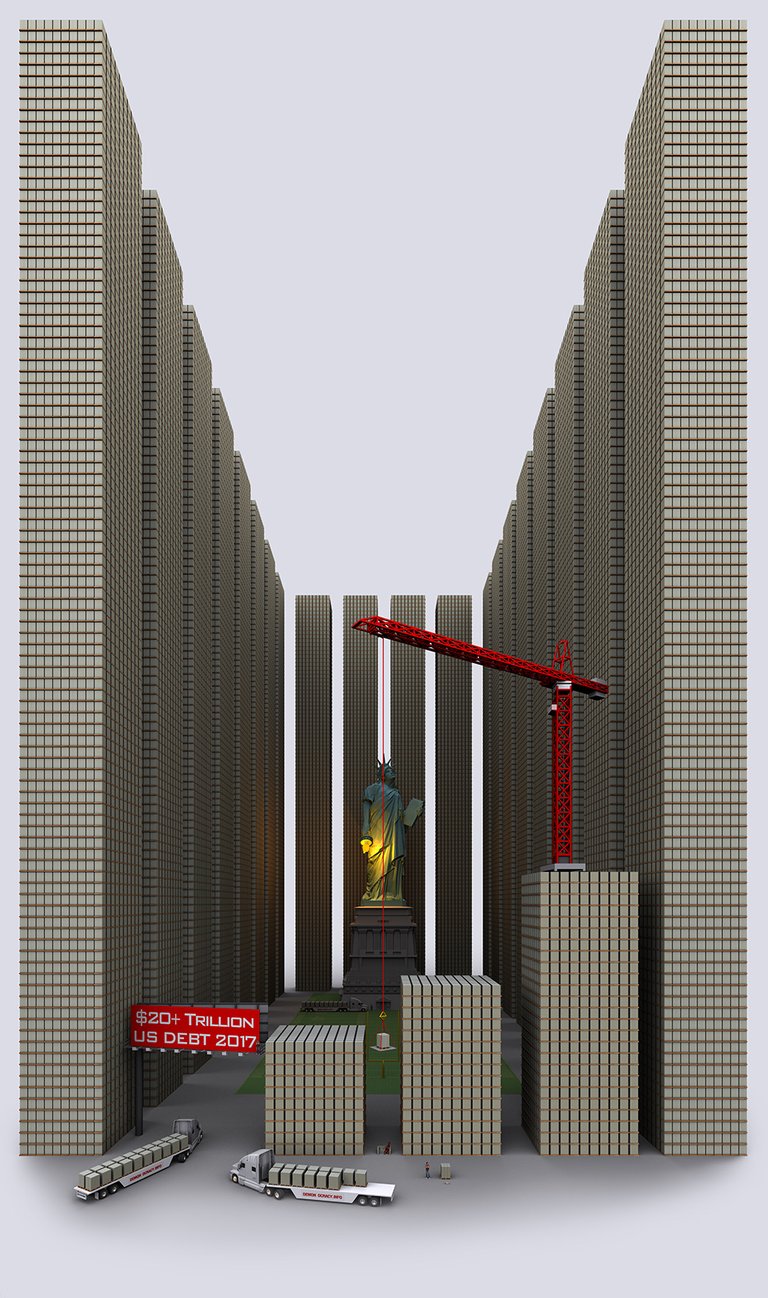

The equivalent of about US$22 trillion has been printed by central banks in the last decade alone. Back in mid-June of 2017, our friends at Visual Capitalist had made a superb post and infographic conveying the absurdity of how much money $20 trillion (the amount of External Debt the US had at the time) in cash would look like. Here is what it looks like visually:

Source: Visual Capitalist – $20 Trillion of U.S. Debt Visualized Using Stacks of $100 Bills. Side note: they’ve also done a super job with All of the World’s Money and Markets in One Visualization

But, if you want to have an idea about the current Global Debt you’ll need to multiply this amount by 10x, or about $250 trillion.

We are coming to an end of this fiat monetary regime folks. It may not happen all at once. But with the unsustainability of debt burdens at all levels – individuals, businesses, and governments – the writing is on the wall.

Prepare accordingly. The best you can do is to try to pay down as much debt you owe as you can. Owning physical gold and/or silver outside of the banking system (i.e., in your own hands) is a must, as they are the only true form of money that have ever existed, preserving their value and purchasing power over millennia.

Notice the irony – the year in which this statement was made – the year prior to the creation of the Federal Reserve (in 1913).

In Peace & Liberty,

Great post!

I could not agree more, the timing is interesting...

Thanks

Resteemed

Thank you very much for the comment and re-steem!

You're welcome ;)

Keep it coming!