A little bit later than usual a summary of my portfolio and cryptfolio for the end of March 2018. Basically, the longer I am involved in the financial world (getting close to 3 years now) the more I understand that I am an investor rather a trader. I seem to have this urge to get my eyes glued to the graphs for a month or two and I am not saying I have made a huge amount of losing trades, but this urge tends to go away pretty quickly and I seem to settle down as the excitement in the markets diminishes. I do believe in my research and my investments though (I only trade asset pairs which I believe in which reduces the amount of opportunities available to me, but also reduces risk which in turn inversely correlates with the quality of sleep that I get at night). All in all, if I get more than 50% or my decisions right I should be able to do alright in the long term.

One thing that I have repeatedly mentioned in my previous blog posts is that self-control is extremely important when things are not necessarily going as expected and self-control is a lot easier to achieve if exposure to risk is kept within a comfortable range. For some people this number could be 5% of total assets while for others it might be 50%. As long as you are able to sleep at night and your behaviour is controlled by your logic and not by emotions you should be alright too.

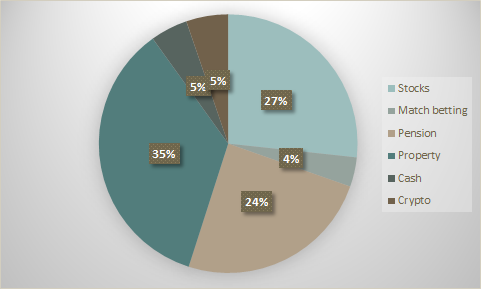

Moving on to the topic of the post, the month of March has seen my stock portfolio increase by approximately 4% comparing to the previous month. I have made a decision to not increase my position in cryptocurrencies as I am struggling to pick up any signs of immediate recovery, however having too much cash in the time of super low interest rates (at least in the UK) also does not seem to be the most financially prudent decision, hence the increase in value of my stock portfolio. As it happens, the news about Trump trade war with China came out pretty much immediately after my order was filled, which resulted in turbulence in the global stockmarket with FTSE retreating to below 7000 level for the first time since the end of 2016 which meant that I could have done better had I waited for a few more weeks, but as they say it's time in the market and not timing the market that usually pays.

Other than that, crypto assets nose-dived from 11% to 4% comparing to the previous month. For those of you who are holders of large-cap crypto assets this will not come as a surpise (I have not sold anything). I am naturally a little bit disappointed, but my exposure to crypto market is at a comfortable level for me, plus I have confidence that the market is going to recover sooner or later. And here are the graphs:

Overall asset allocation.

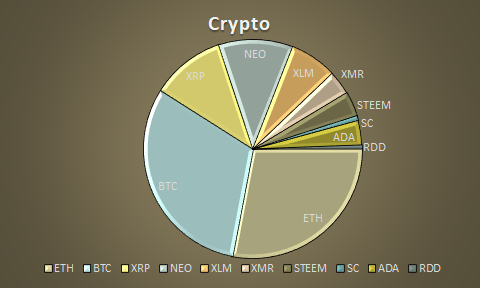

Crypto asset allocation.

Let me know how you are positioning yourself for success in this turbulent time. Also, I'd appreciate your upvotes, follows or any feedback that you might have in the comments below. Thanks for reading.

Thanks for sharing the post!