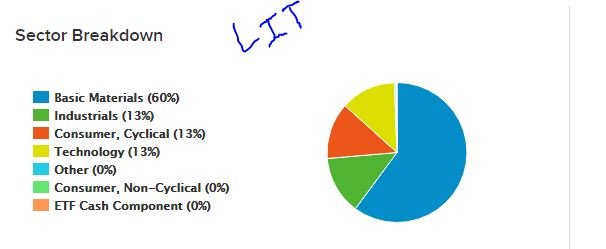

Be aware that the LIT ETF invests in the full cycle of lithium. Only 60% is invested directly in materials. It has 3.5% in Tesla, for example

Source: http://etfdb.com/etf/LIT/

I have focused on going down a level - maybe looking at suppliers who can bring capacity on to market quickly - e.g., SQM.

Amplify have filed to launch a new ETF that goes wider than lithium in the battery world and will include some of the other materials (like cobalt). Its ticker will be BATT. That might be worth looking at when it launches.

https://whotrades.com/people/21440584/timeline/4390670?showMore=1