Reinsurance margins have been smashed by the big hurricane events of 2017. Time to look for long term recovery plays. Interest rates have my attention again. Back on the Bitcoin bus paying high spreads but in charge of where stop losses go.

Bought

Swiss Re AG: (SREN.VX): Swiss Reinsurance. Swiss Re is the world's largest reinsurance company. I bought December 2021 92 strike call options in July 2017 (see TIB106 for the discussion). Price has passed the 92 strike level a few times since that purchase BUT is not really showing signs of legging up.

I started to look again at the next strike up, 100. I am holding December 2020 100 strikes in the portfolio - chance to average down on those. I wanted also to explore 2021 and 2022. Just like in TIB106, I calculated the premium difference between the years to see how much more I had to pay to get an extra year. Answer was 15% premium between 2020 and 2021 expiry compared with 28% between 2019 and 2020. 2022 options are listed but nobody is making markets yet. Makes sense to see if I could get a bid accepted for the 2021 expiry. I also put a bid in for 2020 to average down my entry price. Of course, the 2020 bid was taken up first and the 2021 later in the night.

How does that look on the charts? First an updated version of the July chart which shows the 92 strike calls with breakven and 100% profit lines. Key takeaway from that is I can see which of the run up models the market is following - the blue arrow and that needs to move across and down to where price reversed in late 2017. I have done that and added the pink arrow. I am definitely going to need 2 of those to hit 100% profit. Lesson: review this chart before going to the 100 strikes.

The next chart plots in the new 100 strike call options with breakeven and 100% profit shown as blue rays. Expiry is the far right margin. I know from the last chart work that I am going to need more than the blue arrow run to get to profits on the 92 strikes. It is time to work on make believe. What I do know is price likes to consolidate before it makes its next move forwards. We see one of those in 2013 after the strong run from the bottom. I also know that price often moves ahead in waves (called Elliot waves). I have modeled one from the 2013 consolidation (the left hand zig zag ABCDE).

I have cloned that across to the 2016 consolidation (ignore the pink zig zag) - that shows me that 100% is possible well before the 2020 or 2021 expiry dates. The problem I have is the 2nd A did not pass the first E (i.e., price did not make a higher high). Price is being compressed into a wedge of lower highs and higher lows. I do know that when price breaks out of a compression zone like this it breaks really hard. Question will be is which way will it break?

Of course if I use the pink zig-zag which starts at the end of the 2017 consolidation, things look a whole lot easier especially if the pink A is achieved. How about the fundamentals and the comparatives? There have been a few big natural disasters since July which dented reinsurance underwriting margins. Apart from low fixed income returns, investment returns will have been solid. In the words of the CEO, Christian Mumenthaler

The severe natural catastrophes we have experienced so far this year have clearly impacted our results. At the same time, we are able to absorb these losses and join forces with our clients to help affected people and businesses in getting back on their feet. This shows that our strategy to ensure superior capitalisation at all times is paying off. We believe we have the financial strength to respond to potential market developments and we continue to stay committed to creating long-term shareholder value

http://www.swissre.com/media/news_releases/nr_20171102_nine_months.html

Insurance runs in cycles. If the balance sheet is strong, profits will flow until the next cycle. I have just under 4 years to be right.

I wrote in TIB106 about disquiet comparing Swiss Re to Zurich Insurnace (ZURN.VX). Since then Swiss Re has outperformed Zurich. Also looking at the number 2 reinsurer, Munich Re (MUV2.DE), Swiss Re has performed in line - which tells me there are no key management differences in the way they face the same market conditions (they are about the same size).

Note: I own both Zurich and Munich Re.

https://www.statista.com/statistics/217285/net-reinsurance-premiums-written-by-leading-global-reinsurers/ for data on market sizes

Shorts

EuroSwiss 3 Month Interest Rate Futures: The more I watch charts for Eurodollar and Euribor, the more I think Swiss interest rates cannot stay that far out of line. This chart is December 2018 expiry Eurodollar futures. I see a straight line from top left to bottom right as rates rise [Note price chart falls means rates rise].

There are 50 basis points from top to bottom = 2 rate hikes. In the last 4 weeks, there has been a 25 basis point shift (bracketed in blue). Yet Swiss rates have not moved. I went short another contract. There are 3 months on this chart. If Swiss rates make a move like that starting in the next quarter, September 2018 expiry will work just fine.

Separately, I am reminded about something my investing coach always talks about - "let winning trades run". I have watched those Eurodallar and Euribor profits rack up and have had take profits targets set well below the lows on those charts. Yesterday I moved those even further away. I just have that feeling that we have not seen anything yet on rising interest rates. Soon I will pull together some thoughts on when to exit.

Cryptocurency

Bitcoin (BTCUSD): I chased momentum on Bitcoin as price rejected the $9,000 lows. Not smart trading but I was looking to average down my entry price. I was a little more patient on the 2nd trade for the day and waited for a reversal on a one hour chart. Chart shows the new trades (right hand blue squares). I have put a profit target on one trade half way to the prior highs at $12,750.

Having said I would not pay high spreads again, I did. I prefer to run a trading platform where I can be in control of stop losses by using margin.

Currency Trades

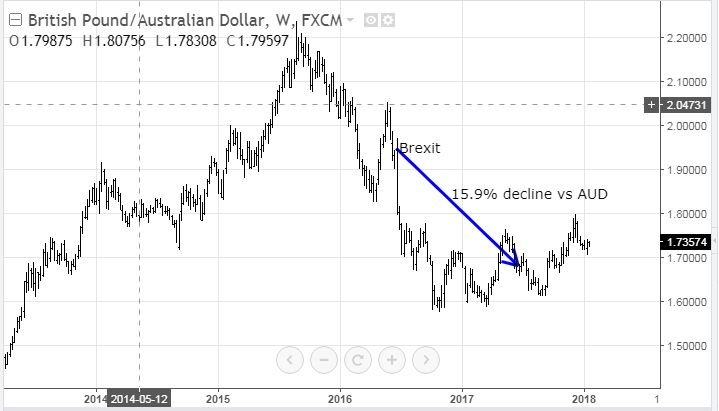

British Pound (GBPAUD): I needed to fund my pension fund AUD account to pay next months pensions. Sold British Pounds to do that - price is recovering steadily from the lows. I am itching to make long GBPAUD trades as I see GBP break the downtrend on a weekly chart- but the Brexit risk is too high.

Forex Robot did not close any trades and is trading at a negative equity level of 7.1% (higher than prior day's 6.4%).

Outsourced MAM account I run an outsourced forex trading account with Actions to Wealth. They closed out 4 trades for 0.46% profits for the day. They have 3 open trades

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with Bitcoin for as little as €50 (in Bitcoin) and earn Bitcoin at a rate way better than your bank will offer - think weeks instead of months. Not available in US or Canada. http://mymark.mx/Mark

January 18, 2018

nice post please vote my comment, because your vote is very valuable to me

Asking for votes is a good way to collect flags.

What a good statement @carrinm.

@wandaloen you just need to make a good content or none at all. Just don't ask for a stranger's votes,cause you might get flagged.

the impact of BTC happened a very extraordinary panic. @carrinm

Panic it was. Not that extraordinary in the history of Bitcoin. We will only know it is extraordinary if it does not recover this time

nice and detailed information keep it up... post updated

Thanks for the information

nice & detailed. Thank for your sharing

Followed up you for more updates :-)

@carrinm it was said that a lot of investors pulled out their money on bitcoin. That it affected the bitcoin's fall the other days.

And some says, that it was because of the government of china and korea putted limits to the amount of bitcoin that a person may hold, or invest that it fell down the drain.

Do you think it was liable?

No evidence that China or Korea did anything. A lot of unconfirmed words. The big collapse happened when Korea/China were asleep. The answer is SCARED money

You have point, I think people made speculation on their own to make them sane after the fall.

good information

Still unclear if we have another leg down around the corner.

I have learned not to try to predict price. I am not trading as if there is another leg down coming. But I do not have a stop loss in place if one comes. I have a lot of margin in the account.

We may be getting to a key point in the life of Bitcoin. Other coins are providing better ways to make payments. Other applications are adding more value to the payments facilitation. As the world finds these avenues, Bitcoin use will flatten out.

Example, my last two new exchange accounts opened, I funded using ETH. I did all trades into other altcoins using ETH. Business lost to BTC purely because their payments infrastructure did not hack it.

Some how I stumbled on to your blog and read through a few of your posts. I like how you applied a custom filter on coinmarketcap to pick out altcoins to invest in. I am a total noob when it comes to investing in cryptocurrency. Yet the overall bullishness is allowing me to get gains even if I make some bad investments along the way. Diversification is key. Will be interesting to see how your crypto portfolio progresses as the year moves. You have acquire new follower. Thanks.

I learned a hard lesson in the dot com crash through no choice of mine. I am not a great fan of diversification. I want to lean in the direction of things that are working - i.e., not diversify for the sake of it. That is why I set up my altcoins that way. The market was giving me clues. The lesson was to be wary of a single point of failure. So I spread my risk - multiple coins across multiple exchanges and only a small percentage of my portfolios. That will change with strong winners - e.g., STEEM